War And Peace

War beats peace in driving markets today. The search for safe-havens restarts with JPY and CHF benefiting. The border clash intensifies with Pakistan claiming it shot down 2 Indian jets after it carried out six airstrikes on Kashmir. Ground forces are exchanging fire in more than a dozen locations. Both markets are suffering from the conflict and both are being urged to show restraint On the peace side, the US/North Korea summit started with hope. “Vietnam is thriving like few places on earth. North Korea would be the same, and very quickly, if it would denuclearize,” Trump said on Twitter before the meetings. Then there is the in-between of democracy as the UK Parliament debates Brexit today. Markets are focused on the outcome as the “no-deal” hard Brexit risk was priced out of the market yesterday but the risk for delay, another referendum, and more political confusion continues. Also notable is the BOJ battle to push back deflationary pressures even as its QE and negative rates seems insufficient in the face of a slowing global trading environment. The BOJ dove Kataoka pushed for more action. “While not impossible, it’s hard to achieve the price target with monetary policy alone,” Kataoka said, adding that fiscal and monetary policies “must be on the same page” to change public perceptions that deflation will persist. The German Bundesbank Weidmann noted that economic weakness from 2H2018 persists but that pessimism is unwarranted given the foundations for growth from cheap financing, expanding employment and higher wages. He also got the green light for another term keeping his hat in the ring for replacing ECB Draghi. The markets are confused and stuck in between war and peace over politics and policy with the JPY and CHF the best barometers for fear today both are more stuck yellow than red.

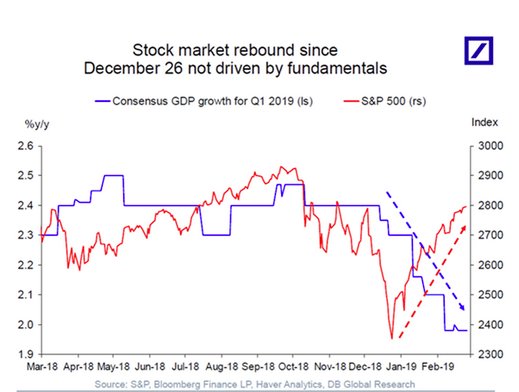

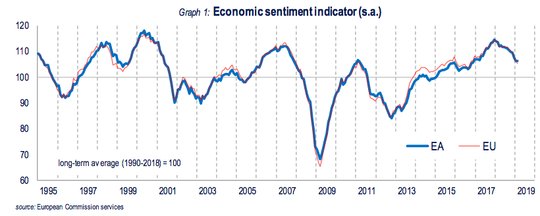

Question for the Day: Do fundamentals matter? Markets are a confidence game and the future expectations beat present conditions. The bounce in US consumer confidence, (best in 18-years), and the slip to 2-year lows in Europe, confused markets over the last 24 hours. The role of the ESI today or Italian business morale (at 3-year lows) is insufficient for explaining price action in FX or equities. The EUR is holding bid over its 55-day moving average and has been rallying with US/China trade deal hopes. Watching 1.1450 and 1.1515 for a larger melt-up.

In a world where policy dominates - fiscal, foreign and monetary - the power of present economic growth and potential becomes secondary to investors. That is the world we live in and one that makes the rebound in equities since December that much more dangerous to sustain. This is the view from DB economist and one that is doing the rounds. "Either markets have to come down to where growth expectations are, or growth and earnings expectations have to move higher to justify current market valuations," said Torsten Slok, Deutsche Bank's chief international economist, in a note on Tuesday.

What Happened?

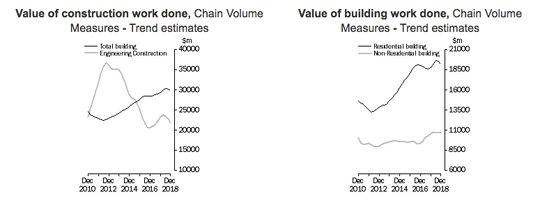

- Australian 4Q Construction work -3.1% q/q, -2.6% y/y after revised -3.6% q/q - weaker than +0.4% q/q expected. The value of work done on building fell 1.7% q/q, with residential -3.6% q/q and non-residential up 1.9% q/q. Notable weakness in engineering -5% q/q. The total spending was A$51.1bn – lowest since 2017 – and about 0.3% less for 4Q GDP.

- Sweden February consumer confidence 92.5 from revised 92.2 – weaker than 93.8 expected. The business confidence drops to 98.9 from100.3 – also weaker than 102.5 expected. Consumer inflation expectations rose to 3.5% from 3.4% - more than the 3.2% expected.

- Italy February consumer confidence 112.4 from revised 113.9 (prel 114.0) – weaker than 113 expected. Overall business confidence fell to 98.3 from 99.1 – 3-year lows. The manufacturing business confidence drops to 101.7 from 102 – slightly better than 101.4 expected, construction fell to 135.5 from 139.2, services fell to 98.3 from 98.6.

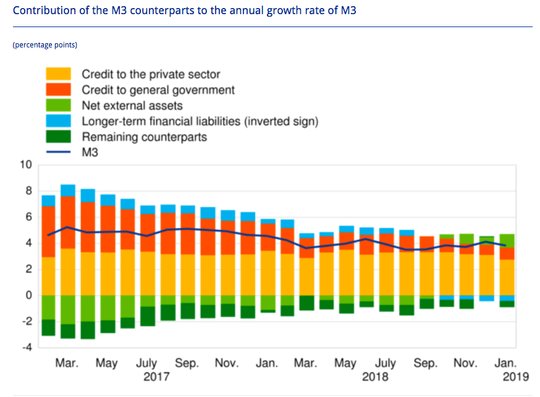

- ECB January M3 slows to 3.8% y/y from 4.1% - less than the 4.0% expected. The loan growth slows to 3.2% after revised 3.2% (prel 3.3% y/y) – as expected.

- Eurozone February economic sentiment 106.1 from revised 106.3 (prel 106.2) - better than 105.8 expected. The business confidence steady at 0.69 – better than 0.63 expected. By sector, consumer confidence -7.4 from -7.9; industrial sentiment -0.4 from +0.6, services 12.1 from 11.

Market Recap:

Equities: The US S&P 500 futures are off 0.2% after losing 0.08% yesterday. The Stoxx Europe 600 is off 0.4% reacting to India/Pakistan worries while the MSCI Asia Pacific is up 0.3%

- Japan Nikkei up 0.50% to 21,556.51

- Korea Kospi up 0.37% to 2,234.79

- Hong Kong Hang Seng off 0.05% to 28,757.44

- China Shanghai Composite up 0.42% to 2,953.82

- Australia ASX up 0.40% to 6,233.60

- India NSE50 off 0.26% to 10,806.65

- UK FTSE so far off 0.75% to 7,096

- German DAX so far off 0.55% to 11,476

- French CAC40 so far off 0.2% to 5,227

- Italian FTSE so far flat at 20,469

Fixed Income: Slight safe-haven buying with equities and India stories and some weak data – also throw in month-end buying and good auctions for Germany and Italy – 10Y German Bund yields off 1bp to 0.11%, French OATs off 1bps to 0.51% (back to lows), UK Gilts flat at 1.21% - all about Brexit today – while periphery mixed on data – Italy up 3bps to 2.74%, Spain flat at 1.15%, Portugal off 1bps to 1.43% and Greece off 2bps to 2.71%.

- Germany sold E3bn of 10Y 0.25% Bunds at 0.12% with 2.01 cover- previously 0.2% with 1.2 cover

- Italy sold E2bn of 2.45% 5Y BTP at 1.59% with 1.46 cover- previously 1.49% with 1.33 cover - and E4bn of 10Y 3% BTP at 2.81% with 1.31 cover - previously 2.60% with 1.36 cover.

- US Bonds are mixed, curve steeper into more supply, Powell take 2– 2Y flat at 2.48%, 5Y flat at 2.44%, 10Y flat at 2.63%, 30Y up 1bps to 3.01%.

- Japan JGBs are lower with equities, ignoring BOJ– 2Y up 1bps to -0.16%, 5Y up 1bps to -0.16%, 10Y flat at -0.02%, 30Y up 1bps to 0.61%.

- Australian bonds rally on weaker construction– 3Y off 3bps to 1.63%, 10Y off 2bps to 2.07%.

- China PBOC adds liquidity but curve continues to flatten– 2Y up 3bps to 2.73%, 5Y up 2bps to 3.02% and 10Y off 3bps to 3.19%.

Foreign Exchange: The US dollar index is flat at 96 – hit yesterday on dovish FOMC and weaker housing and holding on today – USD is more bid in emerging markets - EMEA: RUB off 0.1% to 65.694, ZAR off 0.1% to 13.849, TRY up 0.3% to 5.287; ASIA: INR off 0.5% to 71.297, KRW 1117.90 off 0.4%.

- EUR: 1.1390 flat. Range 1.1373-1.1404 with EUR stuck 1.1380-1.1420 zone matters but risk is in FOMC and US data now with 1.1320.

- JPY: 110.50 off 0.1%. Range with EUR/JPY 125.90 off 0.1% - slight safe-haven push in EU but 110-112 holding and BOJ focus key.

- GBP: 1.3310 up 0.45%. Range 1.3233-1.3337 with EUR/GBP .8555 off 0.45%. Seems like everyone wants to buy GBP for 1.40 again – does Brexit matter?

- AUD: .7165 off 0.25%. Range .7164-.7199 with NZD .6870 off 0.25%. Fizzle with less construction driving RBA cut theme. Watching .7050-.7250

- CAD: 1.3140 off 0.2%. Range 1.3131-1.3176 with oil and rates key – focus is on data and 1.3050-1.3250.

- CHF: .9970 off 0.25%. Range .9962-1.0008 with EUR/CHF 1.1355 off 0.25%. Focus is on safe-havens with .9880 next.

- CNY: 6.6785 up 0.3%. Range 6.6730-6.6980 with focus FOMC dovishness vs PBOC net add of CNY40bn in 7-day repos.

Commodities: Oil up, Gold up, Copper is off 0.5% to $2.9510.

- Oil: $56.55 up 1.9%.Range $55.72-$56.65 with OPEC ignoring Trump and API crude inventories surprised with -4.2mb draw on the week after a 1.26mb build. Oil watching $55-$58 WTI and Brent up 1.55% to $66.22 watching $65.50-$67.

- Gold: $1329.50 up 0.1%. Range $1327.50-$1332.00 – a dovish Powell, conflict between nuclear powers, low rates and economic weakness – and Gold isn’t over $1345 yet. Watching $1325 for $1305 test. Silver up 0.45% to $15.91, Platinum up 1.3% to $872 and Palladium off 0.6% to $1514.10.

Economic Calendar:

- 0830 am Canada Jan CPI (m/m) -0.1%p +0.1%e (y/y) 2%p 1.4%e / core 1.7%p 1.5%e

- 0900 am Mexico Jan trade balance $1.836bn p -$2.3bn e

- 1000 am US Dec factory orders (m/m) -0.6%p 0.6%e / ex trans -1.3%p +0.8%e

- 1000 am FOMC Chair Powell testimony

- 1000 am US Jan pending home sales (m/m) -2.2%p -0.5%e

- 1030 am US weekly EIA crude oil inventories 3.672mb e +1mb e

- 0130 pm Mexico Banxico inflation report

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.