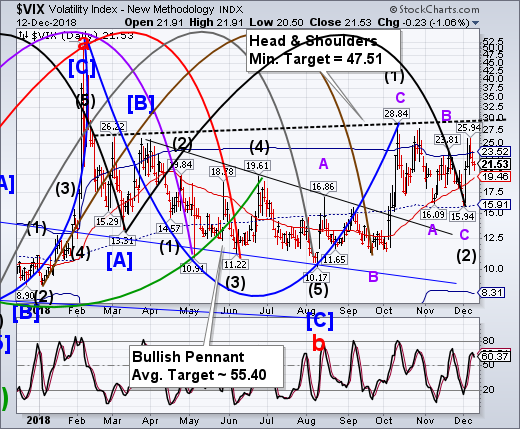

VIX Broke Out Above Its Cycle Top

VIX broke out above its Cycle Top resistance at 23.52, giving a strong buy signal. The following pullback stayed above the 50-day Moving Average at 19.45, giving a good long entry position for traders. It appears that few are aware of the potential for a breakout above the Head & Shoulders neckline at 29-30.00.

-- The NYSE Hi-Lo Index came up for air today but sank into the negative zone by the close. This appears to be more indicative of the confusion in the market than a change of trend. The Cycles Model anticipates a further decline through mid-December.

(Bloomberg) Wall Street is making peace with the new normal of higher volatility as stocks careen between agonizing sell-offs and sudden rallies.

After the gut-wrenching $2.5 trillion wipeout in the S&P 500 since early October, traders are resting at relative ease as they prep for market bumps down the road.

A measure of expected changes in the Cboe Volatility Index is sitting near its lowest level since 2016 versus the underlying fear gauge, while demand to hedge tail risks is at multi-year lows.

Markets are “beginning to accept a shift in the volatility regime back to more historically average levels,” said Patrick Hennessy, head trader at IPS Strategic Capital in Denver, Colorado.

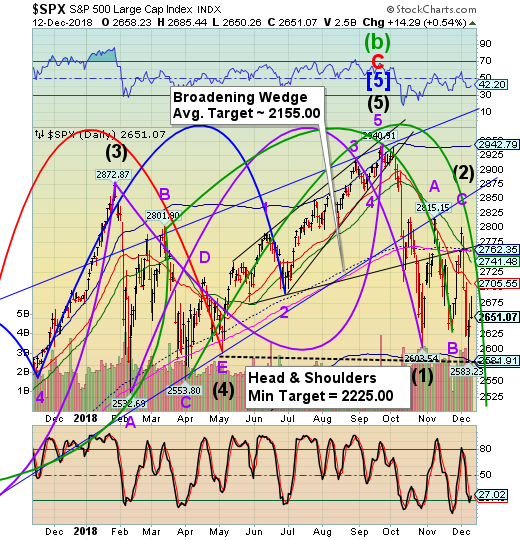

-- SPX appears to have completed a near-50% retracement from Monday’s new low today. Monday’s new baseline lowered the Head & Shoulders neckline and its potential target. The 50-day Moving Average (2741.48) made a Death Cross on the 200-day by declining beneath it at 2760.00. The SPX is no longer positive for 2018.

(Bloomberg) U.S. stocks advanced as the outlook for trade took a positive turn and the British prime minister defeated a challenge to her leadership.

The S&P 500 rose 0.5 percent after an afternoon slump that pared its gain by more than half. It marked the fourth straight day that investors sold an early rally, a trend that’s a stark reversal from months where traders bought any meaningful dip. Oil’s retreat coincided with the move, amid reports that deep discord exists among OPEC members ahead of planned output cuts.

“We’re in a stock market correction. All rallies are suspect,” said Michael Antonelli, the managing director at Robert W. Baird & Co.

-- NDX made a 59% retracement from its Monday low, challenging Intermediate-term resistance at 6840.15. It appears to have met strong selling pressure and is in retreat at the close. The 50-day Moving Average (6974.34) has crossed beneath the 200-day Moving Average at 7075.04, giving yet another technical sell signal. Should the NDX break the Head & Shoulders neckline at 6442.36, the selling may accelerate.

(CNBC) Large-cap tech and telecom stocks rallied on Wednesday, with one exception: Verizon.

As the Nasdaq Composite Index popped 1 percent at the close, Verizon sunk 2.7 percent following a downgrade from Morgan Stanley and the news that it will take a $4.6 billion charge for its failing media business, Oath.

Verizon made public the hefty goodwill impairment charge Tuesday in its 8-K filing, acknowledging the business turned out to be less valuable than initially expected.

"Verizon's Media business, branded Oath, has experienced increased competitive and market pressures throughout 2018 that have resulted in lower than expected revenues and earnings," according to the filing. "These pressures are expected to continue and have resulted in a loss of market positioning to our competitors in the digital advertising business."

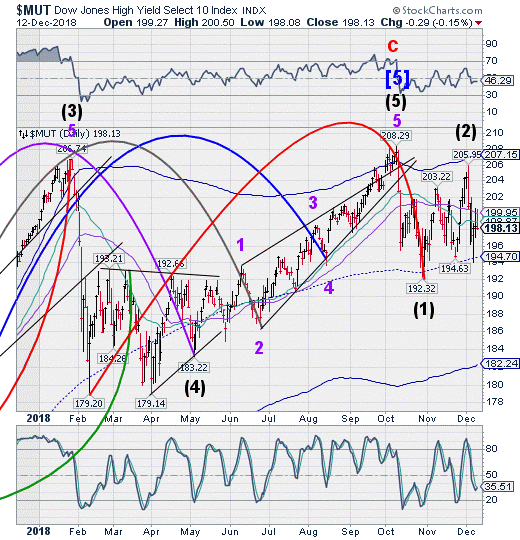

The High Yield Bond Index declined to its lowest point since October on Monday, then made a 55% retracement on Tuesday. It is beneath the 50-day Moving Average at 199.95 and on a sell signal.

(ZeroHedge) 2018 is looking like being the worst year for investment grade credit markets since 2008's Lehman-led collapse...

And worse still, Citigroup's analysts are weary that the clock is ticking for the riskiest corporate bonds...

“The markets are entering a new phase of increased volatility,” they wrote, and “we are a long way from a sustained high yield recovery.”

Prices for bonds rated CCC or lower (the weakest high yield credits) have dropped about 8.7% since the credit selloff started in early October, according to Bank of America Merrill Lynch Indexes. And as prices fall, yields on CCC-rated bonds have climbed to 11.5% - well above the current coupon around 8.1% (meaning dramatically higher refunding costs).

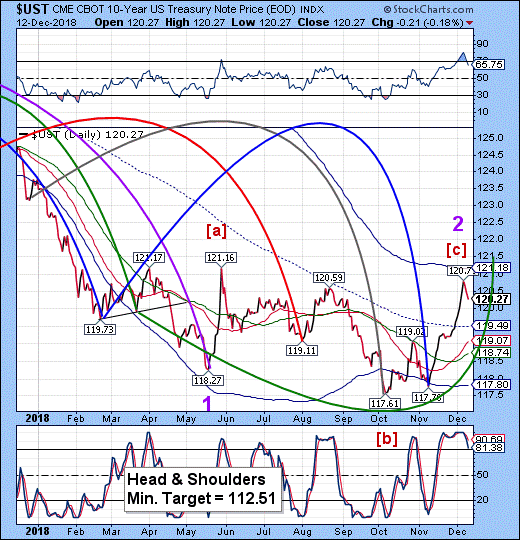

10-Year Treasuries pulled back today as it rallies toward the Cycle Top resistance at 121.18. It appears that UST may have a Cycle inversion by hitting that target in mid-December.

(ZeroHedge) After yesterday's mediocre 3Y auction and today's selloff across the curve, moments ago the US Treasury sold $24 billion in 10Y paper in an auction that was quite poor.

The high yield of 2.915%, while the lowest since July and far below November's 3.221%, tailed the When Issued 2.910% by 0.5bps, and was only the 2nd tailing 10Y in the past 7 auctions.

The Bid to Cover slumped from 2.54 to 2.35, the lowest since February and well below the 2.53 six auction average.

The internals were similarly ugly, and while Directs rebounded from last month's abnormally low print of 1.2% as most other recent auctions have done, printing at 10.8%, just above the recent average of 9.7%, it was the drop in Indirects from 73.8% to 63.1%, the lowest since August, that was notable and another indication of waning foreign appetite for US paper.

Finally, dealers were left with 26.1%, right on top of the 26.2% six auction average.

Overall, a poor auction which was not well-accepted by the market, and which has sent the 10Y yield to session highs of 2.915% after the results printed.

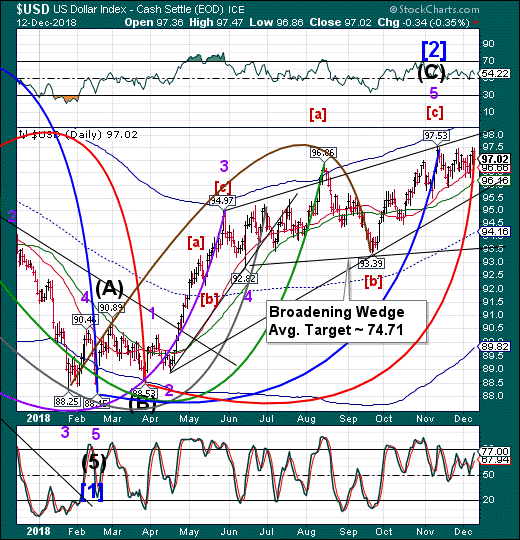

- The U.S. Dollar made a retracement high at 97.52 yesterday before easing down today. This event is considered a Master Cycle inversion. A decline through the trendline of the Ending Diagonal may trigger a possible change in trend.

(Bloomberg) Strategists in the $5.1 trillion-a-day currency market are gearing up for a slumping dollar next year while pinning their hopes for 2019 gains on the yen.

A major driver of the dollar’s decline could be a downturn in the U.S. economy, especially in the second half of the year, JPMorgan Asset Management predicted. Others expect the Federal Reserve to slow down interest-rate increases, which they see as bearish for the greenback. Rising market volatility and capital demand abroad will also spur an outflow of funds from the U.S., according to Morgan Stanley strategists.

Whatever the reason, a popular view is for a dimmer dollar. The greenback is 10 percent to 15 percent overvalued, according to Morgan Stanley. A Bloomberg survey of foreign-exchange forecasters shows losses are expected for the greenback against traditional haven currencies such as the yen and Swiss franc. The median forecast for the dollar-yen pair is that it will drop from its current level near 113 yen to 108 yen by the end of 2019.

--The Yen may have had an inverted Master Cycle high on December 6. However, the structure does not appear to be complete. This appears to be a good argument for a Cycle extension higher that may last another week.

(FXStreet) Analysts at Morgan Stanley are warning that the Japanese Yen could be gearing up to stage a rally across the broader markets.

Citing ongoing risk aversion from Brexit, as well as a steady breakdown of global liquidity conditions dragging down risk assets. With sovereign bond yields also declining, which MS says will start to draw investors away from the USD 'carry' trade.

With global market risks continuing to rise, and an unattractive USD carry, the Yen could see a broad-market gainer as market flows back out of the US Dollar.

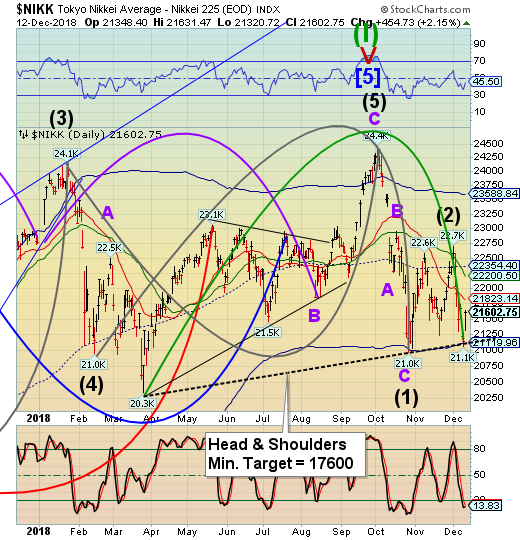

The Nikkei bounced from its Cycle Bottom support and a potential Head & Shoulders neckline on Tuesday, making a Master Cycle low. The bounce from these supports may last a few more days with Intermediate-term resistance at 21823.14 as a potential stopper. There are many cross-currents that indicate this bounce may not last very long.

(Reuters) - Japan’s Nikkei rallied on Wednesday morning, recouping some of the losses over the past two days, as investor risk appetite revived on positive developments in Sino-U.S. trade relations.

U.S. President Donald Trump said on Tuesday that China was buying a “tremendous amount” of U.S. soybeans and that trade talks with Beijing were already underway by telephone, with more meetings likely among U.S. and Chinese officials.

The Nikkei share average soared 1.9 percent to 21,546.43 by the midday break, after closing at the lowest level since March the previous day.

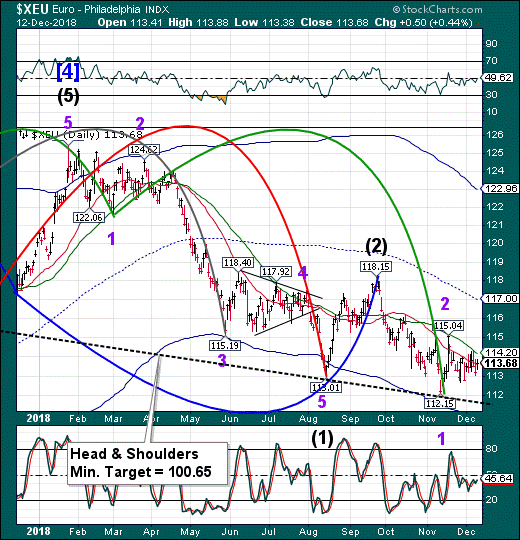

-- The Euro continues to consolidate beneath its 50-day Moving Average at 114.20. The Cycles Model suggests that weakness may continue for another week. If so, the Head & Shoulders neckline may be challenged.

(Bloomberg) It took Emmanuel Macron just one speech to ditch his entire strategy for shaking up the eurozone. Upon his election, the French president pledged to respect the monetary union’s budget rules to regain credibility with Germany. Fiscal consolidation and structural reforms weren’t just a way to strengthen the French economy, they were also the key to unlocking significant reforms of the eurozone — including a shared budget.

On Monday night, in his response to the gilets jaunes protests, Macron changed his priorities. Noting that the country was in a state of “social and economic emergency,” he announced a string of measures aimed at helping low- and middle-income workers. These include a 100 euro a month increase in the minimum wage and ending levies on overtime work.

EuroStoxx 50 Index bounced from a new low on Monday in what may have been a Master Cycle bottom. However, the rally appears to be stalled at the Cycle Bottom resistance at 3108.20. Should the resistance hold, STOXX may retest the low or make a new one next week.

(Nasdaq) European shares rallied on Wednesday after U.S. President Donald Trump sounded upbeat about a trade deal with China and optimism grew that Italy could reach a compromise with the European Commission over its disputed 2019budget.

A report rekindling talk about a possible merger involving Deutsche Bank DBKGn.DE helped the eurozone stock benchmark. STOXXE to rise by 1.8 percent, its biggest one-day gain since April.

The index is down 11.5 percent year-to-date, having touched its lowest level in 2 years earlier this month, dragged lower by signs that global economic growth is slowing and worries over political stability in Europe.

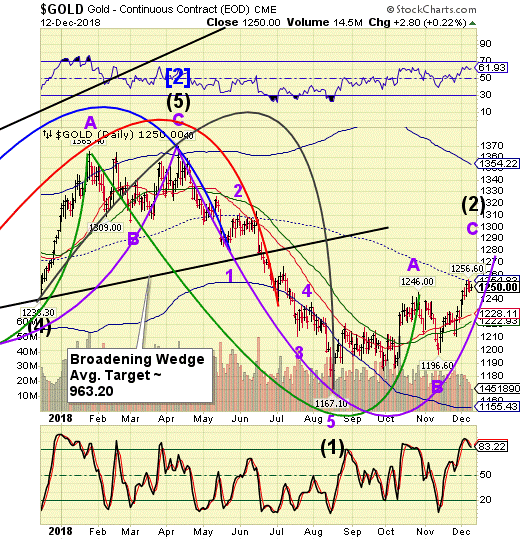

-- Gold was repelled at the mid-Cycle resistance on Monday and has consolidated under that temporary impediment. The Cycles Model suggests that strength may revive in the next few days to propel gold to a potential target near 1275.00 by the end of December.

(Reuters) - Gold prices edged higher on Wednesday as the dollar slipped and expectations for the number of U.S. interest rate hikes next year dimmed, increasing the appeal of non-interest yielding bullion.

Spot gold was up 0.1 percent at $1,244.40 per ounce as of 1:41 p.m. EST (1841 GMT). U.S. gold futures settled up $2.80, or 0.22 percent, at $1,250.

The dollar was weaker against a basket of currencies after data showed U.S. consumer prices were unchanged in November, supporting the view that underlying inflation remained firm, but not enough to push the Federal Reserve to take a more aggressive stance.

West Texas Intermediate Crude continues to consolidate near its lows. This is healthy since confidence must be “earned” again after the sell-off. The Large Speculators (Long) and Commercial Traders (Short) are almost evenly matched. Something will need to convince them that a recovery may be at hand since the Cycles Model suggests a rally to mid-Cycle resistance at 66.78 over the next two months.

(OilPrice) OPEC expects demand for its crude oil to average 31.4 million bpd in 2019, down by 100,000 bpd from last month’s forecast, which suggests that the cartel would need to strictly stick to the new production cuts and rely on continued declines from exempt members Iran and Venezuela if it wants to prevent an oversupply.

In its closely watched Monthly Oil Market Report, OPEC said on Wednesday that demand for OPEC crude in 2019 was revised down by 100,000 bpd compared to the previous report to stand at 31.4 million bpd—down by 1.0 million bpd lower than the 2018 level.

OPEC’s crude oil production in November, on the other hand, averaged 32.97 million bpd, down by 11,000 bpd compared to October, as Saudi Arabia massively increased its oil production to an all-time high, while Iran’s production plunged. Crude oil production in Saudi Arabia surged by 377,000 bpd from to 11.016 million bpd in November, according to OPEC’s secondary sources, while Iranian production plummeted by 380,000 bpd to below 3 million bpd—2.954 million bpd. The other notable increases were in the United Arab Emirates (UAE) and in Kuwait, who, together with Saudi Arabia, moved in to anticipate a plunge in Iranian oil exports when U.S. sanctions on Tehran’s oil returned.

Time may have run out for the Shanghai Index to make a new retracement high. Should it remain beneath its critical resistance at 2625.85, we may see the decline resume dramatically through the end of the month/year. Downside targets range from 2200.00 to 1900.00. Conversely, a recovery above the support/resistance levels may produce a rally to 2750.00.

(ZeroHedge) Did President Trump just win the trade war?

Stocks futures exploded higher Wednesday morning following a report in the Wall Street Journal claiming that China is planning to increase access to its domestic market. If accurate, this would constitute a major concession in the trade war and address one of the Trump Administration's biggest complaints about the inherent unfairness and anti-competitiveness of China's "Made in China 2025" policy.

China's top planning ministry is working on a replacement for "Made in China 2025" that would play down Chinese dominance in manufacturing and open the door to more competition from foreign firms.

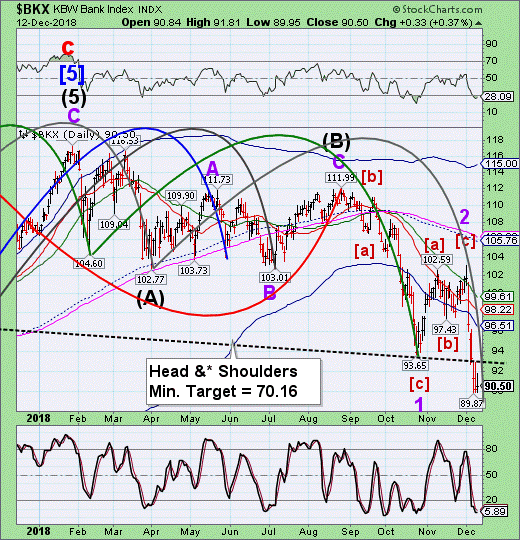

-- BKX fell beneath its Head & Shoulders neckline at 93.00 on Monday, then retested it on Tuesday. While today’s action was positive, BKX closed near its low. A further decline beneath the Head & Shoulders neckline may produce a panic for a week or more. The Head & Shoulders target is listed on the chart.

(ZeroHedge) DataTrekResearch's Nick Colas notes this morning that:

" US large cap Financials trade like death itself. Looking at the weighting of this sector in the S&P 500, they should be nearing a bottom. At a current weight of 12.5%, they are back to trading at their June 2000 low"

And eyeballing the charts, he is absolutely not wrong...

The problem, Colas points out, is that markets may be pricing in something worse than a garden-variety slowdown and the February 2009 low weight was 9.7%, implying, this group needs to stabilize soon, or “the end is nigh” crowd will have one more arrow in their quiver."

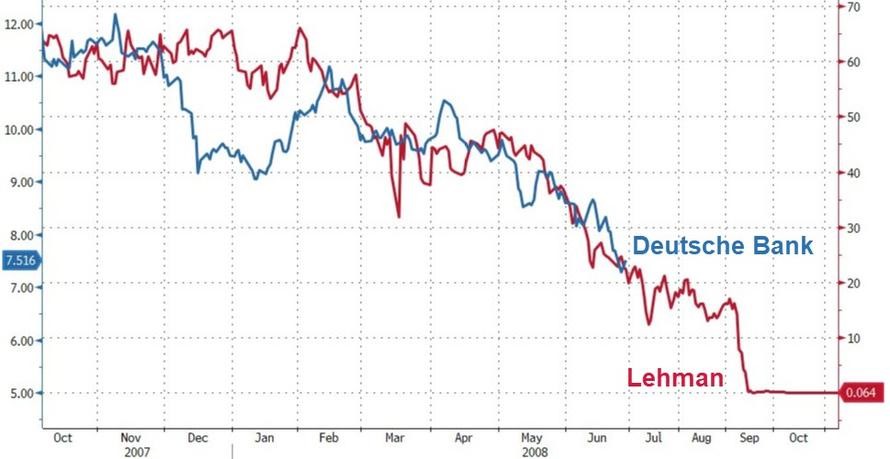

(ZeroHedge) It seems the accelerating similarities between Deutsche Bank (once the most systemically dangerous bank in the world) and Lehman Brothers has finally forced the German government's hand...

The German finance ministry's oft-reported plans to merge struggling Deutsche Bank with its not-all-that-much-better-off domestic rival Commerzbank have elicited a flood of criticism in the financial press (including an editorial in the Financial Times) following another round of rumor-mongering last week.

(Barrons) You may have noticed that banks stocks have taken a hit in the market recently.

While the S&P 500 is down just under 1% this year, JPMorgan Chase (JPM) is down about 6.5%, Bank of America (BAC) is down 17.5%, Morgan Stanley (MS) is down right around 21%, Wells Fargo (WFC) has fallen 22.5%, Citigroup (C) is off 24% and Goldman Sachs (GS) has dropped a whopping 30%. The SPDR S&P Bank ETF (KBE) has slumped 14%.

Indeed, Goldman and Wells Fargo have now given up the entirety of their post-2016 election “Trump bump,” as regulatory worries for each bank are heaped on top of the macroeconomic issues plaguing the group as a whole.

KBW analyst Frederick Cannon and team have noticed too, and they’ve responded to the thrashing bank stocks have taken by downgrading the broad group of universal banks from Overweight to Market Weight, and removing its buy recommendation on Bank of America, while dropping the bank from Overweight to Market Weight.

Until next week…

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more