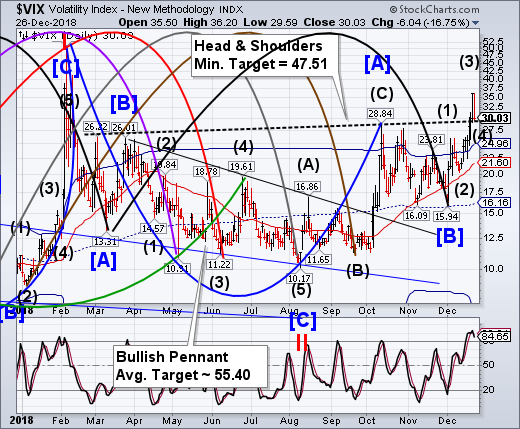

VIX Broke Above The Head & Shoulders Neckline

VIX broke above the Head & Shoulders neckline at 30.00 on Christmas Eve, then pulled back to retest neckline support today. The VIX has been on a buy signal since October. There appears to be no commentary on the VIX in the media.

-- The NYSE Hi-Lo Index shows its bearish side by continuing to close beneath the Cycle Bottom resistance. The Cycles Model anticipates a further decline through the end of December. These are daily numbers, not cumulative.

(ZeroHedge) For years, as the market rose in seemingly uninterrupted fashion buoyed by trillions in excess central bank liquidity and algos programmed to buy any dip while frontrunning each and every buy order, virtually nobody - except for a few "fringe", "fake news" blogs - complained about the threat posed by algo trading and the quiet but dire deterioration in market liquidity.

Now that the S&P has finally suffered its first bear market in a decade, the mass media is out in full force looking for scapegoats and, predictably, in an attempt to deflect attention from the biggest, and only, culprit behind each and every bull-bust cycle namely the US central bank, has focused on "computerized trading."

-- Today’s rally in the SPX was one for the records, but still a bear market bounce. This may be enough to relieve the oversold condition. However, there is more downside risk this week, according to the Cycles Model.

(ZeroHedge) Last Friday, when stocks were tumbling, we reported, "some good news for the bulls" which was lost in the overall chaos over the latest mutual fund liquidation discussed earlier.

And no, we did not anticipate that President Trump would activate the Plunge Protection Team over the weekend: the good news in question was that as Wells Fargo calculated U.S. defined-benefit pensions fund would need to implement a "giant rebalancing out of bonds and into stocks" - in fact the biggest in history - with the bank estimating roughly $64 billion in equity purchases in the last trading days of the quarter and year, prompting the banks to ask if traders are about to make pension rebalancing "great" again.

Judging by today's market action, the answer is a resounding yes, even though as Wells warned investors and traders looking for a desperately needed respite from market gyrations "may have to deal with yet one more seismic bout of volatility before Dec 31 finally pops up on their calendar dials."

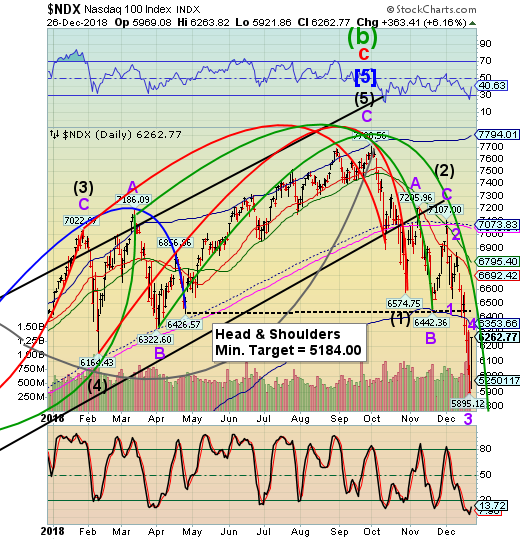

-- NDX bounced today to possibly test resistance at its Cycle Bottom at 6353.66. There appears to be one more probe to lower prices that may continue through the year-end. While the rally looks impressive, a bear market may give even more impressive declines.

(TheGuardian) US stock markets staged a post-Christmas rally on Wednesday, soaring sharply higher after their worst ever performance on Christmas Eve.

After wobbling at the open the S&P 500 Index, the DowJones and Nasdaq had all recorded significant gains by the end of the day. The Dow added over 1,080 points (4.9%), its biggest points gain in history, the S&P rose 4.9% and the Nasdaq, which has suffered the most in recent falls, closed 5.8% up.

The Dow and S&P 500 dropped more than 2.5% on Christmas Eve, their worst ever pre-holidays performance. Worries about rising interest rates, Donald Trump’s attacks on the Federal Reserve for raising those rates, a government shutdown and the continuing trade tensions between the US and China have all rattled investors and the major indices were on the brink of a bear market – a 20% fall from their most recent high.

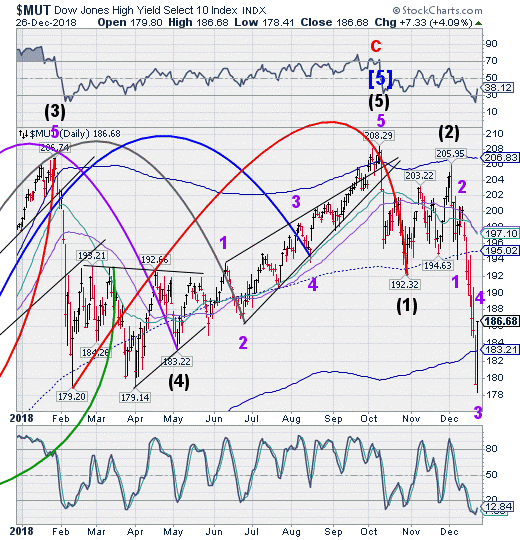

The High Yield Bond Index declined to its lowest point for 2018 on Monday. Today it bounced, recovering all of Monday’s losses. However, the Cycles Model suggests that the decline isn’t over yet.

(Bloomberg) Bond traders have a technical name for what just happened to the U.S. high-yield bond market. They call it a “puke.”

The yield spread on junk bonds widened 33 basis points on Thursday, the biggest jump in more than seven years, to 508 basis points, according to Bloomberg Barclays data. As recently as Dec. 14, high-yield investors were holding on to a slight gain for 2018. Now they’re down 2.2 percent, on track for the first annual loss since 2015. Funds tracking U.S. corporate high-yield debt lost $788.5 million in the week ended Dec. 19, the fifth consecutive week of outflows, according to Lipper data. That followed a massive $2.06 billion withdrawal the previous week. And speculative-grade borrowers are steering clear of the meltdown entirely: December is shaping up to be the first month in 10 years with no bond sales.

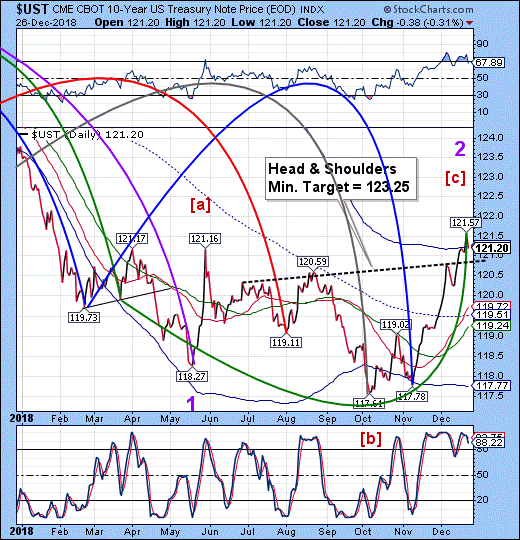

10-Year rallied above the Cycle Top resistance at 121.24, where it may have made a Master Cycle high, then closed beneath the Cycle Top. UST may extend its rally through the end of the year, but it has already extended both price and time for the completion of a Master Cycle. Late-Cycle formations such as this may be less predictable, but signal an extension beyond the average target such as the Cycle Top.

(MarketWatch) A time-tested relationship between stocks and bonds is breaking apart, and that could portend danger for investors who held Treasurys in the expectation that they would cushion the slide in stocks.

Usually, the S&P 500 SPX, +4.96% and the 10-year Treasury note yield TMUBMUSD10Y, +2.41% have tracked each other closely so that when equities came under pressure, bond prices would rise, pushing their yields lower. But that all changed this year as Treasury prices struggled to reflect the slump in stocks.

“What is safe to say is that there is something driving equities lower, which is not impacting rates. Or there is something keeping long rates high, which is not impacting equities,” said Torsten Slok, chief international economist at Deutsche Bank, in a Wednesday note.

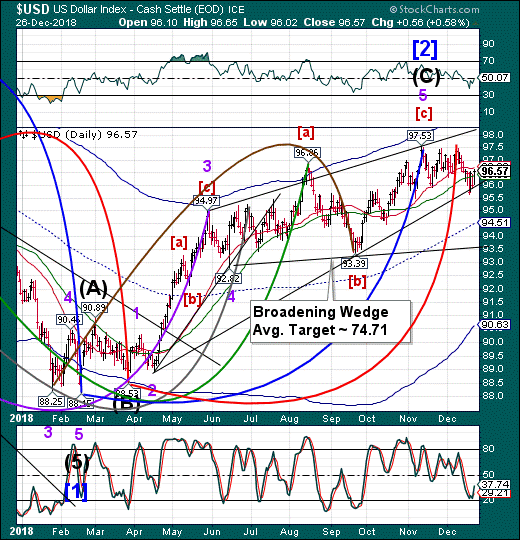

- The U.S. Dollar challenged its Ending Diagonal near 96.00 and bounced above the 50-day Moving Average at 96.38. A decline beneath the Diagonal trendline gives the USD a sell signal. The Cycles Model tags tomorrow as an important turn date, suggesting the decline may resume in earnest.

(Reuters) - The dollar gained against the euro on Wednesday as U.S. stocks came off 20-month lows, though uncertainty relating to the U.S. government shutdown and Federal Reserve monetary policy remained a headwind for the greenback.

Wall Street opened higher after a few punishing sessions that left the S&P 500 on the brink of bear market territory on worries over slowing growth and the drama in the White House. [.N]

“There is a modest sense of temporary stability returning to equity markets,” Nick Bennenbroek, a currency strategist at Wells Fargo in New York said in a report.

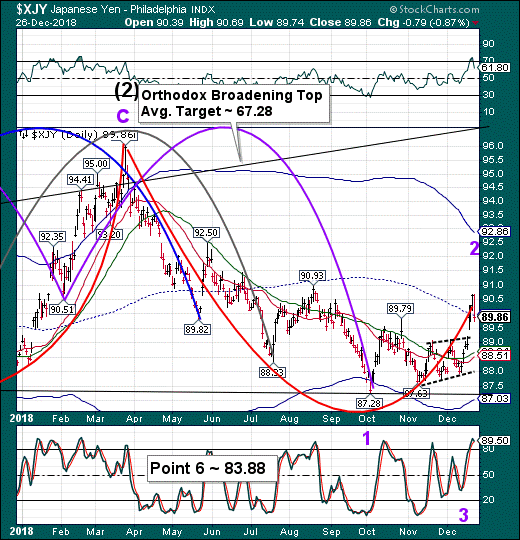

--The Yen pulled back from an inverted Master Cycle high on Monday at 90.69. The structure now appears to be complete. The Cycle extended higher three weeks beyond the average. If correct, we may see a decline lasting through the month of January.

(CNBC) The dollar fell against the safe-haven yen and Swiss franc on Tuesday as investors cut their exposure to riskier assets amid the partial U.S. government shutdown and signs of confrontation between the White House and the Federal Reserve.

The dollar fell 0.39 percent to 110.00 yen, its lowest level since late August and is set to fall for an eighth straight session against the Japanese currency, with London and New York shut for Christmas.

The yen also hit a 16-month high against the British pound, trading at 139.90 yen and a four-month high against the euro, at 125.60 yen.

The Nikkei made a new low this morning before bouncing. The spike on the chart may be due to a bad data feed. There is a good probability of a deeper low before year end.

(Bloomberg) Christmas Day brought no presents for the Japanese stock market, as the Nikkei 225 Stock Average plunged below 20,000 and slipped into a bear market. Investors are bracing for more pain to come.

The Nikkei 225 sank 5 percent on Tuesday for the biggest single-day drop since November 2016, taking its cue from U.S. equities, which tumbled during a shortened trading day on Christmas Eve. It followed the broader Topix index into a bear market with a 21 percent decline from a high on Oct. 2. For Hajime Sakai, the chief fund manager at Mito Securities Co. in Tokyo, a combination of panic selling and a lack of buyers in thin holiday trading suggests the declines may have further to run.

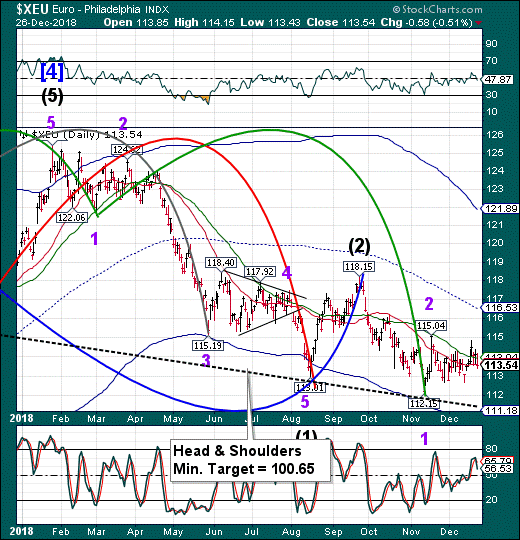

-- The Euro could not maintain its elevation above the 50-day Moving Average at 113.04 but closed beneath Intermediate-term support at 113.62. The Cycles Model suggests that weakness may resume for the next six weeks or longer.

(Express) EUROPEAN countries outside of the eurozone can easily bend the rules of the Brussels bloc to intentionally avoid the adoption of the common currency indefinitely, claimed Czech author Petr Kratochvil.

Speaking to Express.co.uk, the EU expert claimed the Czech Republic central bank is "intentionally" avoiding membership of the eurozone by ensuring it is yet to fulfill all the criteria necessary before Brussels could force them to adopt the euro. Mr. Kratochvil argued this is the reason a second referendum on the euro in the Czech Republic would be unlikely despite the EU country having failed to join the eurozone since 2003. He said: “Some of the Czech parties, especially on the liberal side, would be calling for quick adoption of the euro but I don’t see that as a very probable outcome of the current situation.

The European Bourses remained closed today after a half-day session on Christmas Eve. It may be due for a sympathy bounce, but the Wave/Cycle structure may not be complete to the downside.

(Nasdaq) As most of the markets across Europe will remain shut on Wednesday for Boxing Day holiday, price movements in markets where trading will be on, are expected to be quite sluggish.

The major markets in Europe, including France, Germany, U.K., and Switzerland will remain shut. A few other markets, including Sweden, Switzerland, Spain, and Norway are also closed today.

The mood in the rest of the markets in Europe is expected to be cautious following recent heavy sell-off across the globe amid rising concerns about growth and trade war jitters.

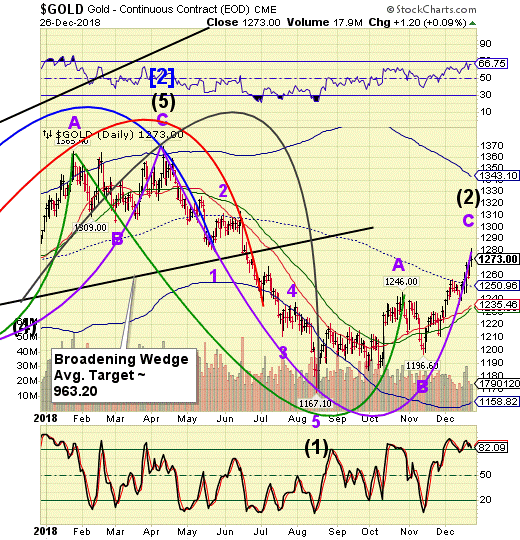

-- Gold appears to have met both time and price targets for its Master Cycle inversion. While strength may continue to end of December, the probability of an extension is dwindling. The rally target was 1275.00. A decline back beneath the mid-Cycle support at 1250.96 suggests the rally is over.

(CNBC) Gold pared all its earlier intraday gains on Wednesday, as rejuvenating U.S. equities made safety assets less lucrative to investors, while a stronger dollar further dented appeal for the metal.

Spot gold fell 0.2 percent to $1,266.32 per ounce. It had earlier touched its highest since June 19 at $1,279.06. U.S. gold futures settled up 0.1 percent at $1,273 an ounce.

“With the U.S. equity markets rebounding from a Christmas Eve sell-off, investors are looking to take more of a wait and see approach, and starting to pull a little bit out of safe-haven assets and potentially ship more into the equity markets,” said Josh Graves, senior commodities strategist at RJO Futures in Chicago.

West Texas Intermediate Crude bounced smartly today as it attempts to work off its oversold condition, thanks to pension fund rebalancing. The bounce may continue through the weekend. However, the decline may quickly resume. We may not see a bottom until early February.

(CNBC) Oil surged on Wednesday, posting its strongest daily gain in more than two years in a partial rebound from steep losses that pushed crude benchmarks to lows not seen since 2017.

Both U.S. and Brent crude rose about 8 percent, their largest one-day increase since Nov. 30, 2016, when OPEC signed a landmark agreement to cut production. It was unclear whether follow-through buying would push prices higher again once trading desks are more fully staffed after the new year begins.

The bounce on Wednesday amounted to a relief rally after Monday’s plunge, with the energy complex getting a boost from the surging equity market, said John Kilduff, founding partner at energy hedge fund Again Capital. The Dow Jones Industrial Average rose more than 1,000 points, posting its biggest-ever one-day point gain on the heels of the worst Christmas Eve on record...

The Shanghai Index appears to be easing down toward its Cycle Bottom at 2430.94. The Cycles Model suggests potentially another week of decline. Downside targets range from 2200.00 to 1900.00. Year-end selling may come on strong with no buyers.

(SouthChinaMorningPost) Shares listed in mainland China fell on Tuesday, tracking the steep losses in markets in Japan and the United States triggered by an intensifying row between the White House and the US Federal Reserve. The Hong Kong market will remain closed until Thursday.

Top of Form

The Shanghai Composite Index dropped by as much as 2.5 per cent during the day before paring some of the losses to close 0.9 per cent, or 22.19 points, lower at 2,504.82. The decline follows a Wall Street bloodbath on Monday, in which a 2.7 per cent decline at the close bought the S&P 500 to the brink of bear market territory.

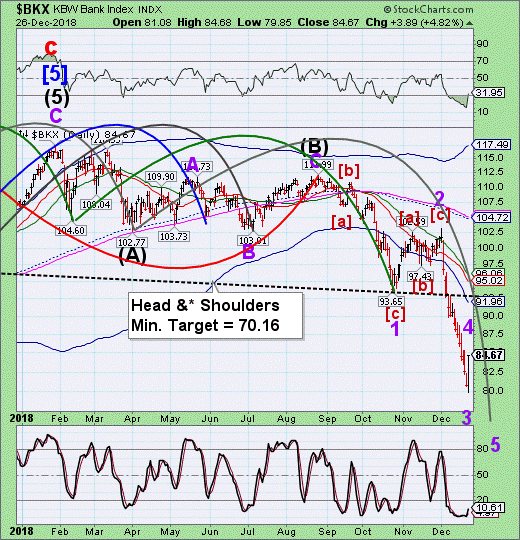

-- BKX bounced today after the worst Christmas Eve trading session ever. While the bounce appears impressive, the Cycles Model warns that there is more to come on the downside. The Head & Shoulders target is still a likely candidate for this decline.

(CNNBusiness) Treasury Secretary Steven Mnuchin left a lot of people scratching their heads. In trying to assure everyone that banks are healthy, he opened up a question most market observers weren't asking, at least publicly.

"The problem with his comments [is] he's either incredibly out of touch, or he knows a problem nobody else knows," said Dennis Kelleher, CEO of financial reform group Better Markets.

The stock market looked to recover a bit on Wednesday. But Mnuchin's comments raised a new anxiety: Should people be worried about the soundness of US banks?

Public evidence suggests the banks are not in crisis.

The Federal Reserve conducts annual stress tests of how the biggest banks would hold up under various hypothetical scenarios, such as if unemployment skyrocketed or housing prices plummeted.

In a report in June, the Fed concluded that American banks are in good condition and strong enough to withstand the next economic downturn. And regulations enacted after the 2008 financial crisis mandate that banks maintain certain levels of liquid assets, which can be easily converted to cash to pay off obligations in a crunch.

Mnuchin's remarks on Sunday that banks have "ample liquidity" were met with confusion and surprise, triggering a wild day of trading just before the Christmas holiday. The Dow and the S&P 500 each fell by nearly 3% — their biggest Christmas Eve declines in history.

(Bloomberg) Chinese authorities are studying plans to help banks replenish capital as they look to continue with their crackdown on financial risk without hurting credit growth.

Key Insights

- The move to promote sales of perpetual bonds as soon as possible comes as new regulations on asset management force banks to absorb off-balance-sheet debts.

- Swelling soured loans and a slump in share prices are making it harder for banks to raise money.

- Stronger capital buffers also put the banks in a position to increase lending to private companies and help meet the government’s vow to support the struggling sector.

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more

Interesting read. Certainly, finding the reason stocks are behaving as they are would allow us to not be so comfortably (or perhaps uncomfortably) numb as we heard many years ago from Pink Floyd:

What seems to be the trouble

Are we feeling out of sorts

Do you think they're gone forever

Can you show me where it hurts

I think I know what's wrong

A lot people get this way

Take two of these four times a day

I'll drop in when I pass this way again

There is no pain, you are receding

A distant ship smoke on the horizon

You are only coming through in waves

Your lips move but I can't hear what you're saying

When I was a child I had a fever

My hands felt just like two balloons

Now I've got that feeling once again

I can't explain, you would not understand

This is not how I am

I have become comfortably numb.

genius.com/Pink-floyd-comfortably-numb-lyrics