VIX And S&P 500 Diverge – Non-Commercials Actively Cover Net Shorts In VIX Futures

VIX continues to struggle to take out its high from 13 sessions ago, even as major equity indices dropped to fresh lows yesterday. Non-commercials in the meantime are actively covering their net shorts. At least near term, there is room for premium to come out of VIX.

Equity bulls and bears are right in the midst of a tug-of-war.

From the all-time high reached on September 21 through Monday’s intraday low, the S&P 500 large cap index dropped 11.5 percent. Bears still have possession of the ball, attacking every opportunity they get. On the 17th, they defended broken support at 2800. Monday, they showed up near the 11th low of 2710.51; the session widely – and wildly – vacillated between up 1.8 percent to down 2.1 percent, in the end closing down 0.7 percent (Chart 1).

Bulls – bruised and beat-up – are beginning to work up courage. Monday’s, as well as last Friday’s, candles had long lower shadows. Thus far, buying the dip has not worked, with loss of one after another support. Conditions as a result are extremely oversold, the daily in particular. Concurrently, the daily RSI is showing a positive divergence. Bulls probably also like how VIX is behaving.

The volatility index rose to an intraday high of 28.84 on the 11th (arrow in Chart 2). This was the highest since February this year. The S&P 500, plus other major US indices, have gone on to undercut the lows in that session, even as VIX is unable to surpass that high. Monday produced a spinning top with very long upper and lower shadows. Odds of a pullback near term continue to grow.

Then, there is this.

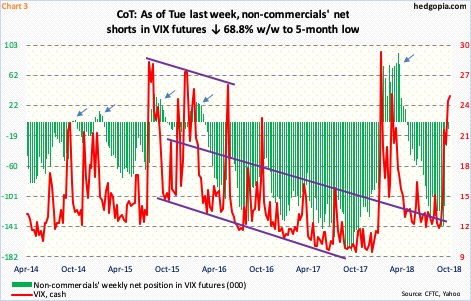

Several times in the past, non-commercials switching to net long VIX futures has coincided with a peak in the cash (arrows in Chart 3). Most recently, these traders switched from net short 59,357 contracts in the week ended January 30 this year to net long 85,818 a week later. VIX peaked at 50.30 intraday on February 6 (Chart 2).

In the latest week – as of Tuesday last week – non-commercials were net short 10,303 contracts. Just three weeks before that – as of October 2 – they were net short 140,444. They quickly covered as the cash began to rally. The S&P 500 began dropping beginning October 3. It will be interesting to see what this week brings. Non-commercials’ holdings as of today will be published Friday. Fingers are crossed. This is potentially another data point that could argue for a drop in VIX near term.

Disclaimer: This article is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more