Value Pushes Back Against The Bear

Those who thought Value is dead probably had a rotten January, at least if they acted on such assumptions. I’m not prepared to say the rest of 2019 will be smooth sailing for fans of Graham, Dodd, and Buffett; the future has limitless ways of confounding us. But I am now tripling down on comments I made last September and again about a month later to the effect that the FANG-like momentum-driven world we had been seeing is not the new normal. Financial theory (including the value factor) still matters.

© Can Stock Photo, bruesw

Value Came Back

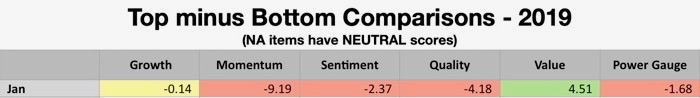

Figure 1 shows the January 2019 scorecard for each of six key factors I track, five of which reflect Portfolio123 ranking systems I created and one of which, Power Gauge, is a multi-factor approach created by Wall-Street veteran Marc Chaikin. (The figures are based on monthly share price returns for stocks in a Russell 3000-like universe sorted from best to worst by rank score and divided into five “buckets.” The Top bucket refers to the highest-ranked stocks whole the Bottom refers to the group of stocks with the worst factor scores).

Click here for an explanation of the factors I use, how I define them, and most important, why, I approach factors the way I do.

Figure 1

(Click on image to enlarge)

Value is the obvious winner. Momentum is even more obvious as the big loser. Growth had a neutral showing while the other styles faltered, albeit not as badly as Momentum.

Context

Information like that is all well and good, but it's the context that makes it significant. Figures 2, 3, 4 and 5 supply that by showing the monthly tallies for 2015-18. Figure 6 repeats the 2019 information.

Figure 2

(Click on image to enlarge)

Figure 3

(Click on image to enlarge)

Figure 4

(Click on image to enlarge)

Figure 5

(Click on image to enlarge)

Figure 6

(Click on image to enlarge)

Interpretation

Bear in mind, here, that this presentation is about Value as a factor. “Value Investing,” the process of identifying and choosing stocks whose valuation ratios, however high or low they may be, are lower than where they should be in light of company characteristics, was never out of fashion and never will be.

Value as a factor in and of itself is most productive when consensus investor expectations fail to materialize when high priced companies don’t fare as expected causing stocks to suffer and/or when meagerly valued companies prove less bad than previously supposed causing stocks to correct in a favorable way. The often-empirically-demonstrated long-term efficacy of the value factor tells us that for the most part, investors are not especially good at analyzing companies.

2017 and 2018 marked departures from the norm, when many investors found less occasion than usual to be surprised or disappointed. It may be that the investment community got smarter. If this is so and it does, indeed, become the new normal, we have to expect the value factor to become less useful going forward, meaning many models that are meaningfully influenced by this factor will have to be abandoned or revised. That might be the case, but I believe it would be very dangerous to bet the farm on it. Wall Street has historically had a tendency to naively assume recent trends will persist, while reality has historically had an even stronger tendency to progress via ebbs and flows, zigs and zags, rather than in straight-line fashion. A bet on the long-term death of the value factor is tantamount to a bet that we’ll be able to predict trends using graph paper and a straight-edge ruler.

If on the other, hand, the satisfied-expectations aberration was produced merely by unusually prolonged trends, then we can take the Value comeback we saw in January as a harbinger of things to come, a return to a world in which valuation ratios point investors in good directions; i.e. toward stocks in which the investment community was overly naive in assuming recently observed trends, good or bad, will persist forever.

Putting all of the factors-style together, Growth (which reflects actual historical outcomes) was generally neutral. But the investment community had been pricing many equities based on much more favorable assumptions; assumptions that had to be walked back toward reality. The multi-factor Power Gauge model, acting as it often has much the way a thoughtfully diversified portfolio acts to forego positive extremes while shielding against the potentially more damaging impact of negative idiosyncratic risks, was negative to a modest degree and fared noticeably better than Momentum, Sentiment, and Quality.

The Bottom Line

I can’t promise the end of turbulence for the Value factor. On a month-to-month basis, anything can happen. (In fact, with January looking to be a transitional situation-correcting situation, more turbulence across the board is highly likely). But it’s not about winning the moment. It wasn’t so for equity investors, who, in May 1979 just before the stocks began the great bull market, were famously ridiculed by Business Week as “old fogies” who failed to understand that “[t]he stock market is just not where the action’s at.” It probably won’t be any more so for the value factor today.

Disclosure: None.