UVXY: Market Uncertainty And Telling The Untold Future

In my office I have framed the famous quote, “Know from whence you came. If you know whence you came, there are absolutely no limitations to where you can go”. This was and is still today one of the most inspiring quotes that is applicable to my life and as offered by James Baldwin. James Baldwin offered a vital literary voice during the era of civil rights activism in the 1950s and '60s. I know what you’re thinking, “not quite what I expected to read from an article concerning financials, investing or the equity markets”. Don’t worry, it’s coming.

Last week, the equity markets produced a minor pullback as a great deal of uncertainty plagued investor sentiment. Coming into the week, investors were forced to choose from buying rather expensive stocks on a historical basis and doing so with a major piece of legislation set for a vote, stand pat or simply lock in profits. With a market that seemingly adjusts favorably to every single cause for concern over the last several years, selling equities has been an unwise decision. Having said that, there is a reasonable time to lock in profits and adjust one’s portfolio to the macro-environment.

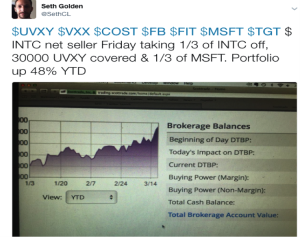

On Friday March 17,2017. I decided to do that very thing and lock in some profits myself and as we headed into the week of March 21st. My following tweet alerted my Twitter followers that I was a net seller of equities to end the week of March 13th. Simply put, this activity was nothing more than a desire to lock in profits and hopefully get an opportunity to repurchase certain assets at a more appreciable valuation.

In the Golden Capital Portfolio, I invest a majority of the portfolio’s capital with Vix-leveraged ETFs/ETNs. For my constant readership, this is not something unfamiliar. Coming into 2017, Golden Capital Portfolio had 20% of invested capital short shares of ProShares Ultra VIX Short-Term Futures ETF (UVXY). In the article titled “My Plans For Success in 2017 Continue To Involve Vix-Leveraged ETFs/ETNs” I outline my short ownership of this investment vehicle.

Since authoring this article, I had reduced that position in shares of UVXY to roughly 15.2% of invested capital. With the Golden Capital Portfolio up nearly 50% year-to-date in a rather robust equity market that exhibits low levels of volatility, the portfolio’s alignment has been optimal or optimized to express great profit potential. And that is from whence I came into the year and found myself on March 17th, as Mr. Baldwin might say. As such and as recognized by my tweet above, I covered another significant portion (30,000 shares) of the portfolio’s short position in UVXY at $15.85 a share. This activity brought the Golden Capital Portfolio to a weighted UVXY short holding of roughly 11% with the recent reduction.

The action taken proved prescient, fortunately. In truth, it was nothing more than strategic, disciplined action sprinkled with a little bit of good luck. I say this because during the week of March 21st, shares of UVXY were found trading at much higher price levels than where I had covered a portion of my shorts, locking in profits. Don’t get me wrong, the remaining shares in the Golden Capital Portfolio have given up some of their profit level with UVXY’s share price increasing, but that is the nature of holding such an instrument long-term; you give a little to earn a great deal more over time.

Last week, most trading days found shares of UVXY trading higher. There was a good deal of volatility during the week and levels of contango had fallen with certain VIX Futures contracts expiring during the week. I used the opportunity that found shares of UVXY trading higher than where I had covered to trade shares during the week and found a goodly amount of success in doing so. Additionally, I was able to take some of these acquired shares and put them back into the portfolio’s core UVXY position for long-term consideration. Having covered shares on March 17th, I was able to reshort those shares as high as $19.85 on Friday March 25th, $4 higher. March 25th found many investors/traders pondering the pending healthcare legislation vote. The equity markets rose and fell sharply in both directions that day, producing volatility and trading opportunities for which I took advantage.

“There are absolutely no limitations to where you can go”, said Mr. Baldwin in his literary works. And that is certainly the truth as it pertains to shares of UVXY near-term. But knowing the near-term directional movement of UVXY is of little concern to me given the design of the instrument. VIX-leveraged instruments like UVXY, VXX and TVIX are designed to decay in price over time. Sometimes the time variable can offer a short duration for achieving profits and sometimes the duration can be extended for a few weeks and in extreme cases a couple of months. What is of greatest importance for Vix-leveraged investors/traders is the maintaining of liquidity and/or ample cash to withstand periods of volatility or “backwardation”. Having a sound investing/trading strategy for shorting these instruments is optimal and beneficial. It is for this reason that I offered to readers/investors/traders my strategy for utilizing these instruments since 2012. In the article “UVXY Reverse Split Ahead: How To Position When Volatility Spikes” I explain my strategy for layering into shares of UVXY as well as maintaining liquidity. I would go so far as to suggest that anybody employing this strategy would have achieved a strong profit performance since 2012. Ok, time to buckle back in and get back to where we came from.

My earliest childhood memory was of my mother awaking me in the middle of the night, pulling me from the top bunk and as my little brother slept below. I couldn’t have been more than 4 or 5 years old. She would drag me from my slumber into the dining room where she had already prepared her concoction of narcotic relief. She would tie the belt around her arm, hand to me the slack and proceed to inject herself in the arm before convulsing. It was during the convulsions that I would run back to my room, lock the door, climb back up the bed and hope tomorrow would bring something not of this nightly routine. I know from whence I came and it wasn’t the most welcoming of worlds I entered into as a youth.

At age 13, in high school, I opened a book that echoed the words of James Baldwin. They spoke to me in a profound way and as if to say, “That crap that you dealt with back then, it doesn’t define you or your future. Your future is only as limited as you make it to be”. It was my epiphany and what has driven me through my youth and into adulthood. It’s what has driven my professional career and my investment philosophy.

What lay ahead next week for the equity markets is unclear, as we will be met with the likelihood of two opposing viewpoints. On the one side we will have a certain number of investors/traders that believe the “no-vote” of the healthcare legislation will prove to impede the Trump administration’s ability to pass Tax Reform. Thus, the assumed Tax Reform that was pending upon Donald Trump’s electoral victory and for which boosted the equity market significantly, may evaporate. That previous level of confidence may find equity markets under pressure and forced to lesser valuation levels. But then there is the other possibility… On the other side of the coin is optimism. It’s this side that recognizes that the no-vote on the recent healthcare legislation didn’t change the state of the economy or the S&P500 earning’s forecast, for better or worse. In fact, the recent FOMC rate hike hasn’t even found yields on the 10-year treasury higher than the day the rate hike was announced. And when we review the weighting of the financial sector on the major averages, this may prove to be the market “tell”. Or, it may not!

Moreover, while there will be many variables to consider regarding the equity markets and as there always is, VIX-leveraged instruments remain an optimal investment for the Golden Capital Portfolio. I’ve come from the best of times and the worst of times with regards to VIX-leveraged ETFs/ETNs…and life some might say. I’ve experienced UVXY go against my short positions by upwards of 180% in the past and as I layered into that surge in share price. Certainly during the 180% backwardation move I pondered my lifestyle and living standards, thinking this was the one that would break me. And I can’t deny the morbid thoughts that plagued me as a youth and as I struggled with those visions and experiences of a parental addict. But… “Know from whence you came. If you know whence you came, there are absolutely no limitations to where you can go”. Make it a great one, make You a great one.

Disclosure: I am short UVXY and VXX

Sorry hear what you had to go through as child. Very much agree the quote. You have been motivation for me to follow a methodical approach for profits, i might not be as aggressive as you are in shorting $UVXY, but am short never getting into a "called in" situation. Thanks for your posts.

Thank you for reading and your comment. I'm glad to see you are accommodating for necessary liquidity and achieving strong results.