Used Vehicle Prices Spike By Record 9% YoY As Worried Consumers Abandon Mass Transit

One major problem over the last few months for the auto market was that the price of used vehicles was plunging, pressuring new vehicle sales. Now, that trend looks to have reversed in a grand fashion.

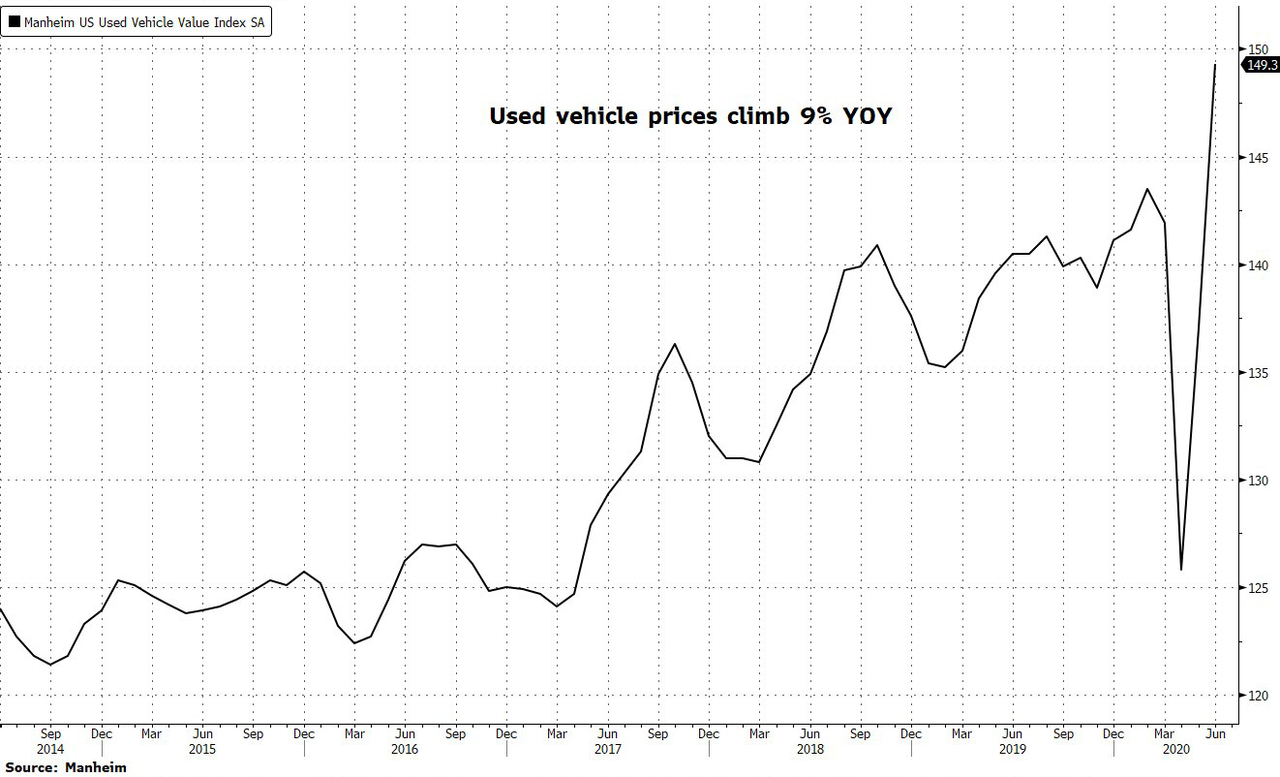

Used car prices are up 9% year over year, according to data from the Manheim U.S. Used Vehicle Value Index for June. The spike is being attributed to more people heading back out of the house - as states across the U.S. reach various stages of re-opening - but avoiding mass transit and ride sharing services.

The idea of having your own, quarantined vehicle is now back in fashion and has caused a 50% to 75% drop in mass transit in some major cities, according to Bloomberg.

In Seattle, public transit usage is down about 70%. According to Bob Foran, chief financial officer for the Metropolitan Transportation Authority, New York City subway and commuter rail traffic is down an astounding 90% over the last 120 days.

The effects look like they could be relatively permanent, too. A survey conducted by CarGurus showed that 44% of people who used mass transit think they will abandon it permanently. Ride sharing services are also feeling the pain: 40% of people surveyed who previously used ride sharing services said they would decrease their usage or stop using such services altogether.

That doesn't bode well for Lyft (LYFT) and Uber (UBER).

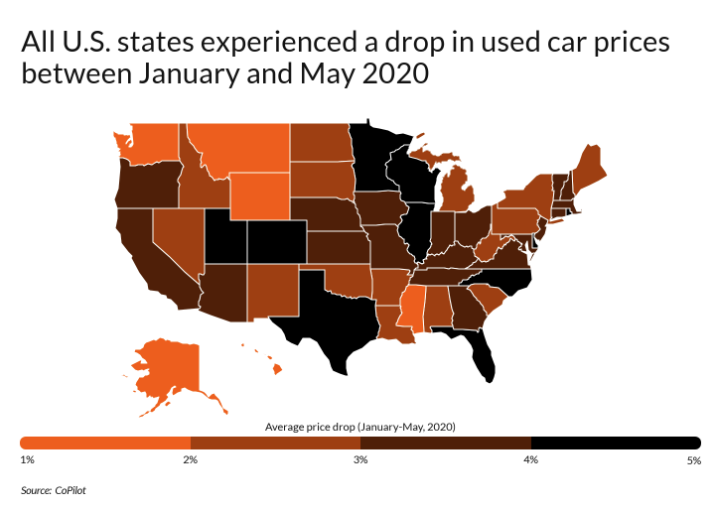

The survey also found that 20% of people who were looking to buy a car hadn't been interested in doing so prior to the pandemic. Recall, just days ago we were busy highlighting all of the places nationwide where used car prices had crashed.

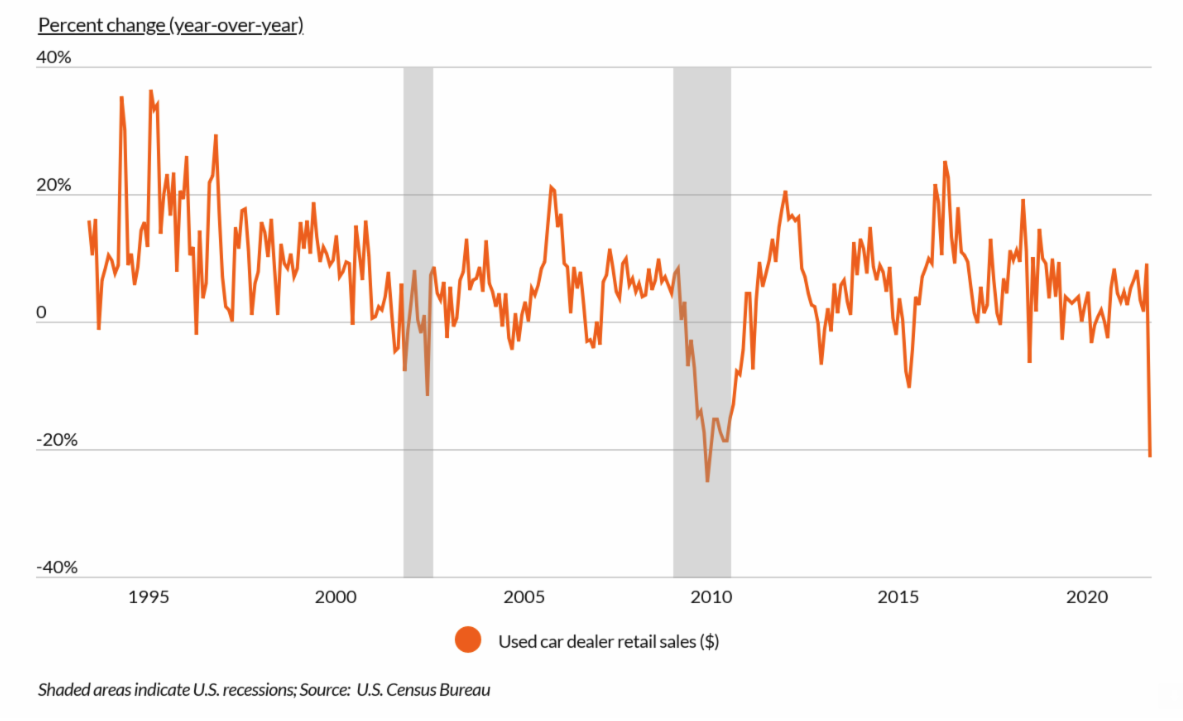

In January, prior to the virus shutdowns, auto companies had set the tone for the year, starting 2019 just as miserably as 2018 ended, with major double digit plunges in sales from manufacturers like Nissan (NSANY) and Daimler (DDAIF). Since then, things have only worsened, with major markets like China and the U.S. seeing sales fall off a cliff as consumers have been forced to stay home.

And while dealers were set to offer incentives to spur new car sales, used car prices were tanking, as we noted. Over the last few months we detailed how used car prices were set to cripple what little interest in new cars remains, how dealers are scrambling to desperately offer incentives, and how ships full of vehicles are being turned away at port cities due to a lack of space and inventory glut.

Hilariously enough, it was Manheim that indicated last month that wholesale prices dropped as much as 11% in April and predicted that "this price drop hasn't fully hit the retail market yet." Their June report predicted that since "dealers have largely avoided purchasing new inventory in recent weeks, they aren’t in a rush to cut prices as a way to move their existing inventory."

They also predicted a sharp drop in retail prices in the coming weeks, stating that "a combination of record supply, damaged consumer confidence, and new car incentives will ultimately create a perfect storm causing retail prices to drop sharply in the coming weeks."

And despite the fact that between January and May individual U.S. states experienced price drops ranging from 1% to 5%, it looks as though the trend has now reversed significantly, showing this recession's first actual V-shaped recovery.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more