USD/JPY Will Not Stay In Range For Too Long With The Fed And The NFP

This was the week: All the negotiations are stuck

Negotiations between the US and China did not go anywhere fast. It culminated with reports that some talks were canceled, but these stories were denied. Nevertheless, there is no breakthrough, and it does not help sentiment. US Commerce Secretary Wilbur Ross said that China and the US are “miles away.”

The Chinese economy grew by 6.6% in 2018, as expected, but this is the slowest pace since 1990. The data sent shivers down the spines of financial markets.

In the US negotiations between President Donald Trump and Democrats are stuck. Attempts to find a compromise failed, and Trump’s State of the Union address was canceled by Hosue Speaker Nancy Pelosi.

The government shutdown affects around 800,000 workers that are not receiving paychecks. The longer it lasts, the more devastating the economic damage. Also, the government is not publishing the full range of economic indicators, and in some cases, no data is collected.

After the cancellation of Durable Goods Orders, the preliminary GDP report for Q4 is in doubt as well. Among the figures that did come out, Existing Home Sales disappointed by dipping just below 5 million units annualized, exposing the weakness of the sector. On the other hand, Initial Jobless Claims dropped to 199K, the lowest since 1969.

Another front where there is no progress is Brexit. The UK Parliament debates various motions including options to prevent a hard Brexit and an option to postpone Brexit. So far, markets are optimistic.

The Bank of Japan downgraded its inflation forecasts, basically acknowledging reality. The move was expected, and the BOJ remains the most dovish central bank in the developed world.

All in all, markets remain concerned about the global slowdown, and this keeps the pair pressured.

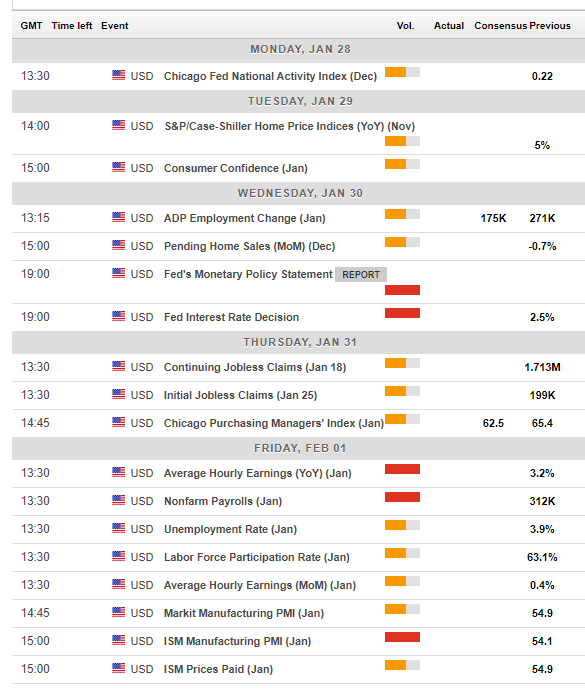

US events: NFP and the Fed stand out

Tuesday is a warm-up with the S&P Case Shiller HPI that provides another look at the housing sector. Also, the Conference Board’s Consumer Confidence measure will likely slide in January, following the drop in the University of Michigan’s parallel gauge.

Wednesday is a busy day. The ADP Non-Farm Payrolls report is set to return to normal levels after showing a whopping gain of 271K in December, hinting at the blockbuster NFP later on.

The first release of Q4 GDP will likely be postponed due to the shutdown, but if it comes out, a slowdown to sub-3% growth is projected.

The central event of the week is also due on Wednesday: the Fed decision. See the next section for a detailed preview.

The second critical event is the Non-Farm Payrolls on Friday. December’s jobs report was a blockbuster one: 312K positions were gained, and wage growth accelerated: 0.4% MoM and 3.2% YoY. More moderate numbers are likely now. The Unemployment Rate rose to 3.9% in December but it remains low, and it came on top of an increase in the Participation Rate, a welcome development.

The last word of the week belongs to the ISM Manufacturing PMI. The forward-looking index usually serves as a hint towards the NFP but carries its weight. The survey for December plunged from the highs to 54.9, indicating a significant shift in sentiment. Another drop would trigger further concerns. A score of 50 points separates expansion from contraction.

Here are the top US events as they appear on the forex calendar:

(Click on image to enlarge)

Fed: Powell practices patience

The Federal Reserve is projected to keep interest rates unchanged after hiking in December. Back then, world’s most powerful central bank downgraded the projection for 2019 from three to two rate hikes. The decision was still perceived as hawkish, as markets had expected a further downgrade. Also, Fed Chair Jerome Powell said that the reduction of the balance sheet, aka Quantitative Tightening, would continue on auto-pilot.

The Fed changed its tunes since then. Powell called for patience on raising rates and also opened the door to changing the balance sheet reduction scheme. Other FOMC members also conveyed the message of “patience,” and one even went as far as suggesting a rate cut is possible.

The January Fed decision does not consist of new forecasts, but Powell will likely confirm that the Fed is not on course to raise rates very soon. He will try to balance between concerns about a slowdown, stemming from external demand, and the underlying strength of the economy, primarily seen in the job market. Markets will scrutinize every word in the statement and his press conference.

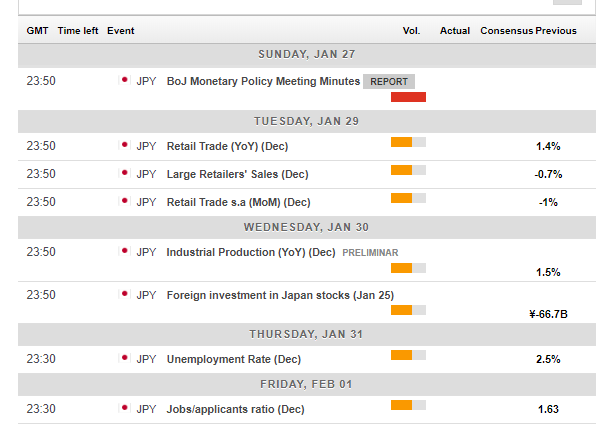

Japan: Awaiting trade developments

The Japanese yen remains the ultimate safe-haven currency that finds demand in times of trouble. The BOJ decision sustained this status. We will hear from the BOJ early in the week via its meeting minutes.

Later in the week, retail trade data and Industrial Output will be of interest.

However, the central driver for the currency is set to be the direction of US-Chinese trade talks. Progress can send the yen down while a deadlock can push it higher.

Brexit has not had a significant impact on the Japanese currency, but if things heat up, it could become a market mover.

Also, it’s worth watching developments around North Korea ahead of the second Trump-Kim Summit in February.

Here are the events lined up in Japan:

(Click on image to enlarge)

USD/JPY Technical Analysis

Dollar/yen’s recent range trading limited has put the Relative Strength Index and Momentum to sleep. However, the 50-day Simple Moving Average crossed the 200-day SMA to the downside, a pattern known as the “death cross.” This does not bode well for the pair.

Support awaits at 109.15 which was the weekly low and capped USD/JPY earlier in the month. 108.60 was a stepping stone in the recent recovery and also served as support in the past. 108.10 was a swing low in the spring of 2018 and serves as another support line.

107.75 was a swing low in mid-January and also capped $/yen in April 2018. 107.50 follows closely as the initial support line after the flash crash which bottomed at 104.87.

Looking up, the round number of 110 capped the pair in mid-January and also worked as support around Christmas. 110.45 was a swing low in September and switches to resistance. 111.10 is where the 50 SMA meets the price and a temporary cap.

111.40 was a peak in December, just before the crash. 111.70 was a support line in October, and 112.20 was a double bottom during the autumn.

(Click on image to enlarge)

-636840060038091388.png)

USD/JPY Sentiment

While the Fed may be more dovish and weigh on the US Dollar, the reason for being dovish is not good news for the world. An economic slowdown can send flows into the yen. So, there is a better chance to see falls than gains.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more