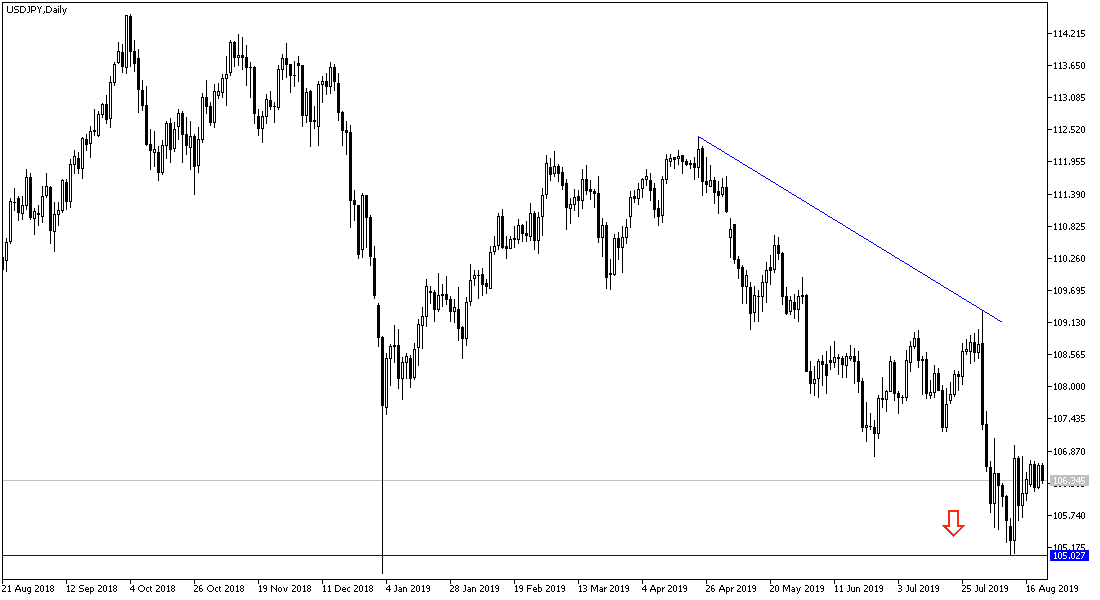

USD/JPY Technical Analysis: Failing To Cross A Resistance

For four consecutive trading sessions, the USD/JPY is unable to cross the 106.70 resistance level as seen on the provided daily chart below. This confirms the strength of the Japanese yen as a safe haven in times of uncertainty amid growing global trade and geopolitical tensions, and there are plenty of them it at the moment. This failure means that the downtrend is still the strongest and it may come back to complete the trend. The pair did not benefit much from the announcement of Federal Reserve's July meeting’s contents. The report stated that the increasing risks and uncertainties associated with the global economic outlook and international trade prompted the bank to consider cutting interest rates by a quarter-point in this meeting to update its policy cycle, and it may continue with same steps in the near future, which will be determined by economic developments and external risks, especially with continues world trade wars, with the US being a strong party in them, with the adoption of America First first.

The US central bank is under increasing pressure to cut interest rates by US President Donald Trump, who has repeatedly criticized Federal Reserve Chairman Jerome Powell's approach to the monetary policy through several tweets on Twitter. Before the announcement, Trump tweeted: “Great performance with China and other business deals. The only problem we face is the policy of Powell and the Fed. It's like a golfer who can't hold on, strong economic growth in the United States will be supported by a significant rate cut” and added: “We are competing with many countries who have lower interest rates, ours should be lower”.

Technically, USD/JPY is ready to continue the downtrend if it fails to break above 106.700 resistance and then reach 107.30 and 108.00 resistance levels respectively. The general trend is still supporting the possibility of the pair returning to the threshold of 105.00 psychological support, which supports the strength of this trend. Risk aversion and investor appetite for safe havens will be in Japanese yen's favor.

As for the economic data today, like the rest of the week, no significant Japanese economic data is expected today. Only from the United States, there will be an announcement of unemployed claims. And any new developments from monetary policy officials at the Jackson Hole symposium organized by the US central bank.

(Click on image to enlarge)

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more