USD/JPY Price Looking At New Highs Above 110.40, Dismal Data Helps

The USD/JPY price rallied and now wobbling at the 110.30 zone. The pair has jumped above strong upside obstacles signaling potential buying. It remains to see what will really happen as the DXY drops right now after reaching major dynamic resistance.

The pair edged higher as the Japanese Yen was weakened by the Nikkei’s bounce back. The JPY has lost significant ground versus all its rivals, not only against the USD. The Yen was punished by the Japanese Trade Balance, reported at -0.09T, far below 0.02T expected while compared to 0.02T in the previous reporting period.

Tomorrow, the US Unemployment Claims, CB Leading Index, and the Existing Home Sales could bring more stimulus into the game if the figures printed better than expected. Also, the ECB could have an impact on the USD/JPY.

USD/JPY price technical analysis: Bulls ready to roar!

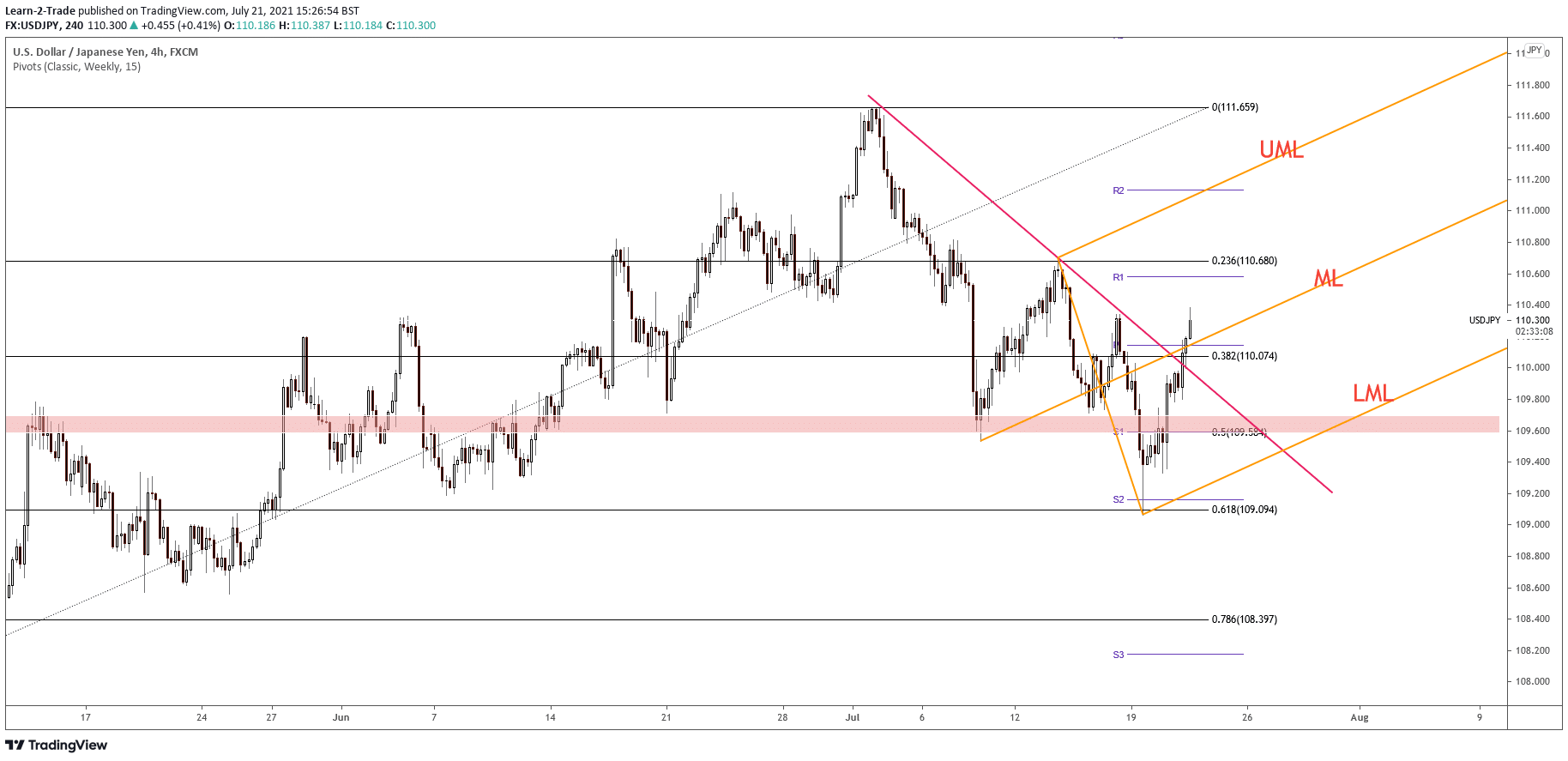

The USD/JPY pair has escalated as much as 110.38 level today, but it could slip lower to retest the broken resistance level before resuming its upside. Nevertheless, it has managed to pass above the down trendline, through the median line (ML), and above the weekly pivot point of 110.14.

(Click on image to enlarge)

USD/JPY price analysis on 4-hour chart

The DXY’s current drop forced the pair to lose altitude. Still, the pair could increase further as long as JP225 jumps higher. The Nikkei rallies right now as the US equities are strongly bullish.

Technically, USD/JPY has found strong demand around the 61.8% retracement level and now is traded back above the 38.2% retracement level. Furthermore, its false breakdown with great separation through the S2 (109.16) and below the 61.8% level signaled an upside move.

The USD/JPY pair could resume its growth if it stabilizes above the ascending pitchfork’s median line (ML). A new higher high, jump and close above the 110.38 today’s high could activate more gains in the short term.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more