USD/JPY Price Corrects Lower After Breakout, US CPI To Follow

The USD/JPY price is trading in the red at 110.08 after failing to resume its upwards movement. The pair has slipped lower as the Dollar Index and the JP225 are trading in the red right now. Still, the current decline could be only temporary. DXY could jump higher anytime if the US economic data came in better than expected during the week.

Also, the Nikkei (JP225) is traded below as strong dynamic resistance, so the pressure is still high in the short term. You should know that the Japanese Banks are closed in observance of Mountain Day.

Today, the pair could be moved by the FOMC Member Bostic, and FOMC Member Barkin remarks. Tomorrow, the Japanese Current Account, Economy Watchers, and the Bank Lending could bring some action.

The main event of this week is represented by the US inflation data release. The CPI and the Core CPI will be published on Wednesday. Most likely, USD/JPY will register sharp movements around these figures.

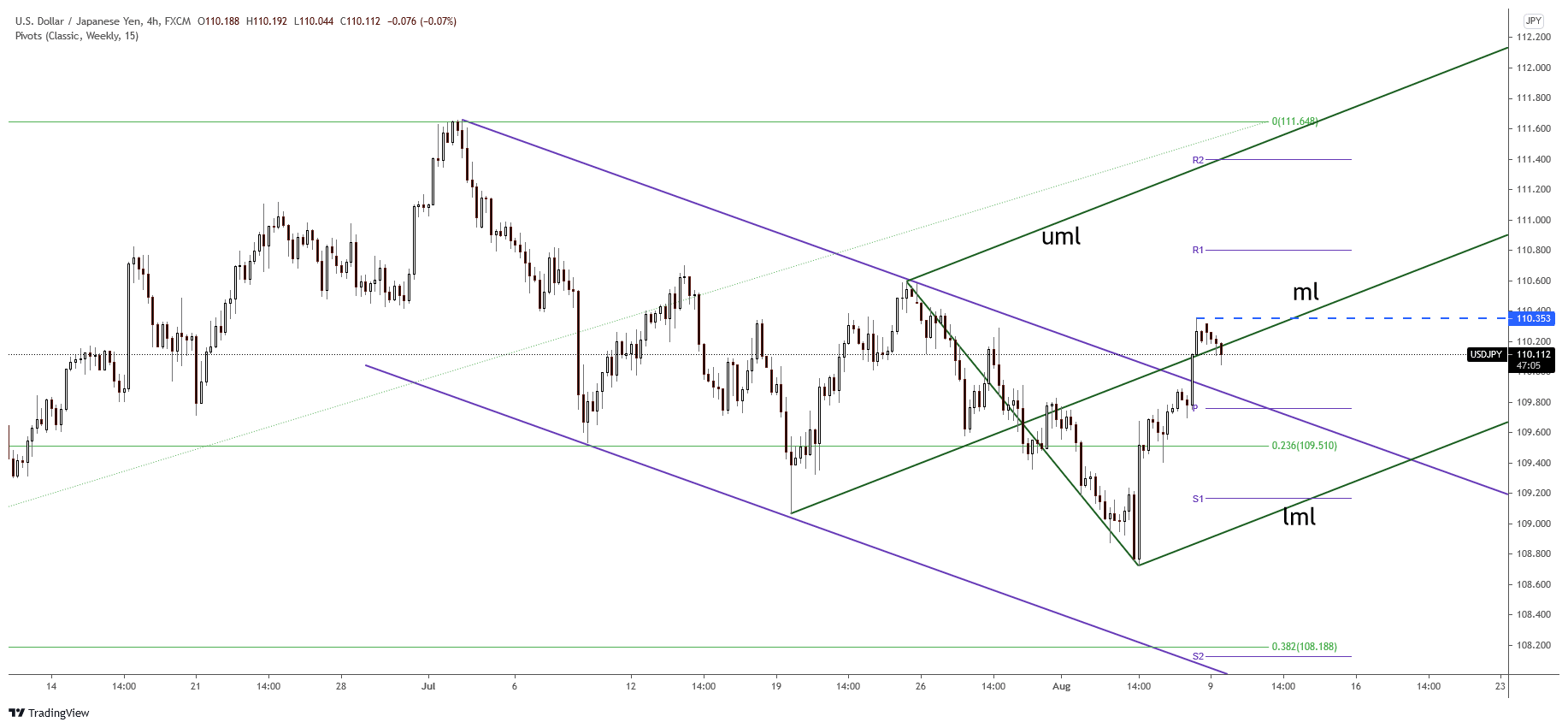

USD/JPY price technical analysis: Key levels to follow

(Click on image to enlarge)

USD/JPY 4-hour price chart

The USD/JPY price dropped after reaching the 110.35 level. It’s located below the ascending pitchfork’s median line (ml). Staying below it may signal further decline towards the broken downtrend line and down to the 109.75 weekly pivot point.

Technically, a minor consolidation could bring us a new long opportunity. Now, we don’t have a great buying or selling opportunity. The USD/JPY pair has escaped from the down channel pattern signaling an upwards movement.

The pair could come back to test and retest the immediate support levels before jumping higher. USD/JPY has failed to stabilize under the 23.6% retracement level, signaling that the retreat is over.

Personally, I believe that only a downside breakout below the ascending pitchfork’s lower median line (LML) could invalidate the upside scenario. It could still increase as long as it stays above the broken downtrend line, channel’s resistance.

Coming back above the median line (ml) and making a new higher high to close above 110.35 may signal further upward movement.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more