USD/JPY Fails At Resistance And Pivots Lower, But The Underlying Trend Remains Bullish

The hawkish bias adopted by the Federal Reserve has somewhat changed the narrative and created a more favorable environment for the US Dollar, especially against low-yielding currencies such as the Japanese yen. In its June monetary policy decision, the FOMC left its benchmark interest rate and quantitative easing (QE) program unchanged but signaled two rate hikes for 2023 amid rising inflationary pressures and optimism about the state of the recovery. In the press conference, the bank also stated that preliminary discussions on reducing its bond-buying program had begun, although it stressed that the conversation was at an early stage and that more inroads toward "substantial further progress" were needed before advancing the debate.

The hawkish shift by the central bank triggered a spike in nominal rates, lifting the US 2-year treasury yield roughly 9 bps above 0.2%, its highest level in 12 months. The US 10-year yield also jumped, although the move has since reversed. The rate repricing provoked an initial strong bullish move in the USD/JPY, pushing its price to 110.82, the highest mark since last April. Today, however, the pair has retraced some of the Fed-induced gains but remains biased to the upside in light of the latest developments.

One of the key takeaways from the FOMC meeting is that policymakers appear more upbeat about the recovery outlook and somewhat uneasy about rising consumer prices, with Chairman Powell acknowledging for the first time that “inflation could turn out to be higher and more persistent than expected”. In the coming weeks, improvements in the labor market and high inflation outcomes may bring forward the tapering timeline or, at the very least, strengthen the argument for the need to start reducing asset purchases sooner rather than later. This may accelerate the transition to higher rates at the long end of the curve, supporting the dollar.

Meanwhile, in Japan, low coronavirus vaccination rates relative to other developed nations should continue to act as a drag-on activity at the domestic level. With a weak recovery in sight, the Bank of Japan is likely to maintain a steady hand in terms of further monetary policy actions, reinforcing the low-yield status of the Japanese yen. For all these reasons, when the dust settles and market noise recedes, the path of least resistance for USD/JPY appears to be higher.

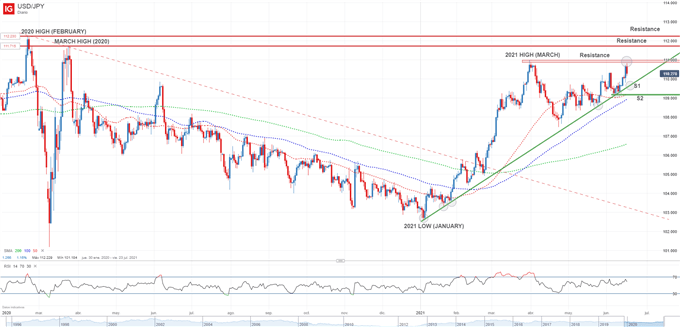

USD/JPY TECHNICAL ANALYSIS

USD/JPY approached the 2021 swing high near 110.90 on Thursday but was quickly rejected from those levels as sellers recharged. The pull-back, however, may just be a temporary setback for the dollar due to the daily retreat in the US 10-year yield. In any case, the pair is likely to resume the uptrend at any moment amid broad-based greenback momentum in the market, especially if it manages to remain above the ascending trendline extended from the 2021 low. That said, if USD/JPY regains strength and pivots higher, the first technical resistance comes at 110.80/110.97 (2021 highs region). Should buyers push price above this ceiling, the pair could head towards the 2020 March high near 111.71.

On the contrary, if the USD/JPY moves lower and breaks support at 109.60 (rising trendline mentioned before), the June low will come into play.

USD/JPY TECHNICAL CHART

Disclaimer: See the full disclosure for DailyFX here.