USD/JPY Advance Stalls Ahead Of FOMC As U.S. CPI Fails To Impress

JAPANESE YEN TALKING POINTS

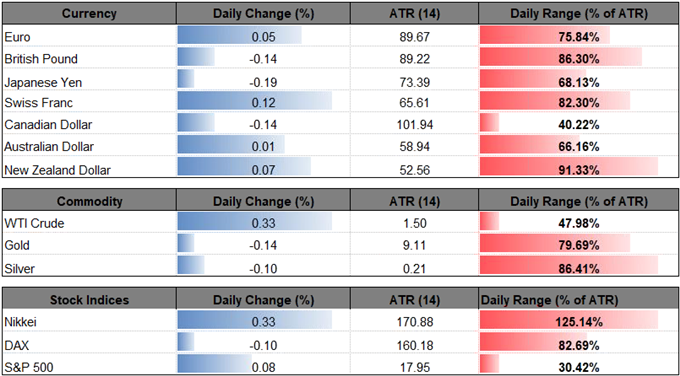

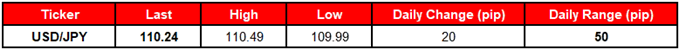

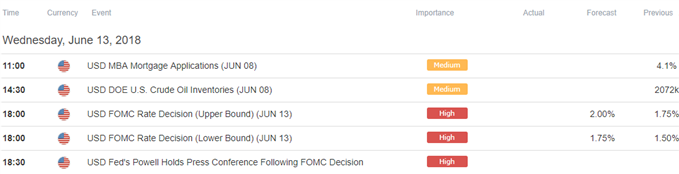

USD/JPY pulls back from a fresh weekly-high (110.49) as the updates to the U.S. Consumer Price Index (CPI) instill a mixed outlook for the real economy, and the dollar-yen exchange rate may continue to consolidate ahead of the Federal Open Market Committee (FOMC) interest rate decision on June 13 as market participants weigh the outlook for monetary policy.

(Click on image to enlarge)

USD/JPY ADVANCE STALLS AHEAD OF FOMC AS U.S. CPI FAILS TO IMPRESS

Despite the uptick in both the headline and core CPI, a deeper look at the report showed Average Hourly Earnings holding flat in May, with Average Weekly Earnings narrowing to 0.3% from 0.4% in April.

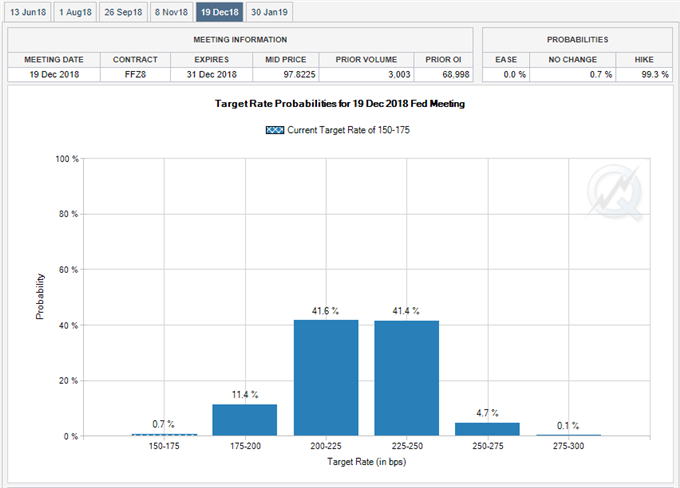

Signs of subdued wage growth may impede on the Federal Reserve’s hiking-cycle as ‘market-based measures of inflation compensation remain low,’ and the central bank may soften its hawkish tone throughout the second-half of the year as ‘inflation on a 12-month basis is expected to run near the Committee's symmetric 2 percent objective over the medium term.’

(Click on image to enlarge)

With that said, the U.S. dollar stands at risk of facing a more bearish fate if the FOMC may merely stick to the current script, and ongoing projections for a neutral Fed Funds rate of 2.75% to 3.00% is likely to produce headwinds for the U.S. dollar as market participants scale back bets for four rate-hikes in 2018.

USD/JPY DAILY CHART

(Click on image to enlarge)

- USD/JPY appears to be making a run at the May-high (111.40) as breaks the monthly opening range, with the Fibonacci overlap around 111.10 (61.8% expansion) to 111.60 (38.2% retracement) on the radar as the pair initiates a fresh series of higher highs & lows.

- However, failure to test the May-high (111.40) may give way to range-bound prices, with a move break/close below the 109.40 (50% retracement) to 110.00 (78.6% expansion) region raising the risk for a move back towards 108.30 (61.8% retracement) to 108.40 (100% expansion).

(Click on image to enlarge)

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more