USD/CAD Technical Outlook: Initial Targets For Post-NFP Reversal

The US Dollar pared early-week gains today as weak NFPs / strong Canada jobs data fueled a reversal off key resistance in USD/CAD. These are the updated targets and invalidation levels that matter on the USD/CAD charts heading into the close of the week.

USD/CAD DAILY PRICE CHART

(Click on image to enlarge)

Technical Outlook: In my previous USD/CAD Weekly Technical Outlook we noted that the immediate advance was vulnerable as price approached, “a key resistance zone at 1.3375-1.3435- a region defined by the 50% retracement of the 2016 decline, the June swing highs and the 2017 yearly open”.

USD/CAD registered a high at 1.3445 before reversing sharply with strong Canadian employment data today further accelerating the decline. Note that we’ve been marking ongoing momentum divergence and highlights the risk for deeper losses here near-term. Initial support rests with the October channel with a break below the monthly opening-range low at 1.3160 shifting the focus back towards the slope support confluence / 100-day moving average at 1.3083/90.

USD/CAD 240MIN PRICE CHART

(Click on image to enlarge)

Notes: A closer look at Loonie price action shows the pair trading within the confines of the ascending slope series we’ve been tracking in USD/CAD since October and further highlights this week’s reversal off confluence resistance. Initial support now rests at with the lower parallel / 61.8 % retracement at 1.3269 – we’re looking for a reaction here – watch the weekly close.

Bottom line: USD/CAD is testing upslope support here and IF broken, would keep the near-term short-bias in play targeting the monthly range lows and more significant slope support. From a trading standpoint, look to reduce short exposure on a drop towards 1.3269 – If price is heading lower, rallies should be capped by the 1.3375/85 resistance zone. I’ll favor fading near-term rallies while below this threshold, for now, targeting a move towards the 1.31- handle.

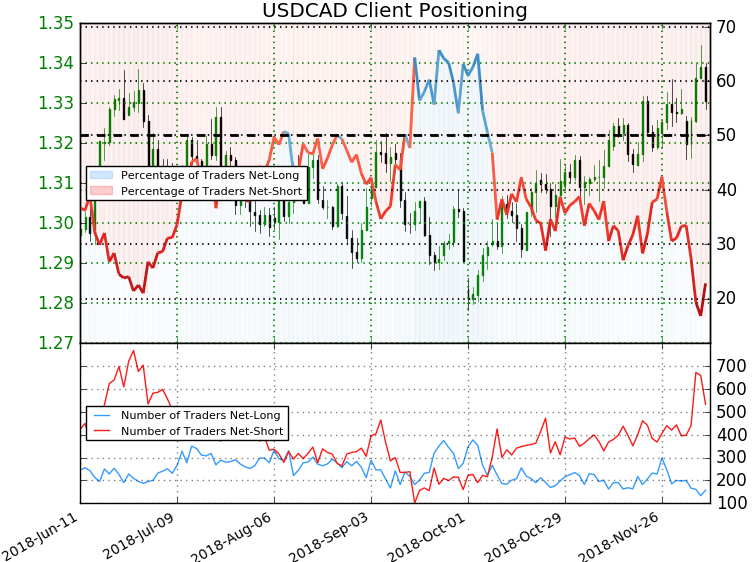

USD/CAD TRADER SENTIMENT

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -3.39 (22.8% of traders are long) – bullish reading

- Traders have remained net-short since October 9th; price has moved 3.9% higher since then

- Long positions are12.8% lower than yesterday and 34.6% lower from last week

- Short positions are 19.1% lower than yesterday and 12.7% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Yet traders are less net-short than yesterday but more net-short from last week and the combination of current positioning and recent changes gives us a further mixed USD/CAD trading bias from a sentiment standpoint.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more