USD/CAD Clears February High, RSI Flashes Bullish Signal Ahead Of BoC

USD/CAD appears to be staging a near-term breakout after bouncing along the 200-Day SMA (1.3160), and the topside targets sit on the radar ahead of the Bank of Canada (BoC) interest rate decision as the exchange rate carves a series of higher highs & lows.

USD/CAD CLEARS FEBRUARY HIGH, RSI FLASHES BULLISH SIGNAL AHEAD OF BOC

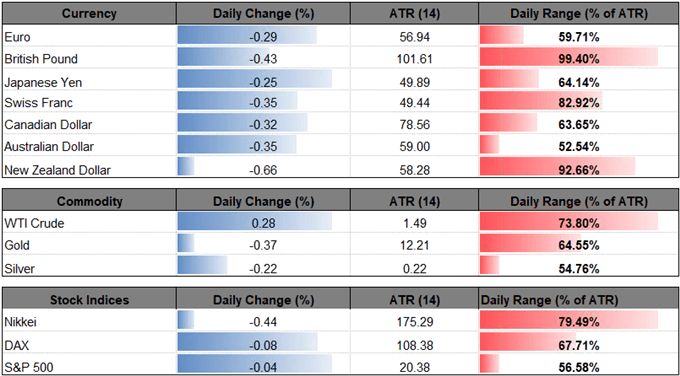

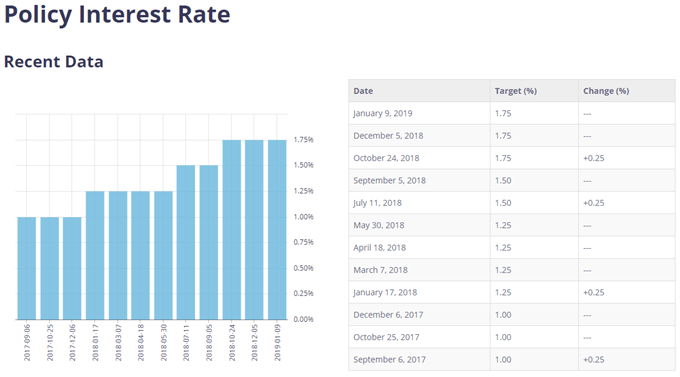

USD/CAD extends the advance following Canada’s Gross Domestic Product (GDP) report, which showed the growth rate increasing 0.4% in the fourth-quarter of 2018 versus forecasts for a 1.0% print, and the BoC meeting may do little to shore up the Canadian dollar as the central bank is widely expected to keep the benchmark interest rate at 1.75% in March.

(Click on image to enlarge)

With that said, the Canadian dollar is likely to react to the forward-guidance for monetary policy as the BoC argues that ‘the appropriate pace of rate increases will depend on how the outlook evolves,’ and it remains to be seen if Governor Stephen Poloz & Co. will continue to prepare Canadian households and businesses for higher borrowing costs as the ‘Governing Council continues to judge that the policy interest rate will need to rise over time into a neutral range to achieve the inflation target.’

Indications of a looming BoC rate-hike is likely to shake up the near-term outlook for the Canadian dollar as the central bank seems to be on track to further normalize monetary policy in 2019, but a material change in the forward-guidance may fuel the recent advance in USD/CAD as market participants scale back bets for higher interest rates.

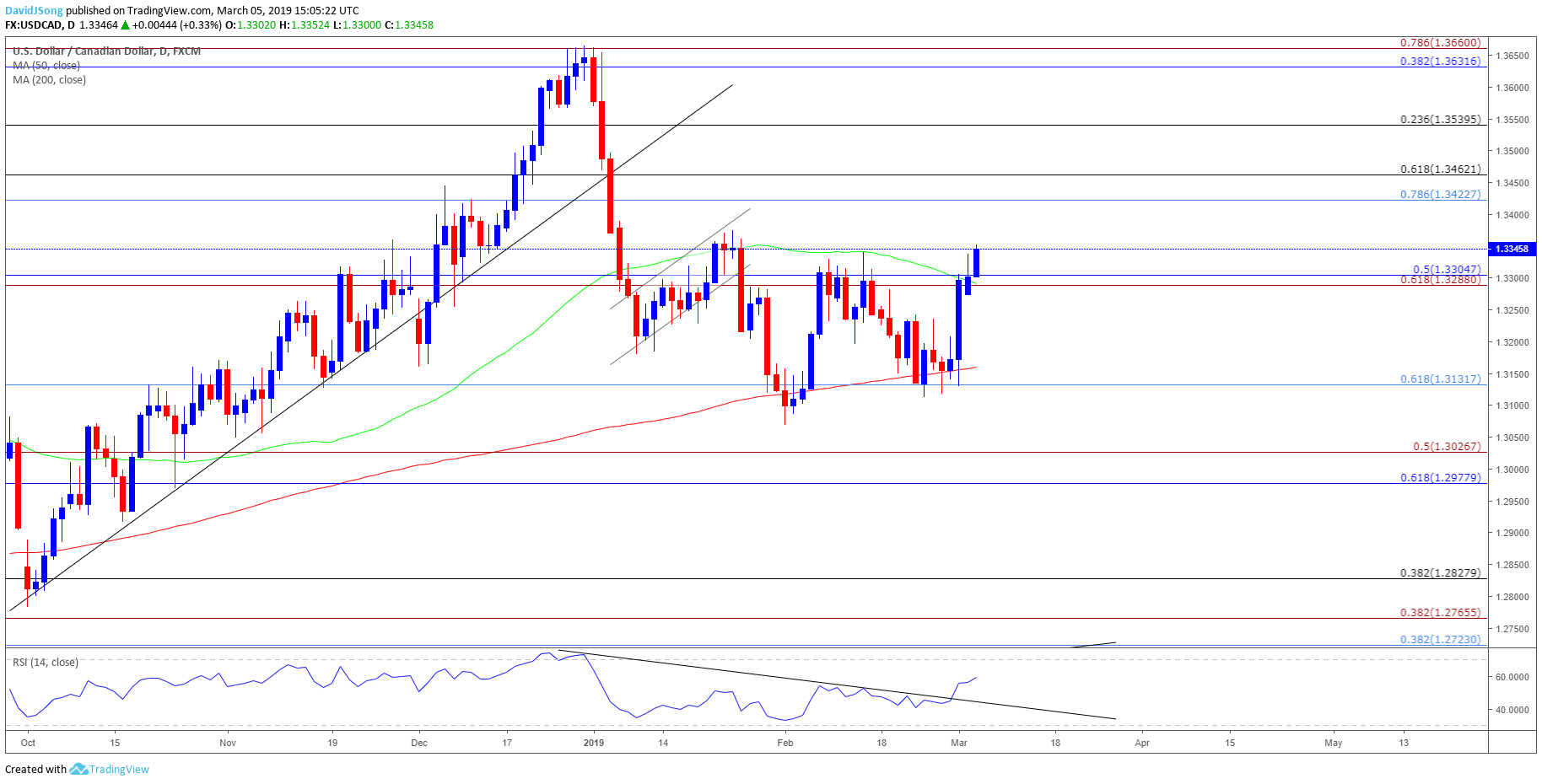

Keep in mind, the broader outlook for USD/CAD remains constructive following the break of the June-high (1.3386), while the bear-flag from earlier this year appears to have run its course amid the failed attempt to test the November-low (1.3049). More recently, the dollar-loonie exchange has cleared the February-high (1.3340) after bouncing along the 200-Day SMA (1.3160), and recent series of higher highs & lows bring the topside targets on the radar especially as the Relative Strength Index (RSI) highlights a similar dynamic.

USD/CAD DAILY CHART

(Click on image to enlarge)

- USD/CAD may continue to retrace the decline from the January-high (1.3663) following the string of failed attempts to close below the 1.3130 (61.8% retracement) hurdle, with recent developments in the RSI highlighting the risk for a further appreciation in the exchange rate as the oscillator breaks out of the bearish formation from earlier this year.

- In turn, a close above the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region may point to a near-term shift in USD/CAD behavior, with the next area of interest coming in around 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement).