US Supply Constraints Hold Back The Recovery

The US manufacturing sector continues to perform very strongly, but it is increasingly clear that supply constraints are holding back output and are pushing up prices. Construction is experiencing similar challenges. Nonetheless, the US remains on course for double-digit GDP growth in 2Q 2021.

No problem with demand...

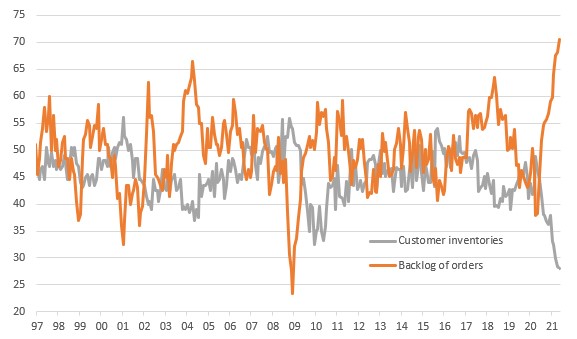

The May ISM manufacturing index rose to 61.2 from 60.7 (consensus 61.0). Production dropped from 62.5 to 58.5, but this remains well above the break-even 50-level with the slower output growth likely reflecting supply chain strains holding back output, rather than any moderation in demand. Indeed, new orders rose to 67.0 from 64.3 with the backlog of orders at all-time highs.

At the same time, supplier delivery times rose to their highest since 1974. The problems within the auto industry are well documented, but it is clear that getting hold of both components and workers is a growing challenge sector-wide.

Supply constraints and record demand = improved pricing power in the manufacturing sector

Source: Macrobond, ING

The issue is meeting that demand

Indeed, the fact that employment came in at only 50.9 versus 55.1 previously, likely reflects the difficulty in finding staff – homeschooling forcing parents to stay home, some hesitancy given the ongoing pandemic, older workers may have taken early retirement and uprated unemployment benefits may have diminished the financial attractiveness of going to work given commuting /childcare costs. We doubt these labor supply constraints will ease significantly before September and could hold back payrolls growth again this Friday

Given the data shows that customer inventories are at all-time lows it is clear that manufacturers have pricing power right now – they know their customers are desperate and output cannot keep pace with demand. This all adds to our sense that inflation is likely to be more persistent than the Fed acknowledges right now.

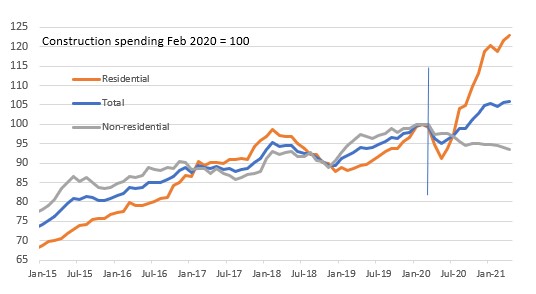

Construction output levels

Source: Macrobond, ING

Construction facing the same challenges = inflation pressures

Meanwhile, construction spending rose 0.2% month-on-month in April versus the 0.5% consensus, but March's figure was revised from 0.2% to +1% so on balance, the level of activity is ahead of expectations. Residential construction rose 1% while non-residential contracted 0.5% given the uncertainty over the need for office space and constraints on local government spending. Similarly to the manufacturing sector there are supply constraints - the cost of lumber and the ongoing problem of finding workers – so we wouldn’t be surprised to see the rate of activity slow. Amid robust demand, this means house prices are likely to remain supported.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more