US Stocks Led Global Rally In Asset Classes Last Week

Shares of American companies rebounded last week, forging into record territory before edging back by the close of the trading week on Friday, Dec. 18. When then dust cleared, US stocks led most of the world’s major asset classes, which posted solid gains, based on a set of exchange-traded funds. The outlier: a fractional loss for US investment-grade bonds.

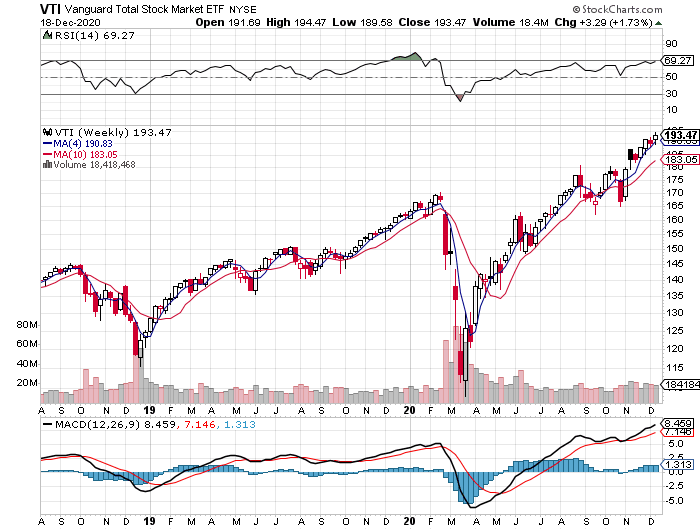

Vanguard Total US Stock Market (VTI) revived its long-running winning streak following the coronavirus crash in March and rose 1.7% last week. The latest bounce for the fund left it just slightly below a record high at Friday’s close.

Nearly all of the remaining slices of the world’s major asset classes also rose last week, lead by equities ex-US. Following on the heels of last week’s increase in the American stock market, shares in emerging markets and foreign developed markets were the second-and third-best performers, respectively.

The only loser: a broad measure of US investment-grade fixed income. Vanguard Total Bond Market (BND) slipped 0.1%. The fund has been trading in a tight range since September and last week’s slight setback doesn’t suggest that a sharp breakout, up or down, is imminent.

The Global Markets Index (GMI.F) recovered last week, rising 1.3%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETF proxies. The latest advance followed a modest setback during the previous week, which marked the end a five-week run of gains.

Turning to the one-year window, US equities are still the top performer for the major asset classes. VTI ended last week’s trading with a 21.2% total return for the past 12 months.

US and foreign property shares are the only one-year losers. Vanguard US Real Estate (VNQ) and its offshore equivalent (VNQI) are in the red by -3.6% and 5.9%, respectively, relative to the year-ago level after factoring in distributions.

GMI.F is up a strong 14.5% over the past year.

Ranking global markets by current drawdown continue to show that most of the major asset classes are at or near price peaks. At the head of the class: SPDR Bloomberg Barclays US High Yield Bond (JNK), which closed at a new high on Friday.

At the opposite extreme (still): broadly defined commodities (GCC), which continue to post a steep drawdown – the fund is currently suffering a peak-to-trough slide of roughly negative 40%.

GMI.F’s current drawdown is a slight -0.3%.

Disclosure: None.