US Stock Market Weekly Update May 25- May 29, 2020

A second consecutive week with gains for the US stock market, and another series of mostly negative economic news for the US economy, which did not harm the risk-on mood for stocks were the highlights during the last week of May 2020.

Economic news last week

Durable Goods Orders MoM on May 28, 2020, came in at -17.2%, better than the forecast of -19%, yet worse than the previous figure of -16.6%. The GDP growth rate QoQ 2nd estimate came in at -5%. The forecast was for a figure of -4.8%, and the previous reading was 2.1%. Initial Jobless Claims came in at 2123K, worse than the forecast of 2100K but lower than the previous reading of 2446K. On May 29, the US Core PCE Price Index YoY came in at 1%, lower than the forecast of 1.1%, and much lower than the previous reading of 1.7%. The Fed has a 2 percent target. The Personal Income MoM reading was reported at 10.5%, better than the forecast of -6.5%, and better than the previous reading of -2.2%. However Personal Spending MoM reading was weak, with a figure of -13.6%. The figures for the forecast and previous readings were -12.6% and -6.9% respectively. The Michigan Consumer Sentiment Final figure came in at 72.3, worse than the forecast of 74 but better than the previous reading of 71.8.

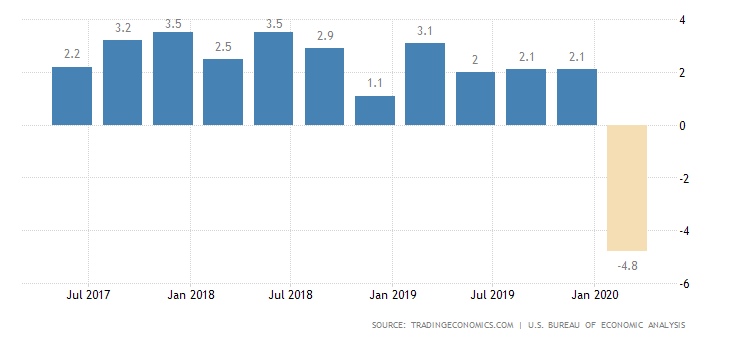

United States GDP Growth Rate

“The US economy shrank by an annualized 5 percent in the first quarter of 2020, more than an advance estimate of a 4.8 percent contraction and ending the longest period of expansion in the country's history, the second estimate showed. It is the biggest drop in GDP since the last quarter of 2008 as the COVID-19 pandemic forced several states to impose lockdown measures in mid-March, throwing millions of people out of work. Private inventory investment was revised downwards while personal consumption and business investment shrank less than anticipated. In the second quarter of the year, the economy is seen contracting as much as 40%, which would be the biggest plunge ever as the "stay-at-home" orders issued in March extended through the quarter, with businesses and schools switching to remote work or canceling operations, and consumers canceling, restricting, or redirecting their spending.”

Source: Trading Economics

For the week of May 25– May 29, 2020, the major US stock market indexes closed as follows on Friday, May 29, 2020:

• Dow Jones Industrial Average: Close 25383.11, +3.75% for the week, -11.06% Year-to-date

• S&P 500 Index: Close 3044.31, +3.01% for the week, -5.77% Year-to-date

• NASDAQ: Close 9489.87, +1.77% for the week, +5.76%, Year-to-date

• Russell 2000: Close 1394.04, +2.84% for the week, -16.45% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Forum Merger II Corp WT (FMCI) Close 2.91, 5-day change +118.80%

2. Draftkings Inc Warrants (DKNG), Close 27.98, 5-day change +65.86%

3. Vectoiq Acquisition Corp WT (VTIQ), Close 12.86, 5-day change +56.26%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Canaan Inc ADR (CAN), Close 2.36, 5-day change -40.85%

2. Intercept Pharmaceuticals (ICPT), Close 72.26, 5-day change -21.19%

3. Aquestive Therapeutics Inc (AQST), Close 4.87, 5-day change -20.81%

Economic events for the week June 1- June 5, 2020:

Important economic data for this week will be the ISM manufacturing Purchasing Managers' Index (PMI) and the services PMI, but the most important news will be the Non-farm payrolls report and the unemployment report, which will show the state of the labor market.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned