US Stock Market Weekly Update March 23- March 27, 2020

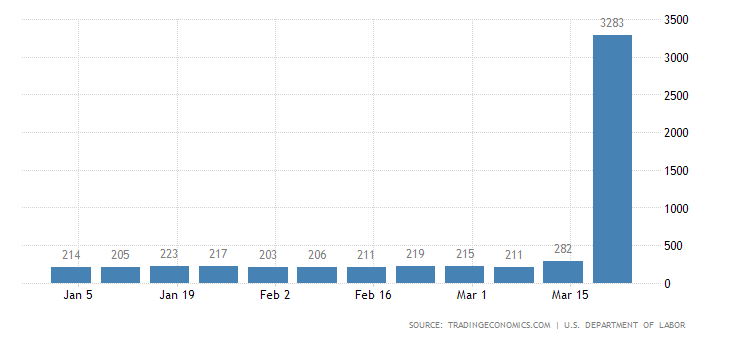

US stocks had a rebound this week, and all major US stock indexes closed higher. But it could still be too early to call this the bottom for the US stock market. Could it be that the stock market has already discounted all the negative implications of the coronavirus outbreak, and it reacts positively to any negative financial news? Like the record weekly US initial jobs claims surpassing the reading of 3 million posted this week. I am not so sure about that.

United States Initial Jobless Claims

“The number of Americans filling for unemployment benefits jumped to 3.28 million in the week ended March 21st, the highest since the series began in 1967 and well above expectations of 1 million. The accommodation and food services sector was the hardest hit, while the health care & social assistance, arts, entertainment & recreation, transportation & warehousing, and manufacturing industries also saw an increase in unemployment. According to unadjusted data, the biggest rises were seen in Pennsylvania (+378,908), Ohio (+187,784) and California (+186,809). The 4-week moving average, which removes week-to-week volatility, also jumped to a record high of 1 million while continuing jobless claims increased to 1.8 million, above consensus of 1.71 million. The report was quite expected by markets as it provides one of the first clues on the economic impact of the coronavirus when near 1 in 3 Americans are in lockdown and many non-essential businesses were forced to close.”

Source: Trading Economics

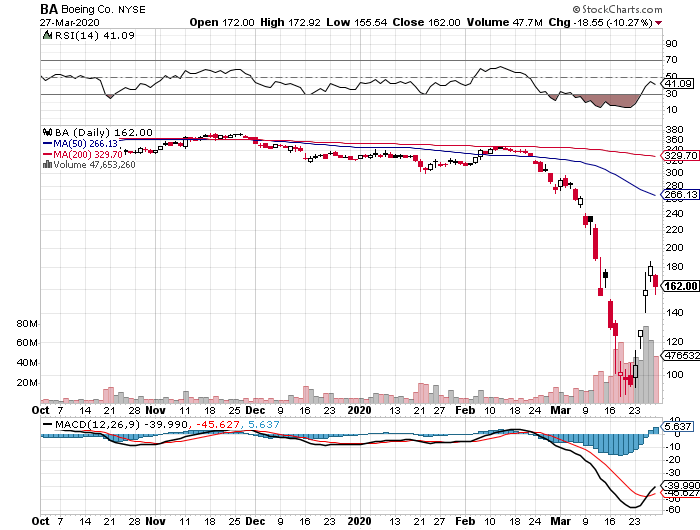

We should wait for the next few weeks to analyze better this extreme negative figure for the US weekly jobless claims. If the next few readings are at these high levels, there should be a significant downward revision for the US GDP growth, and this could harm the stocks and their valuations. Still, the investors and traders have shown a risk-on sentiment buying stocks at very low levels. Boeing (BA) stock was one of the stocks that performed well this week with weekly gains of +70%.

The progress on fiscal stimulus, estimated at $2 trillion, and the extra measures by the Fed to support the economy were the main reasons for this stock market rally.

For the week of March 23– March 127, 2020 the major US stock market indexes closed as follows on Friday, March 27, 2020:

• Dow Jones Industrial Average: Close 21636.78, +12.84% for the week, -24.18% Year-to-date (DIA)

• S&P 500 Index: Close 2541.47, +10.26% for the week, -21.34% Year-to-date (SPX)

• NASDAQ: Close 7502.38, +9.05% for the week, - 16.39%, Year-to-date (QQQ)

• Russell 2000: Close 1131.99, +11.65% for the week, -32.15% Year-to-date (IWM)

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Summit Hotel Pptys Inc (INN-PE) Close 13.44, 5-day change +154.93%

2. Tilray Inc (TLRY), Close 9.10, 5-day change +149.32%

3. Tsakos Energy Navigation Ltd (TNP), Close 3.20, 5-day change +83.91%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Advansix Inc (ASIX), Close 8.94, 5-day change -30.59%

2. Centogene N.V. (CNTG), Close 15.98, 5-day change -24.09%

3. Owens & Minor (OMI), Close 5.51, 5-day change -6.77%

Economic events for the week March 30- April 3, 2020:

Important economic data for this week will be the consumer confidence index, the ISM employment, and ISM manufacturing figures, and the March jobs report with the release of the non-farm payrolls, and the monthly unemployment rate. We should expect an outlier number for the unemployment rate and the non-farm payrolls, but what matters is the trend analysis of these figures, which we will find out in the next few months.

Stock market commentary

Sustained increased volatility in the financial markets continues to have high probabilities being a dominant theme until we have more clear news about the coronavirus developments. The bond yields are still at low levels, and this hesitation suggests investors are still reluctant to the most recent stock market bounce off its lows. Awaiting the earnings season in April, which should provide plenty of information to evaluate the negative effects of the coronavirus crisis on stocks and the economy.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.dailyfx.com/economic-calendar

Disclosure: I have no position in any stock mentioned