US Stock Market Weekly Review July 13- July 17, 2020

A third consecutive higher close for the US stock market for the week ending on July 13, 2020, with supportive economic and vaccine news. The S&P 500 has almost turned positive for the year, and tech stocks continue to outperform on a year-to-date basis, but Nasdaq composite was the only major stock index among Dow and S&P 500 that closed lower for the week. And small-cap stocks outperformed the previous week, so could it be there is a rotation for stocks in various sectors and capitalization among large institutional investors? It is early to say that, but there are some indications.

Economic News

The Core Inflation Rate YoY came in at 1.2%, more than the forecast of 1.1%, and the Inflation Rate YoY came in at 0.6% the same as the forecast, stating not any inflationary pressures in the economy. Still, even if there were inflationary signs the Fed would not raise the key interest rate, as the economic recovery amid the coronavirus era is fragile and uncertain. We anticipate the Q2 GDP Growth Rate to enter a recession and evaluate the degree of economic damage to the economy due to the coronavirus outbreak.

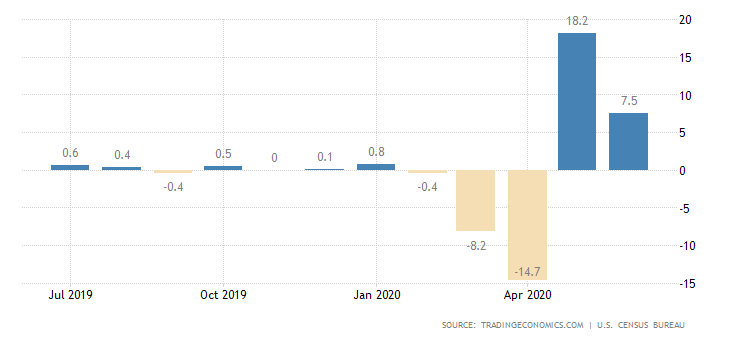

The Retail Sales MoM came in at 7.5%, beating the forecast of 5%, but well below the previous revised reading of 18.2%. Continuing and Initial weekly jobless claims continue to show weakness in the labor market. The Continuing Jobless Claims reading was 17,338,000 and below the forecast of 17.6M but the Initial Jobless Claims figure reported was 1.3M, worse than the forecast of 1.25M. Another positive economic news was Industrial Production MoM with a figure of 5.4%, better than the forecast of 4.3%. On the negative side, the Michigan Consumer Sentiment Preliminary Index was worse than expected with several 73.2, well below the forecast of 79.

U.S. Retail Sales

“Retail sales in the US surged 7.5% month-over-month in June of 2020, following an upwardly revised record 18.2% rise in May. Figures beat market forecasts of a 5% gain as more businesses reopened and domestic trade continues to recover from a slump in April due to the coronavirus lockdown. The biggest increases were seen in sales at clothing stores (105.1%); electronics and appliances (37.4%); furniture (32.5%); sporting goods, music and books (26.5%); food services and drinking places (20%); miscellaneous (17.7%); and gasoline stations (15.3%). Sales also increased at motor vehicle dealers (8.2%); health and personal care (3.5%); and general merchandise (2.7%). In contrast, sales fell for nonstore retailers (-2.4%); food and beverages stores (-1.2%); and building material and gardening equipment (-0.3%). Year-on-year, retail sales went up 1.1%.”

Source: Trading Economics

For the week of July 13– July 17, 2020, the major US stock market indexes closed as follows on Friday, July 17, 2020:

• Dow Jones Industrial Average: Close 26671.95, +2.29% for the week, -6.54% Year-to-date

• S&P 500 Index: Close 3224.73, +1.25% for the week, -0.19% Year-to-date

• NASDAQ: Close 10503.19, -1.08% for the week, +17.06%, Year-to-date

• Russell 2000: Close 1473.32, +3.56% for the week, -11.70% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Microvision (NASDAQ:MVIS), Close 2.71, 5-day change +80.67%

2. Kopin Cp (NASDAQ:KOPN), Close 2.02, 5-day change +55.38%

3. Moderna Inc (NASDAQ:MRNA), Close 94.85, 5-day change +51.49%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Quhuo Limited American Depository Shares (NASDAQ:QH), Close 10.51, 5-day change -17.170%

2. Immatics NV (NASDAQ:IMTX) , Close 10.46, 5-day change -17.31%

3. Geopark Hlds Lmtd (NYSE:GPRK), Close 8.76, 5-day change -16.01%

Economic events for the week July 20- July 24, 2020:

Important economic data for the week will be the Chicago Fed National Activity Index, Existing Home Sales, New Home Sales, the House Price Index, the Jobless Claims, and the Markit Manufacturing PMI Flash.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned

Good read