US Q3 GDP Growth Expected To Match Q2’s Modest Gain

This month’s upcoming estimate of third-quarter economic growth for the US is on track to stabilize at a modest pace, matching the gain in Q2, based on the median estimate for a set of revised nowcasts. Recession risk remains low for now, but today’s update also reaffirms that a rebound in growth is unlikely any time soon.

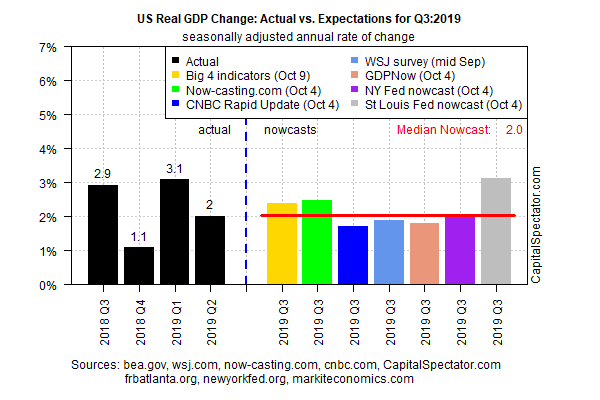

The median nowcast is currently anticipating a 2.0% increase in US output for Q3, based on several models compiled by The Capital Spectator. This median matches the 2.0% gain previously reported for Q2. The official Q3 GDP report – the “advance” estimate from the Bureau of Economic Analysis — is scheduled for release on Oct. 30.

Today’s median update reflects a slightly softer nowcast vs. The Capital Spectator’s previous Q3 estimate of 2.2%, published on Sep. 24.

Recent survey data, however, has painted a darkening picture of US economic activity – the ISM Manufacturing Index reflected contraction for a second month in September.

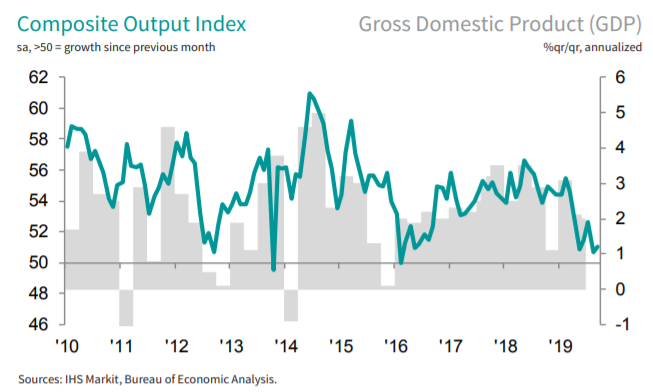

Note, too, that the IHS Markit Composite Index – a survey-based indicator that incorporates manufacturing and services data and is used as GDP proxy – points to a sluggish trend.

“The surveys are consistent with the economy growing at a 1.5% annualized rate in the third quarter, with forward-looking indicators suggesting further momentum could be lost in the fourth quarter,” says Chris Williamson, a chief business economist at HIS Markit, in a report published last week.

But some analysts say that the hard data, reflecting formal economic reports, offer a more encouraging profile. “While the survey data have been steadily disappointing expectations, hard data have been a source of positive surprises,” advises Doug Peta, chief U.S. investment strategist at BCA Research, in a note to clients. “The labor market remains vibrant enough to exert downward pressure on the unemployment rate, and services continue to expand despite the contraction in manufacturing, both here and abroad. The expansion has slowed, but it’s not finished yet.”

Perhaps, but it’s premature to completely dismiss the headwinds. A survey of economists published this week predicts that US growth will fall below 2% next year – marking the slowest trend in three years. “The rise in protectionism, pervasive trade policy uncertainty, and slower global growth are considered key downside risks,” says Gregory Daco, chief US economist at Oxford Economics and survey chair for National Association for Business Economics.

A lot can happen between now and 2020, of course, and so all the usual caveats apply. Meantime, looking at the outlook for the GDP trend through a year-over-year lens suggests that economic growth will stabilize in the immediate future. The annual change in output is expected to hold at roughly the 2% mark for the near term, based on The Capital Spectator’s average estimate via a set of combination forecasts.

But as a casual review of recent headlines reminds, several potentially crucial risks continue to lurk, including the ongoing US-China trade war and impeachment risk. Exactly how these and other factors unfold is unknown, but this much is clear: the road ahead is unusually cloudy. Based on the numbers published to date, however, there’s still a reasonable argument for expecting that modest US growth will endure for the foreseeable future.

Disclosure: None.