US Markets Race China To The Bottom – Can We Avoid Their Fate?

There's no question about it, China is a disaster.

Though officially down "just" 1.3% for the day, the Shanghai Composite fell 3% into the close, once again failing the 3,000 line, which is 42% off the June highs, just 60 days ago. We knew China was going to collapse, that was never in doubt. In fact, in our June Trade Review, my comment to our Members was:

I don't want to be overly dramatic about this stuff (and we are short on both China and Japan through FXI ($51.85) and EWJ ($13.26) as well as short the US markets as full disclosure) but I'm not going to let my people go through what people went through in 2008 if I can help it. If you remember, it was a very slow roll to collapse while the markets made record highs in 2007/8 as well.

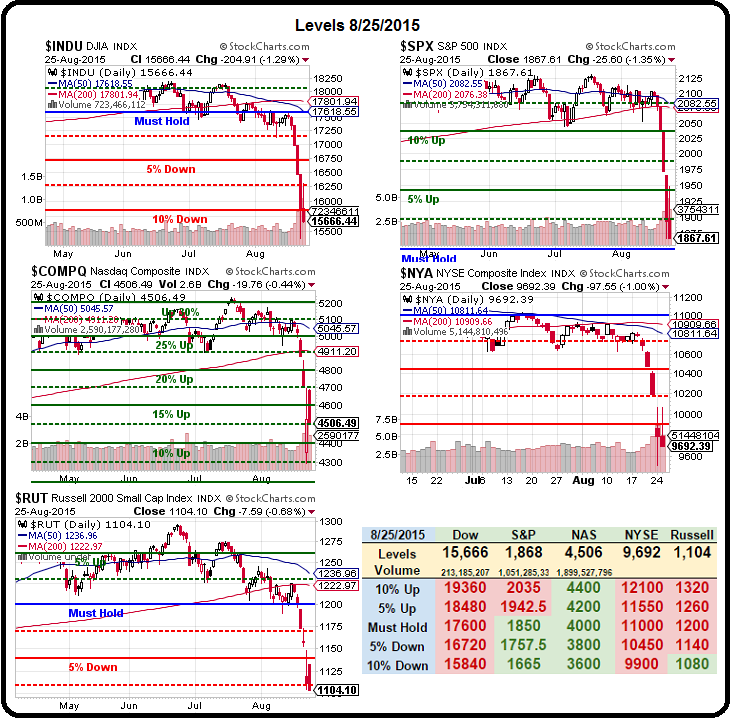

FXI topped out just over $52 and is now $35, down 32.6% and Japan's EWJ bottomed out at $11.25 yesterday, down 11% over the same period. Our own markets only just begun selling off last week but are catching up fast with the S&P falling from 2,100 to our 1,850 target, a 12% decline in very short order. The Nasdaq, however, completed a 22.50% drop yesterday, briefly making a red box on our Big Chart for the first time since last October:

Click on picture to enlarge

We need to keep a close eye on Japan, who are a lot closer to China than we are (geographically and economically). If they are able to hold up in the face of China's collapse, we should be able to as well. Keep in mind (see that review) that my expectations for a 10% correction in the US markets was BECAUSE we thought China would collapse – so this is very much in-line with our expectations.

However, now we have to worry about all the traders who didn't see this thing coming from a mile away and have been caught with their pants down on this sell-off.

It is good news for followers of our 5% Portfolio,where we have a bullish play on Southeby's (BID), who should benefit from an onslaught of volume this quarter, as well as an uptick in appraisal requests. We have been taking the opportunity to pick up a few stocks cheaply and I just sent out an alert this morning with 3 new positions for our Member Portfolios as we have (thankfully) tons of cash on the sidelines, so it's a good idea to take a few shots – even if we're not sure it's a bottom yet.

So far, our 1,850 "Must Hold" line on the S&P is holding but, if we lose 1,080 on the Russell, then all bets will be off. The Russell is made up of companies that do most of their business (70%) in the US and they shouldn't be as affected by China as the S&P or Dow components but they've gone down 15% at 1,100 and if that breaks – it's time to get more bearish for the duration.

BUT, for now, we're looking for the same bounces we were looking for yesterday, which I can summarize as:

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

As I noted yesterday, when I predicted we'd crash if we couldn't hold a 3% gain and we failed at exactly that line, we need to see at least 3 of these 5 weak bounce lines taken and held today or we will have to remain bearish (even though this was our goal for the drop). Just because we were right about the 10% correction, doesn't mean things can't get worse before they get better.

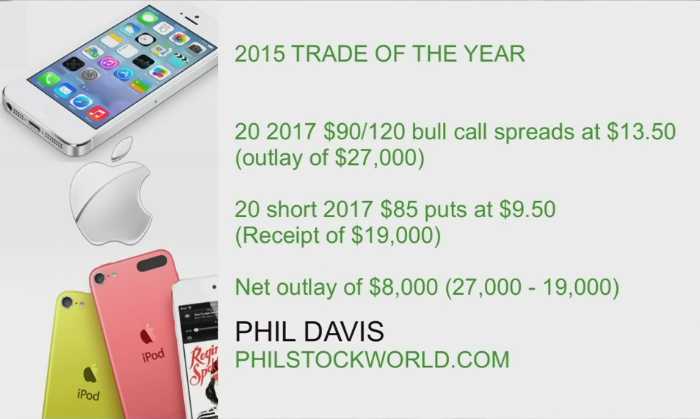

I'll be on Money Talk tonight (7pm) and I'm sure we'll be discussing the progress of our Trade of the Year, which was Apple (AAPL), where we picked the 20 of the 2017 $90/120 bull call spread for $13.50 and sold 20 of the $85 puts for $9.50 for a net of $8,000 (and an obligation to go long 2,000 shares of AAPL at $85 should things go poorly!).

We got out of this trade when it was up over 500% ($40,000) when AAPL hit $130 much earlier than we expected. With the recent sell-off, this trade is back to $6,700 ($335 per unit) even though AAPL is at $103.74, $13.74 in the money. Needless to say we love this trade still but, if I were going at it fresh, I'd do the following:

- Buy 20 AAPL 2017 $80 calls at $31.50 ($63,000 outlay)

- Sell 20 AAPL 2017 $110 calls for $15.60 ($31,200 credit)

- Sell 20 AAPL 2017 $75 puts for $7 ($14,000 credit)

The net on that spread is $17,800 and pays $60,000 if AAPL is over $110 in January of 2017 (16 months) for a potential 237% gain on cash. I don't mind paying more for the spread when the worst case would be owning AAPL for net $83.90 (19% below the current price) - it's hard to imagine that would be a bad thing to own for the long term. We already have a more aggressive spread in our Long-Term Portfolio but, if AAPL gets any cheaper, we'll be adding more like this.

Sadly, our runner-up Trade of the Year, Baker Hughes (BHI), has not been doing well with BHI languishing at $47.74 on fears the HAL buyout deal will fail but BHI gets a $3.5Bn breakup fee if that happens and I really don't mind owning them at this level.

That does not mean, of course, that we sit on the trade while the price drops. If the buyout goes through, we (BHI shareholders) get 1.12 shares of Haliburton (HAL) plus $19 in cash. HAL is currently at $34 so 1.12 x $34 = $38.08 + $19 = $57.08, not BHI's current price of $47.74. That is a fantastic deal, especially if you take into consideration that the whole sector is probably bottoming. The break-even on our trade is $55 (less a small credit), so we're not worried but we can take advantage of the sell-off by doing the following with the existing position:.

- Sell 10 BHI 2017 $50 calls for $7.50 ($7,500 credit)

- Buy 10 BHI 2017 $40 calls for $12.50 ($12,500 outlay)

- Sell 10 BHI 2017 $45 puts for $5 ($5,000)

That transaction nets out to $0 and obligates us to buy 1,000 more shares of BHI should it wind up below $45. It also gives us $10,000 more upside if BHI does get bought for net $50 or more – something we still feel is very likely. The adjustments can be taken as a new trade with no money down and a potential $10,000 payout – I like that very much, especially with Schlumberger (SLB) buying Cameron (CAM) for $14.8Bn today, a strong indication that there may actually be a bottom to this sector!

We certainly don't want to over-extend but, when our trades of the year go on sale – isn't that what our sideline cash is for?

more