US: Labour Market Under Increasing Stress

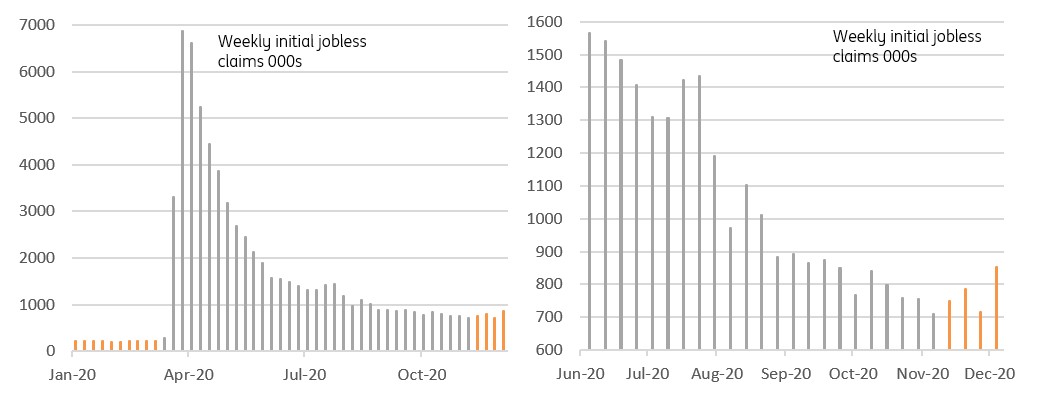

After a disappointing November jobs report, the early indications are that December will be even worse. We could even see a drop in employment if today’s jobless claims numbers are anything to go by.

Rising numbers of Covid-19 cases and the resulting containment measures are once again wreaking havoc on the economy. With an increasing number of businesses forced to shutter, the number of lay-offs is on the rise with today’s initial claims report for the week of December 5th showing a jump to 853,000 from 716,000. This is the highest figure since mid-September while the consensus expectation was for a reading of 725k. Continuing claims also rose, indicating that the labor market is facing more and more stress.

Source: Macrobond, ING

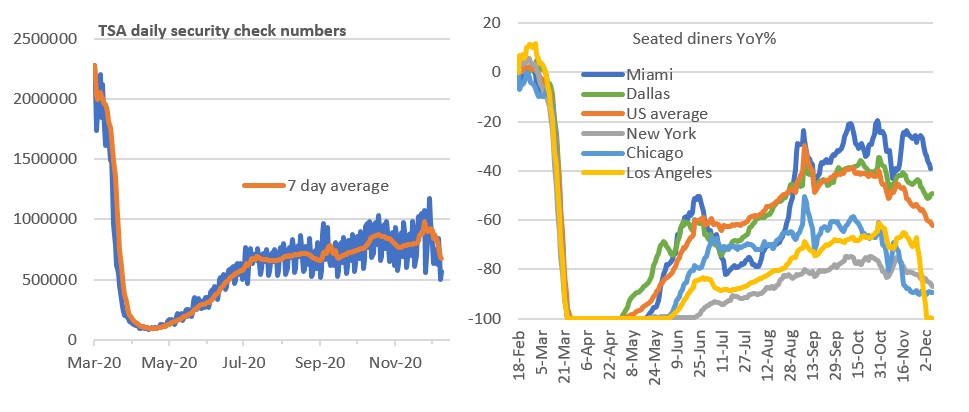

Unfortunately, things are likely to get worse in the next couple of months. We strongly suspect that Covid-19 containment measures will intensify and spread to more and more states. In any case, there is evidence to suggest that consumers are already voting with their feet. The charts below show the number of restaurant visits are plummeting while hotel reservations are at their lowest level since May and domestic travel is also seeing weakness. This means we run the risk of further significant job losses in the leisure and hospitality industry while the potential for closure of non-essential retail is adding to the worries about the jobs market.

Less movement and less spending = fewer jobs

Source: Macrobond, ING

While there is optimism about a vaccine it will take time before it is distributed to enough people to allow a full return to “normality”. This means we need to be braced for a window of perhaps 3 or 4 months where restrictions will weigh on economic activity. Consequently, we see a growing probability that employment declines in the coming months and not just in those sectors focusing on consumer service who are most likely to experience direct restrictions.

This will undoubtedly keep the Federal Reserve very dovish at next week’s FOMC, but the critical thing is whether this newsflow triggers an action in Washington on a fiscal support program for impacted households and businesses. If that doesn’t materialize the news on the economy could be even worse.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more