US: Home Sales Plunge As Bad Weather Bites

February home sales plunged as winter storms and generally cold conditions deterred buyers. Sales are likely to bounce back in March, but rising mortgage rates and a dearth of supply are a constraint over the longer term. Another issue is surging house prices, which could create a major headache for the Federal Reserve.

Source: Shutterstock

Winter storms keep buyers inside

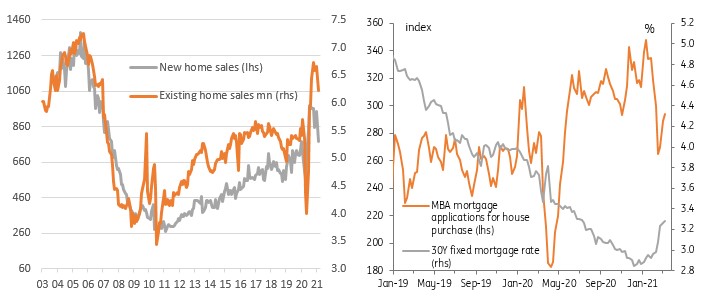

Yesterday’s existing home sales and today’s new home sales data for February both showed substantial declines as the harsh mid-month winter storm and generally cold conditions across the country dampened buyer appetite.

New home sales took the bigger hit, falling 18.2% month-on-month. New home sales are recorded at the point the purchase contract is signed so will have been directly affected by fewer buyers venturing out into the cold. The 6.6% decline in existing home sales, which are recorded as transactions when contracts are closed, would have been impacted by disruption to working practices.

Housing transactions fall with rising mortgage rates an ongoing risk

Source: Macrobond, ING

Rising mortgage rates starting to weigh on demand

March is likely to see a strong rebound in sales, but we don’t expect to see new cycle highs given the decline in mortgage applications for home purchases. This series peaked in the second week of January and has fallen sharply, likely reflecting the recent increase in mortgage rates. This is quite a big drop-off seeing as mortgage rates have only increased around 40bp while longer-dated Treasuries have risen by 70bp. With Treasury yields continuing to grind higher, there is certainly more upside to mortgage interest rates in the months ahead, although housing demand should be underpinned by a strong economic recovery and robust employment growth over the next few years.

Supply of homes for sale at record lows

Source: Macrobond, ING

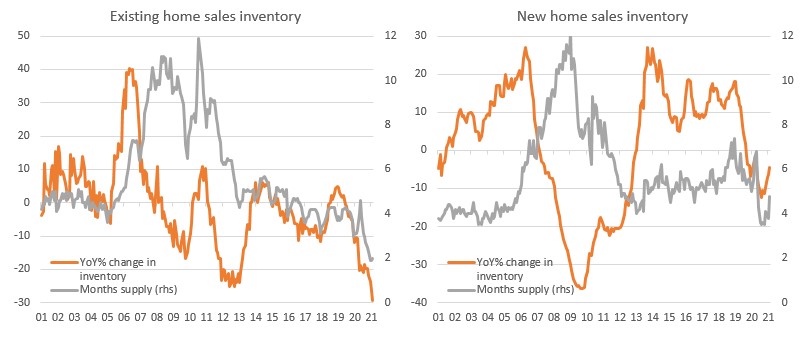

Few bargains to be had

At the same time, supply is very tight with the inventory of existing homes at record lows – equivalent to just two months-worth of sales. It is marginally better for new home sales at 4 months, but that is a much smaller section of the overall property market. This is likely to further limit the scope for an increase in property sales. Those few properties that are for sale are being snapped up within 20 days of going on sale on average. This lack of inventory amidst decent demand is pushing prices higher with the median price of an existing single-family home up 15.8% year-on-year with new home prices rising by 5.3%.

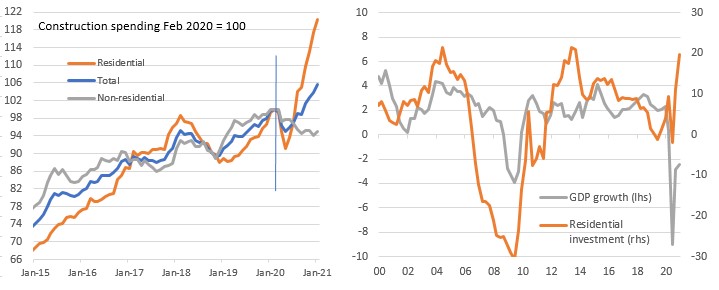

Housing to be a major GDP growth driver in 2021

The recovery in the housing market has led a turnaround in the construction sector as the left-hand chart below shows. The National Association of Home Builders reports that sentiment remains close to all-time highs (it has a 36-year history) with construction employment having risen by 805,000 since April and with housing starts hitting a 14-year high in December.

With home prices well supported by decent demand amidst a dearth of supply, this should incentivize more construction activity despite the higher costs for building materials, such as lumber and steel. Consequently, residential investment is likely to continue making a strong contribution to GDP growth this year.

A strong housing market also boosts demand elsewhere in the economy. Housing activity is strongly correlated to retail sales – as people move to a new home they typically spend money on new furniture and home furnishings, garden equipment, and building supplies such as a new paint job and a bit of home improvement. It also results in demand for moving services while generating legal and mortgage fees within the service sector, which should also all help boost economic activity through this year.

Construction spending & residential investment (YoY%)

Source: Macrobond, ING

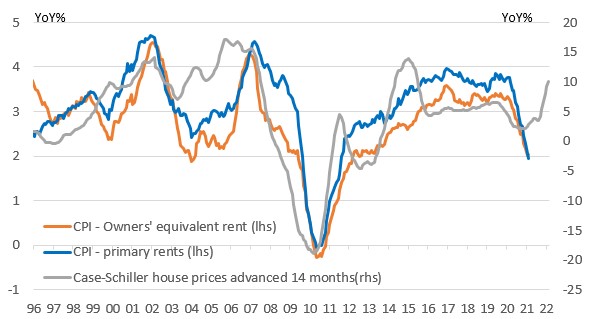

Housing, inflation and a headache for the Fed

The downside from all this is that higher housing costs will feed through into higher consumer price inflation. As the chart below shows, the rent of primary residence CPI component (7.8% of the CPI basket by weight) and owners’ equivalent rent of residences (24.2% of the CPI basket by weight) typically lag turning points in the S&P Case-Schiller house price series by around 14 months. The chart suggests that housing will soon be contributing positively to US inflation readings, which given housing’s combined CPI weighting of 32% is a key reason why we believe that inflation will stay higher for longer than the Federal Reserve thinks. In turn, we expect the Federal Reserve to raise interest rates by the summer of 2023 with the Fed funds target rate hitting 2% in 2025.

Surging house prices to push consumer price inflation higher

Source: Macrobond, ING