Monday, April 5, 2021 1:49 PM EDT

A superb ISM services report follows hot on the heels of a strong ISM manufacturing survey and a bumper jobs report. The stimulus-fueled economy is bouncing back as Covid restrictions are eased. With employment and inflation pressures on the rise too, markets are right to increasingly price in the prospect of a 2022 rate hike.

A new high for service sector growth

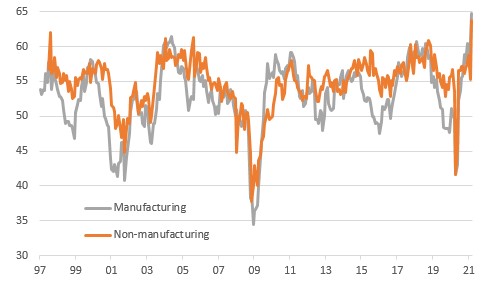

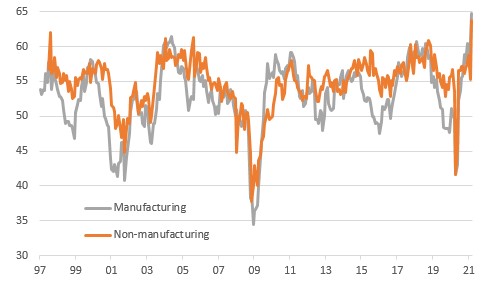

The March reading of the ISM services index jumped to a new record high of 63.7 from 55.3 – significantly above the 59.0 consensus forecast. Admittedly, the data only goes back to 1997, but it underlines the story that with Covid vaccinations proceeding well and restrictions on movement being eased, the stimulus-fueled economy is taking off.

ISM headline indices

Source: Macrobond, ING

Employment and inflation gathering momentum

Among the key sub-components, business activity jumped to 69.4 from 55.5 and new orders rose to 67.2 from 51.9 with employment at 57.2 versus 52.7 in February – the number corresponds to the % of respondents replying positively and half of the percentage of respondents saying things are the same as last month.

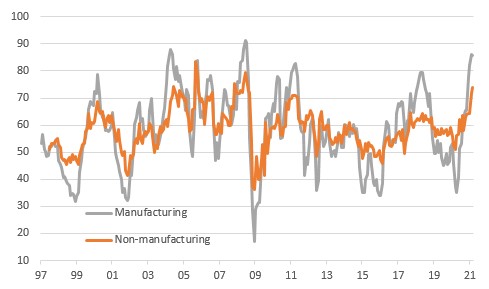

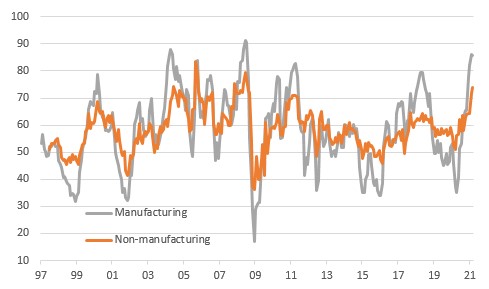

Inflation pressures also continue to rise with prices paid at the highest level since 2008. This is the same message we got from the manufacturing ISM index last week and shows that the US economy is broadly bouncing back across all sectors.

ISM prices paid components

(Click on image to enlarge)

Source: Macrobond, ING

It also suggests that last Friday’s 916,000 increase in employment will likely be beaten in April with more spending and more people movement requiring more jobs to meet the demand. We expect to see 1 million-plus monthly job gain readings through to June as Covid containment measures are eased further.

Tough questions for the Federal Reserve

With today’s report offering more evidence of accelerating activity, strengthening jobs creation, and rising price pressures a late 2022 rate hike looks increasingly likely. Remember too that this is before the economy feels the full effects of the Build Back Better program announced by President Biden last week.

The Federal Reserve’s June FOMC meeting will inevitably require significant revisions to the Fed’s own forecasts. For now, the Fed’s dot plot has the first-rate hike coming in 2024, but that is increasingly difficult to reconcile with the data flow we are currently seeing.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.