U.S. Global's Brian Hicks Shares His Summer Plans For Creating The Ultimate Resource Fund

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

You may want to rethink those tickets to Hawaii, and instead spend the summer basking in the opportunities developing in three different sectors of the oil market. In this interview with The Energy Report, U.S. Global Resources Fund Manager Brian Hicks shares the names of the juniors that could benefit from the current volatility. Plus, he reveals the dramatic shift he made in the fund this year that allows him to get paid to wait for the market to catch fire.

The Energy Report: Summer means driving season, which is good news for oil and gas prices. U.S. Global Investors recently published an article that says Americans are driving and flying more than ever. Will energy investors who "sell in May and go away" kick themselves later, when they look at the stock charts for their favorite companies?

Brian Hicks: The summer driving season is a supportive time for crude oil. Refineries are at very high utilization levels, ramping up production of gasoline, and that creates extra demand for crude oil. We have begun to see inventories come down, which creates physical demand in the marketplace and helps offset high domestic inventories. This is a seasonally strong period for oil, which should alleviate the storage overhang heading into the summer months.

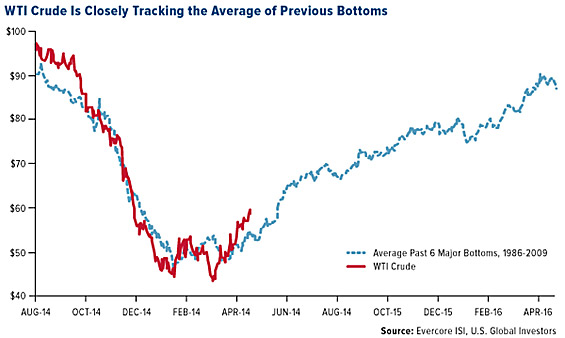

TER: Oil has been above $60/barrel ($60/bbl) recently. Do you believe we've hit a bottom in oil prices? What can we expect going forward if history is a guide?

BH: I think we have hit a bottom. Clearly, oil prices below $50/bbl are not sustainable. We simply can't replace global production at that price. It is way below the marginal cost of production, which we think on a long-term basis is somewhere around $75/bbl. Even at $60/bbl, we have more upside to go to reach an equilibrium price. We have come up a ways since the lows set earlier this year. Perhaps we are entering a holding pattern before the next leg up in the back half of the year. But who knows? We are starting to see production growth decline and inventory levels receding, so we could see prices maintain these levels, or get even stronger, if declines accelerate into the summer.

TER: What are rig counts telling you?

BH: Rig counts coming down over 50% bodes very well for the price of crude oil. The resetting of global crude oil prices resulted in less drilling, particularly in the U.S. That's why we are starting to see a production response.

From a historical standpoint, this is the point in the cycle when you want to look at energy stocks. We believe we are in a trough, and heading into 2016 we are going to need to see the rig count come back up—certainly not to the peaks that we had previously, but higher than current levels. As we see production growth decline and demand pick up, inventory levels are going to head down further.

TER: Are you buying and selling based on Q1/15 results, or are you looking out at Q2/15 or Q3/15 expectations and beyond?

BH: We're trying to look forward. Obviously, some useful data can be gleaned from current financials, but we're trying to look ahead of the noise and over the horizon to see where oil prices will settle out and the prices that energy stocks are discounting in their valuations. We feel good that energy stocks have found a bottom and have started to come up. We think there is more upside as we get closer to 2016.

TER: How are you protecting the fund from volatility?

BH: We are a diversified, long-only mutual fund, so it's not a core strategy for us to short crude oil or energy stocks. But we do try to mitigate volatility through diversification. That means holding companies across the market cap spectrum, in different geographies and with different commodity exposure, to derive a portfolio that is not highly correlated.

TER: I understand you started investing in some larger caps this year. What prompted that?

BH: As part of that diversification, and because there was heightened volatility coming into the year, we were trying to find value in stocks that paid a dividend and offered lower volatility.

In a new energy cycle, the stocks that typically move first out of the trough are the larger caps. We made investments in some major integrated oil stocks, some of which were paying dividend yields as high as 6%, which really helped buffer the portfolio from excess volatility. We were able to pick up some income in the meantime. Historically, when you can buy large companies with high dividend yields, that's a signal of the value to be had.

One of the companies we added to the portfolio is Royal Dutch Shell Plc (RDS-A:NYSE; RDS-B:NYSE). When we purchased the stock, it was yielding over a 6% dividend, and the acquisition of BG Group Plc (BRGYY:OTCQX; BG:LSE) was a nice bonus. We're very encouraged by that acquisition. We feel it strategically places the company very well. BG Group puts Shell in regions of the world that look interesting from a growth standpoint, namely in Brazil and Australia. We feel like that's going to be a good platform for Shell, and for a company of its size, to get more growth.

TER: Are you expecting more merger and acquisition (M&A) activity as we move through this phase of the cycle?

BH: I think we are going to see the cream rise to the top, and companies that have high quality assets or are strapped with excess debt will become targets. In many cases, at this time in the cycle, you can buy oil reserves in the ground for less than the price of drilling for new reserves. Many market upswings begin with an M&A cycle, similar to the late '90s, when Exxon's $80 billion acquisition of Mobil Oil marked a bottom in the energy cycle.

"We believe that we are in the early innings of a recovery in this energy cycle."

We recently saw Noble Energy Inc. (NBL:NYSE) buy Rosetta Resources Inc. (ROSE:NASDAQ). That gives Noble exposure to new, prolific oil and gas basins of the Eagle Ford Shale and the Permian Basin. I think this is a trend that will continue, as companies look to reduce costs and for strategic bargains. I think we'll see more M&A activity into the summer—perhaps a takeout of a larger independent by a major oil company—which would highlight the long-term value embedded in energy shares at this point in the cycle.

TER: Your fund's sweet spot has always been the juniors. Are you finding bargains in the junior space? What are you adding to the portfolio right now?

BH: That has been our core historically. The junior names that look interesting to us are those that, despite cutting capex, are still managing to grow through the drill bit. Other names look attractive simply because their assets are burdened by debt or undercapitalized. On the whole, we're seeing very attractive valuations on a full-cycle basis, which make us quite optimistic.

TER: Can you name some of the companies that you're optimistic about?

BH: They are primarily in Canada. The first name is Legacy Oil + Gas Inc. (LEG:TSX). This company has significant value. It's not a name that most folks are looking at because it has excessive debt on the balance sheet and is actively trying to manage that debt and still grow production. But it has high-quality oil assets, and a lot of operational and financial leverage to the price of crude oil.

"The junior names that look interesting to us are are still managing to grow through the drill bit."

We think, on a sum-of-the-parts basis, Legacy looks very interesting at current prices. If you look at the proven reserves in the ground and you discount them over the reserve life, and then net out the value of long-term debt, the stock could double from current levels based on a normal full-cycle oil price.

In addition, it looks as though there are some large institutional shareholders that are trying to unlock more immediate value by breaking up the company, divesting assets or perhaps even replacing management. That could offer additional catalysts.

TER: Is there another company that reported Q1/15 results you like?

BH: We're always intrigued by companies that are able to grow through the drill bit with low capex spending. One name we like is RMP Energy Inc. (RMP:TSX), also in Canada. It has very interesting oil assets and plans to grow production 10–15% this year despite a capital cutback. At current oil prices, the company should be generating some free cash flow, which could be used to lower its debt, although its balance sheet is relatively strong. There are a lot of options for the company and we expect to hear further good news on improved well completion techniques that could unlock further value. We also are encouraged by the robust wells being drilled at its Ante Creek project. When we come out of this low period, it's this type of company that will thrive. It's a company that can increase shareholder value above and beyond just an increase in crude oil prices.

TER: What will it take for the market to recognize the potential and rerate RMP?

BH: I think execution is the main thing. The company recently issued a production report that showed it is on the right track. In fact, the estimates seemed fairly conservative given where RMP is producing right now. It is experimenting with some new completion techniques that look like they're enhancing the productivity of the new wells. We think there is positive operational and drilling momentum for the company. It looks as though production estimates are more than achievable. Companies that execute are the names that should outperform.

TER: How about a dividend-paying Canadian explorer and producer?

BH: We have been involved in royalty trust companies for some time. It's a model that works well with the right kind of company. Whitecap Resources Inc. (WCP:TSX.V) is a bellwether name with high-quality assets and a strong management team. It recently made an acquisition, which further increases its overall growth profile. It pays a dividend of around 5%, so you get paid to own this name as oil prices begin to recover. This is another company that has historically executed on its drilling plan and should continue to offer value for shareholders.

TER: How, specifically, would Whitecap's acquisition of Beaumont Energy Inc. help to create value?

BH: This is a textbook acquisition for Whitecap. It is going in when there are difficult times and making an acquisition in a core area in West-Central Saskatchewan. It gives the company upside via some basic water flood developments, helps enhance its overall core area as well as its growth profile, and helps offset declines.

"This is a seasonally strong period for oil, which should alleviate the storage overhang heading into the summer months."

This type of acquisition is probably something we'll continue to see with Whitecap Resources, especially since the company has the financial firepower to look for strategic opportunities. This is the time in the cycle when Whitecap can enhance its overall platform and increase its production on a per share basis, while others in the industry are starved for capital. It's an opportune time for shareholders in Whitecap Resources to create some value, and in the meantime there is an attractive dividend yield.

TER: How about one more standout junior in the portfolio right now?

BH: We have owned BNK Petroleum Inc. (BKX:TSX) for some time. It's a little different in that the company has assets with proven oil reserves in Oklahoma. But it has also been doing some exploratory drilling in Poland looking for shale gas, which has come with some challenges and has weighed on the share price. When you couple those challenges with the volatility we've seen in the small-cap space, the shares have been punished to the point where they are trading below present value of future production and reserves booked in the ground. This is rare. But if you back out the liabilities from the PV10 value of this company, you could easily make a case that it could be a double from here in a normalized pricing environment—especially if you consider the role the company could potentially play in Eastern Europe's quest to find an alternative to Russian natural gas. This is another name we've added at lower levels during the energy selloff in the first quarter, and it's beginning to pay off this quarter.

TER: We have talked before about opportunities in service companies. Are you still finding that they are profitable in this environment? Are there some that really stand out to you?

BH: Some investors would think it's a little early to look at service stocks. We would probably agree when it comes to fracking companies and some of the other service providers, but we think it may be an interesting time to look at drilling companies. We are starting to see market share being overtaken by higher-quality, higher-horsepower rigs that can drill multiple wells per pad, as well as rigs that can move much more quickly to different drilling locations. Their drilling days are shorter, which creates a tremendous amount of efficiency and lowers costs for operators. These are the kinds of drilling rigs that operators are looking for, especially in a low commodity price environment.

"Even at $60/bbl, we have more upside to go to reach an equilibrium price."

Patterson-UTI Energy Inc. (PTEN:NASDAQ) is starting to garner market share in this space. We think over the next 12–24 months, this market share will continue to grow. The utilization of higher-end rigs should be well over 90%—maybe even sold out in this particular category over the next 24 months—which implies higher day rates for these higher spec rigs. The three or four companies with this capability should do well and should be buffered by any weakness in the oil services space. Then, as oil prices begin to recover and move back up, operators will increase their capital budgets, and they're going to want these premium rigs. The companies we're looking at, such as Patterson, should thrive.

TER: What advice do you have for investors looking to take advantage of opportunities over the summer without getting burned?

BH: Investors need to focus on the long term. I know it's difficult to think that way when we're bombarded with negative short-term data points. But current crude oil prices are not sustainable at these levels. We cannot replace global production. Demand continues to grow outside of the developed markets in the emerging world. That does not appear to be changing. If we do not see a higher oil price, we're not going to be able to offset the global decline rate in current production or meet future demand.

We believe that we are in the early innings of a recovery in this energy cycle. The companies that are able to withstand the volatility are going to do quite well, and get bigger. There's a tremendous amount of opportunity in the energy space right now. We're very encouraged. It's not to say that we couldn't see more volatility, but I would look at that volatility as an opportunity to add to positions because, over the long run, we will see higher commodity prices and higher share prices within the energy patch.

TER: Thank you for sharing your insights. Have a great summer.

Brian Hicks joined U.S. Global Investors Inc. in 2004 as a co-manager of the company's Global Resources Fund (PSPFX). He is responsible for portfolio allocation, stock selection and research coverage for the energy and basic materials sectors. Prior to joining U.S. Global Investors, Hicks was an associate oil and gas analyst for A.G. Edwards Inc. He also worked previously as an institutional equity/options trader and liaison to the foreign equity desk at Charles Schwab & Co., and at Invesco Funds Group as an industry research and product development analyst. Hicks holds a master's degree in finance and a bachelor's degree in business administration from the University of Colorado.

Brian Hicks joined U.S. Global Investors Inc. in 2004 as a co-manager of the company's Global Resources Fund (PSPFX). He is responsible for portfolio allocation, stock selection and research coverage for the energy and basic materials sectors. Prior to joining U.S. Global Investors, Hicks was an associate oil and gas analyst for A.G. Edwards Inc. He also worked previously as an institutional equity/options trader and liaison to the foreign equity desk at Charles Schwab & Co., and at Invesco Funds Group as an industry research and product development analyst. Hicks holds a master's degree in finance and a bachelor's degree in business administration from the University of Colorado.

Disclosure:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of more