US Futures, European Stocks Slide As Trade Fears Return

US equity futures and European markets fell after a mixed session in Asia as a better than expected start to earnings season was overshadowed by resurfacing trade tensions between the U.S. and China amid a federal investigation into Huawei Technologies for allegedly stealing trade secrets, as fears about profits and global economic headwinds returned on news Apple plans to cut back hiring for some divisions while Singapore exports unexpectedly fell. Treasuries and the dollar were mixed.

Europe's Stoxx 600 Index was down 0.2%, dragged lower by autos and leisure stocks, although defensive food and drink stocks rebound from Wednesday’s drop. After being the top performing sector Wednesday, the Stoxx 600 Bank Index declined 1.5% in early trading, making it the worst performing industry group in Europe on the day, and erasing nearly half of Wednesday’s gain after French bank Societe Generale warned it now sees a 20% trading revenue drop on challenging markets, dragging its stock as much as 4% lower. The Stoxx 600 Automobiles & Parts index slumped, hitting Germany's auto and export-heavy DAX, after Senate Finance Committee Chairman Chuck Grassley said President Donald Trump was inclined to impose tariffs on European cars to win better terms on agriculture.

“There is some focus on the Grassley comments in relation to auto trade tariffs and also reference to there not being much progress in the U.S. China negotiations last week,” said Bank of Tokyo Mitsubishi strategist Derek Halpenny. “There has obviously there has been a lot of optimism (in markets) since the start of the year and risk appetite has had a pretty good run, but this will place a few question marks over that.”

In the UK, the FTSE 100 Index underperformed despite a stable pound, as Prime Minister Theresa May began talks with her political rivals to try deliver a Brexit deal.

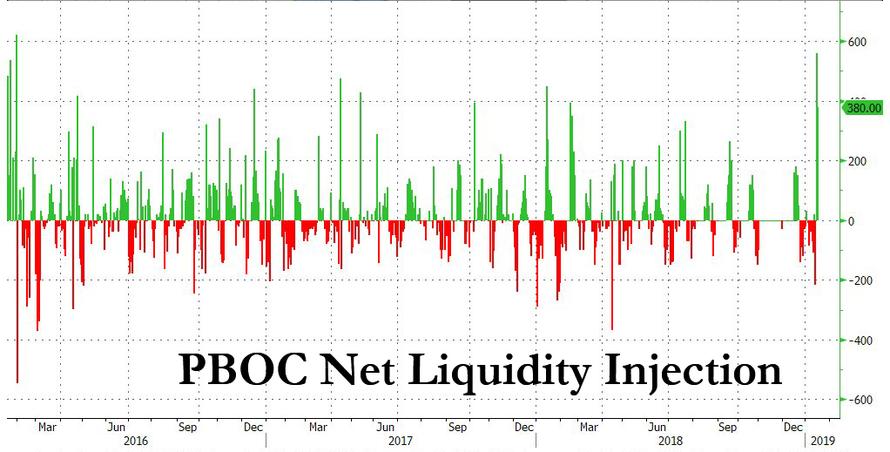

Fresh news was thin as European trading got underway, but traders had more than enough to digest from last 24 hours to follow Asia’s overnight dip into the red. China's blue-chip index ended down 0.55%, led lower by a decline in the country's second-largest home appliances maker, Gree Electric, after it warned of slower profit growth as the economy loses steam. Chinese Premier Li Keqiang promised increased government investment this year and the country’s central bank injected more cash into the financial system, bringing the amount for the week to 1.14 trillion yuan ($168.74 billion).

Shares in Hong Kong tumbled, and some companies dropped more than 75 percent without obvious explanations.

Stoking some caution was news that U.S. lawmakers introduced bills on Wednesday that would ban the sale of U.S. chips or other components to Huawei or other Chinese telecommunications companies that violate U.S. sanctions or export control laws. That came shortly before the Wall Street Journal reported federal prosecutors were investigating allegations that Huawei stole trade secrets from U.S. businesses. Separately, Handelsblatt reported the German government is actively considering stricter security requirements and other ways to exclude Huawei from a buildout of fifth-generation (5G) mobile networks.

Also lurking were worries that the U.S. government shutdown - now in its record 27th day - was starting to take a toll on its economy. White House economic adviser Kevin Hassett said the shutdown would shave 0.13% off quarterly economic growth for each week it goes on.

A better-than-expected start to the earnings season has so far not been enough to spur an extended rally, and on Thursday S&P futures were down 0.3%, the same as Dow futures while Nasdaq futures were 0.4% lower. The VIX was trading 1.5% higher.

As Bloomberg writes this morning, risk assets are showing fresh signs of fatigue after a stronger start to 2019 than 2018's (and the January meltup), when optimism about trade tensions and central bank support overshadowed a litany of concerns as the global economy slowed. Now with both the U.S. government shutdown and Brexit impasse dragging on, and lingering stress between America and China, there are plenty of reasons for caution.

Over in Brexit-land, as expected, British Prime Minister Theresa May narrowly won a confidence vote overnight and invited other party leaders for talks to try to break the impasse on a Brexit agreement. An outline for Plan B is due by next Monday. Markets assume the exit date will be extended past March 29.

“Nothing has happened in the last 24 hours to dissuade us from the view that we are headed in the direction of an Article 50 delay, a softer Brexit or no Brexit,” said Ray Attrill, head of FX strategy at NAB. This left the pound steady at $1.2872, though still short of Monday’s peak at $1.2929. It reached a seven-week low against the euro before steadying at 88.50 pence

UK PM May said there is now an opportunity to find a way forward on the Brexit and that she intends to deliver on Brexit which she believes it is her duty to do so. PM May also said we must work out what lawmakers want and that she spoke to several parties although the Labour party leader has yet to take part in discussions, while there were comments from Labour Party leader Corbyn who declared there will be no talks with PM May until a no-deal Brexit is off the table.

BBC's Political Correspondent Nick Eardley tweets "Tory sources predict majority of Conservatives in Commons would refuse to back permanent customs union and several ministers would quit." Subsequently reported that the EU are to condition any potential delay to Brexit on an agreement being struck between UK PM May and opposition leader Corbyn, according to El Pais.

In central bank news, Fed's Kashkari (Non-Voter, Dove) said Fed has less room to cut rates in future downturn but has other tools, while he repeated that he wants to see wage growth and inflation before backing a rate hike.

In the ongoing shutdown drama, President Trump signed bill to give Federal workers back pay from the shutdown, while there was also reports that the White House threatened to veto the stopgap bill the House is preparing, while US Senate Finance Committee Chairman Grassley said Trump administration's trade negotiations may be delayed due to government shutdown.

In currencies, the U.S. dollar was mixed, easing against the yen to 108.79 but flat versus the euro at $1.1396. The dollar index was up at 96.088. The yen led G10 gains following a U.S. probe into China’s Huawei and as equities and emerging-market currencies drifted lower. The dollar rose on supportive early London flows yet lost steam as the session progressed and the euro and sterling eventually erased modest losses. Commodity currencies were under pressure as risk sentiment waned, with Treasuries edging up and oil lower.

In commodities, oil traded lower, with U.S. crude remaining close to $52 a barrel as traders worried about the strength of demand in the United States after its gasoline stockpiles grew last week more than analysts had expected. Brent (-1.0%) and WTI (-1.2%) prices hover under $61/bbl and $52/bbl respectively, weighed on by the record EIA US crude production figure of 11.9mln BPD for the previous week, an increase from the prior of 11.7mln BPD; a level which was already the largest national output globally. Elsewhere, it has been reported that Russian Energy Minister Novak and Saudi Energy Minister Al Falih are to meet at next weeks Davos summit. Separately, Libyan oil ports Es Sider, Zueitina and Hariga have reportedly reopened following weather improvements. Palladium hit record highs thanks to increasing demand and lower supply. Spot gold was little changed at $1,294.91 per ounce.

The publication of housing starts and building permits is postponed because of the government shutdown. U.S. initial jobless claims are expected to be little changed against last week, while the Philadelphia Fed Business Outlook and the Bloomberg Consumer Comfort will be watched.

Morgan Stanley, PPG Industries and Fastenal are among companies reporting earnings before the market opens, while Netflix and American Express will report after the close.

Markets Snapshot

- S&P 500 futures down 0.4% to 2,604.00

- STOXX Europe 600 down 0.2% to 349.81

- MXAP up 0.06% to 152.46

- MXAPJ down 0.1% to 494.41

- Nikkei down 0.2% to 20,402.27

- Topix up 0.4% to 1,543.20

- Hang Seng Index down 0.5% to 26,755.63

- Shanghai Composite down 0.4% to 2,559.64

- Sensex up 0.3% to 36,415.78

- Australia S&P/ASX 200 up 0.3% to 5,850.05

- Kospi up 0.05% to 2,107.06

- German 10Y yield rose 0.3 bps to 0.227%

- Euro up 0.07% to $1.1400

- Italian 10Y yield fell 11.7 bps to 2.396%

- Spanish 10Y yield fell 1.4 bps to 1.361%

- Brent futures down 0.7% to $60.92/bbl

- Gold spot little changed at $1,293.94

- U.S. Dollar Index little changed at 96.10

Asian equity markets were choppy throughout the session but eventually followed suit to the gains on Wall St, where financials led after strong earnings from banking powerhouses Goldman Sachs and Bank of America. ASX 200 (+0.3%) and Nikkei 225 (-0.2%) were mixed as resilience in financials and commodity-related sectors kept the Australian benchmark afloat, while Tokyo trade was hampered again by currency effects. Hang Seng (-0.5%) briefly surmounted the 27,000 level for the first time since early December where it then met resistance and Shanghai Comp. (-0.4%) swung between gains and losses as participants digested another substantial liquidity operation by the PBoC, as well as US-China concerns after reports that US prosecutors are to pursue criminal charges against Huawei over theft of trade secrets. Finally, 10yr JGB futures recovered from the prior day’s lows but with price action kept range-bound on the session alongside the indecisive risk tone in the region and a relatively tepid Rinban announcement by the BoJ.

Top Asian News

- China Confirms Vice Premier Liu to Attend Trade Talks in U.S.

- China’s Coffee Unicorn Is Burning Millions to Overtake Starbucks

- Debt-Laden Indian Airline Jet Working With Banks on Bailout Plan

- Erdogan Gets Emergency Powers to Use If Turkish Economy at Risk

- Time to Sell Rally in Developed Market Stocks: Credit Suisse

Major European equities (ex-SMI) are mostly in the red, albeit off worst levels [Euro Stoxx 50 -0.3%]. The DAX (-0.3%) is the underperforming index weighed on by the poor performance in the auto sector (-0.9%), following US Senate Finance Committee Chairman Grassley commenting that he believes US President Trump is inclined to impose new US auto tariffs; with Daimler (-1.4%), Volkswagen (-1.4%) and BMW (-0.6%) in the red as a result. Sectors are broadly in the red, with financials underperforming due to Societe Generale (-4.0%) being firmly in the red after stating that Q4 2018 was impacted by disposals. Other notable movers include Sage Group (+5.7%) towards the top of the Stoxx 600 after the Co reiterated their full year 2019 guidance. Elsewhere, ITV (-6.8%) and Voestalpine (-6.2%) are at the bottom of the Stoxx 600 following a broker downgrade and profit warning respectively.

Top European News

- Alstom Warns Siemens Rail Deal Could Be Blocked by Europe

- Italy’s League Said to Seek Far-Right Ally to Box In Five Star

- U.K. Nuclear Plans Ditched as Hitachi Sees $2.8 Billion Charge

- Primark Owner Gains After Holiday Rebound From Tough November

In FX, it has been a choppy day for the Dollar as the index fluctuated in a range of 96.021-250 with upside triggered by rising tensions between US and China regarding Huawei. In terms of the latest, US prosecutors are to pursue criminal charges against the company over trade secret theft, while separate reports noted that US lawmakers are looking to pass a bill which bans chip sales to Huawei and ZTE. In response, the Chinese Foreign ministry urged US lawmakers to stop this bill. On the technical front the index sits just above its 100 DMA at 96.045 ahead of its 50 DMA at 96.639, just below the 2019 peak at 96.960.

- JPY– The Yen firmer on the back of safe-haven demand amid the aforementioned Huawei-related US-Sino tensions. USD/JPY retreats further below the recently-claimed 109.00 level to a low of 108.72 as the pair is underpinned by its 50 HMA around the intraday low. In terms of option expiries, nothing major to report today, however tomorrow sees some USD 3bln between 109.00-10.

- EUR - The Euro was largely unreactive to the in-line December inflation figures as the single currency continues to move in tandem with the Dollar, thus EUR/USD has experienced a relatively choppy session in the range of 1.1372-1.1404 ahead of comments from ECB-hawk Lautenschlager who is due to speak in Dublin at 1100GMT following a recently published interview in which she said she will wait for the March projections before changing her view about a rate hike this year. In terms of option expiries, tomorrow sees 4bln scattered between 1.1400-25.

- GBP – Sideways action following PM May’s victory at last night’s Labour-tabled vote of no confidence in which the Premier defeated the motion via 325 vs 306 votes, as expected. Sterling sold off with Cable re-testing 1.2700 to the downside in the run up to the results before spiking higher to levels just shy of 1.2900 upon the announcement. In terms of the latest, Spanish press reported that the EU are to condition any potential delay to Brexit on an agreement being struck between UK PM May and opposition leader Corbyn, though Sterling was unreactive to this as Corbyn already made it clear that he will not hold talks with the Premier until a no-deal Brexit is off the table. GBP/USD action is largely dominated by Dollar fluctuation as the pair remains choppy sub-1.2900 and below its 100 DMA at 1.2893.

In commodities, Brent (-1.0%) and WTI (-1.2%) prices hover under USD 61/bbl and USD 52/bbl respectively, weighed on by the record EIA US crude production figure of 11.9mln BPD for the previous week, an increase from the prior of 11.7mln BPD; a level which was already the largest national output globally. Elsewhere, it has been reported that Russian Energy Minister Novak and Saudi Energy Minister Al Falih are to meet at next weeks Davos summit. Separately, Libyan oil ports Es Sider, Zueitina and Hariga have reportedly reopened following weather improvements. Gold has traded within a narrow USD 4/oz range, as the dollar has also traded largely unchanged due to a lack of catalysts. Elsewhere, the US Senate voted to reject legislation to keep sanctions on companies linked to Oleg Deripaska, including Rusal. Separately, steel company Voestalpine have issued their second profit warning in 4 months; citing US plant operating problems and cartel investigation provisions as the cause. OPEC monthly report: OPEC crude production fell 751k bpd in December to average 31.58mln bpd, according to secondary sources with cuts led by Saudi Arabia, Libya.

Looking at the day ahead, we get more housing market data with December housing starts and building permits numbers although these will likely be delayed due to the govt shutdown. There should also be some focus on the Philly Fed business outlook print in light of the weak empire manufacturing reading earlier this week, while the other data due is the latest weekly initial jobless claims reading. It’s worth noting that Japan’s December CPI reading is also due out late this evening. Away from all that the ECB’s Lautenschlaeger is due to speak this morning in Dublin while the Fed’s Quarles speaks this afternoon at an insurance forum. Meanwhile, the OPEC monthly report is due out while earnings wise it’s the turn of Netflix and Morgan Stanley today.

US Event Calendar

- NOTE: Housing starts/bldg permits data postponed by govt shutdown

- 8:30am: Philadelphia Fed Business Outlook, est. 9.5, prior 9.4

- 8:30am: Initial Jobless Claims, est. 220,000, prior 216,000

- 8:30am: Continuing Claims, est. 1.73m, prior 1.72m

DB's Jim Reid concludes the overnight wrap

Watching the House of Commons over the last 48 hours has been a good appetizer for the final series of Game of Thrones out this April. Well, we haven’t had dragons........ yet! It seems that the new series is out on April 14th and I move in to my new house supposedly (builder permitting) on April 22nd. Given that the size and quality differential between the TV in my temporary rental accommodation and my new house is substantial I will likely be going off the grid and away from civilization for 8 or 9 days from mid-April to avoid spoiler alerts before I move in and watch two episodes back to back.

I wonder what difference going off the grid for 8 or 9 days now would mean in terms of progress on Brexit when you returned. Now PM May has won her confidence vote by 325-306 (ironically by a ratio of 52:48), things have to move fast to ensure she reports back to the house by Monday (as required) on the next steps. In her post-vote remarks, she continued her pivot toward a softer Brexit, saying “we must find solutions that are negotiable and command sufficient support in this House.” She said she planned to begin talks immediately with senior parliamentarians and leaders of all parties, which was encouragingly conciliatory. The latter point, indicating she would invite Corbyn and other opposition leaders to contribute was new and positive.

However, Mr. Corbyn and the LibDem's both indicated that they will not meet unless and until May commits to removing the possibility of a "no-deal" outcome, a move that she has so far refused. In a late televised statement though, PM May said she had met with the LibDem leader already while expressing disappointment that Labour aren’t currently prepared to talk. Pressure is now building on the Labour Party to announce what their strategy is. Previously they have said that if they can’t force a general election then they will pivot towards a second referendum. We will wait and see. Four other opposition parties wrote a letter urging the Labour Party to back the second referendum with the implication that if they didn’t then these parties may not support any further confidence votes called by Labour in the Government. So it’s less likely that Labour can hide behind no firm policy and repeated try to bring the government down. Elsewhere the SNP's Ian Blackford committed to working with May, but did reiterate their call for a "people's vote" to be on the table. Finally, the DUP's Nigel Dodds (whose 10 votes effectively provided May her majority in the confidence vote) called for the UK to leave the EU as one country, in a possible move to resist any regulatory divergence between Northern Ireland and the rest of the UK.

DB's strategists still think the direction of travel is unequivocally toward a soft Brexit and a stronger pound. For them to be right, someone has to back down though and while I personally think there would be a cross party majority for staying in the customs union such a move could split the Conservative Party and as such be a poisoned chalice to them. What will Mrs May see as the priority? Keeping her party from the risks of a damaging split or trying to find a deal? The next stage of negotiations really feels like one ginormous game of “whac-a-mole”.

The pound was directionless yesterday (and this morning), bouncing around the $1.2870 level all day ahead of the vote, and ultimately closing in that region, up +0.14% on the day. The FTSE 100 dipped -0.47%, consistent with the prior rally in sterling after Tuesday's vote.

The London Times reported late yesterday afternoon that the EU is considering offering a delay of Brexit until 2020. It comes from a credible source but whether it’s realistic is another matter. Many Conservative MPs would probably not be keen on the extension being that long. It wouldn’t do much to focus minds in the short-term and also allow more time to build more and more momentum for a second referendum which creates a more binary outcome and uncertainties. So interesting (if true) that the EU are prepared to offer a lot of road for the can to be kicked along but not too sure it will be that useful.

Earlier, the EU, via Barnier, confirmed that they would actively engage with a softer Brexit approach on the future relationship while late in the afternoon the Handelsblatt reported that the EU is ready to make further offers on the backstop, but that EU officials want the initiative to come from Ireland. So a lot of noise, some small steps in a positive direction but a long way to go to get this resolved.

Around all this, risk assets had US bank earnings to thank yesterday as the S&P 500, DOW, and NASDAQ notched up modest gains of +0.21%, +0.59%, and +0.15% respectively with the banks sector of the S&P rallying +2.72% and to the highest since early December. This followed results from Bank of America (+7.16%) and Goldman Sachs (+9.63%). Like what we’ve seen with the other US banks so far, there were much bigger-than-expected revenue declines in FICC trading however the market has instead focused on positive net interest income and investment banking fees, and to the rosier outlooks being painted by management.

Just before US markets closed, the Wall Street Journal reported that US federal prosecutors are close to indicting Chinese tech firm Huawei for allegedly stealing trade secrets from US businesses. The move could exacerbate economic tensions between the US and China, and the S&P 500 promptly surrendered half of its gains. Regardless, this year still ranks as the 10th best start to a year ever for the S&P 500 (out of the 92 years we have daily data) with a +4.35% YTD gain. In fact it’s the best start since 1987 based on data through to the 16th of January each year while the NASDAQ (+6.02%) has had its best start since the post-tech crisis rebound of 2003.

Credit also performed well yesterday with US HY cash spreads finishing -7bps tighter. That puts the rally back from the January 3rd wides this year at an impressive -92bps. US IG spreads were 2bps tighter and are now 12bps tighter over the same period while Treasury yields ticked +1.1bps higher to 2.722% and continue to be a bit of a sideshow at the moment. European bond markets weakened slightly as well, with Bund yields +1.8bps, though BTPs rallied -12.0bps. Sentiment around the Italian banking sector improved after Finance Minister Tria told reporters that banks are reducing NPLs in line with their plans, in a rebuke to reporting earlier this week that hinted at potential NPL problems. Italian bank stocks rallied +3.97%, back to flat on the week.

Oil continued its strong run, with WTI crude prices rising +0.48% for their 11th gain over the last 13 sessions, the best stretch since October 2017. US inventories data showed a 2.68million barrel draw in US stockpiles, though gasoline inventories continued to build. Saudi Arabia reportedly cut its crude shipments to US refineries, which could reflect either a reduction in Saudi supply or reduced demand from US refiners given the large stockpiles of refined products. Overall, the data did not give a clear signal on where prices are heading, though our strategists target further gains over the medium term.

Overnight in Asia markets are largely up with the Shanghai Comp (+0.46%) and Hang Seng (+0.37%) reversing early losses and leading the gains likely on overnight news that China is speeding up its investment law approval process that would create measures for the administration to protect the intellectual property of foreign investors and protect them from forced transfer of technologies. This is clearly a move towards addressing two of the thorniest issues in the US-China trade talks. The official Xinhua News Agency reported that the National People’s Congress Standing Committee has scheduled a special session for January 29-30 to consider the bill and a personnel reshuffle. Interestingly the closed door gathering will start just a day prior to China’s Vice Premier Liu’s expected travel to the US for trade talks. In the meantime, Kospi (+0.16%) is also up while the Nikkei (-0.09%) is trading flattish after a volatile start to today’s session on a strengthening yen (+0.08%). Elsewhere, futures on S&P 500 are down -0.28% while all the G10 currencies (except the yen) and most Asian currencies are trading weak against the greenback this morning. In commodities, crude oil prices (WTI -0.59% and Brent -0.51%) are heading lower today after the spectacular run described above.

In other news it’s been confirmed that US Secretary of State Pompeo will meet with a senior North Korean official overseeing nuclear talks this Friday with the view that this could lead to a second summit soon. The North Korean representative, Kim Yong Chol, will reportedly bring a new letter for President Trump from Kim Jung Un. In his New Year's address, the dictator suggested that he may seek a "new path" if talks do not progress, potentially signaling more binary risks moving forward, toward either further reconciliation or a breakdown in discussions.

The Fed released its regular beige book, with anecdotal economic details. The report said that wages grew across skill levels, though the gains remain modest. The economy continues to grow but the report cited some weak spots emerging, and price gains remain "modest to moderate." Overall, the report is consistent with slowing, but still positive growth, and since inflationary pressures remain muted, it should allow the Fed to maintain its stance of paused rate hikes.

As far as yesterday’s data was concerned, in the US the NAHB housing market index surprised to the upside at 58 versus expectations of 56. That was only the third monthly improvement since 2017, and it at least provides some relief from the recent fall which has seen the index drop from a peak of 74 at the end of 2017. The other data out in the US was the December import price index which fell slightly less than expected at a headline level (-1.0% mom vs. -1.3% expected) and rose a bit more than expected on the core measure (+0.3% mom vs. 0.0% expected). Here in the UK, we got the December inflation data and there was a small upside surprise in the core reading at +1.9% yoy (vs. +1.8% expected). The headline was on the money at +2.1% yoy with the overall message not really changing the narrative from our economists that inflation is slipping faster than expected and should settle below target this year.

To the day ahead now where this morning in Europe we’ll get the final December CPI revisions for the Euro Area (no change from +1.0% yoy expected) along with November construction output data. In the US this afternoon there’s more housing market data due with December housing starts and building permits numbers. There should also be some focus on the Philly Fed business outlook print in light of the weak empire manufacturing reading earlier this week, while the other data due is the latest weekly initial jobless claims reading. It’s worth noting that Japan’s December CPI reading is also due out late this evening. Away from all that the ECB’s Lautenschlaeger is due to speak this morning in Dublin while the Fed’s Quarles speaks this afternoon at an insurance forum. Meanwhile, the OPEC monthly report is due out while earnings wise it’s the turn of Netflix and Morgan Stanley today.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more