US Dollar Index Bounces Off Lows Near 90.00

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its G10 peers, trades in multi-session lows near the 90.00 support on Thursday.

Image Source: Pixabay

US Dollar Index weaker on risk-on mood

The prevailing sentiment towards the riskier assets puts the buck under further pressure and forces the DXY to challenges the psychological support in the 90.00 neighborhood.

The leg lower in the greenback comes despite yields of the key US 10-year benchmark manages to regain attention and jump to the area beyond 1.12%.

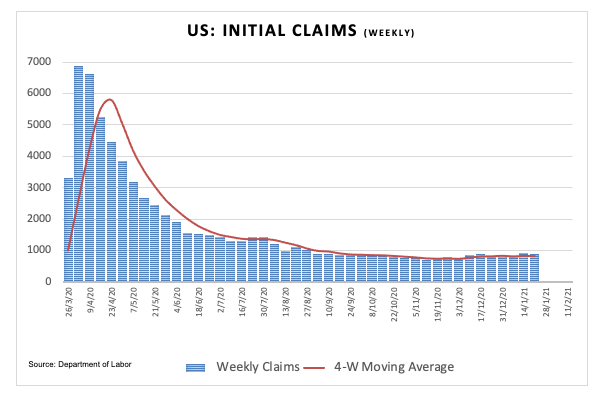

In the US calendar, weekly Initial Claims rose by 900K during last week and the Philly Fed manufacturing gauge improved to 26.5 for the current month (from 9.1). in addition, Housing Starts and Building Permits also surpassed estimates at 1.669 million units (+5.8%) and 1.709 million units (+4.5%), respectively, during the last month of 2020.

What to look for around USD

DXY’s upside run out of steam in the 91.00 region earlier in the week, sparking a subsequent corrective move to the 90.00 zone. Occasional bullish attempts in the dollar, however, are expected to be short-lived amidst the fragile outlook for the greenback in the short/medium-term, and always amidst the massive monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Federal Reserve and prospects of a strong recovery in the global economy.

US Dollar Index relevant levels

At the moment, the index is losing 0.32% at 90.18 and faces the next support at 89.20 (2021 low Jan.6) followed by 88.94 (monthly low March 2018) and 88.25 (monthly low February 2018). On the other hand, a breakout of 91.01 (weekly high Dec.21) would open the door to 92.10 (100-day SMA) and finally 92.46 (23.6% Fibo of the 2020-2021 drop).

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more