US Dollar Forecast: USD Trade Setups & Themes For Next Week

The US Dollar has dominated the currency market since the start of 2020 with the DXY Index – a benchmark measuring USD performance against a basket of other major currency pairs – charging 2.7% higher.

Greenback gains so far this year can be primarily attributed to the recent strength of the US economy outperforming relative to baseline expectations, which has been exacerbated by an influx of risk-aversion due to concerns over the novel coronavirus outbreak.

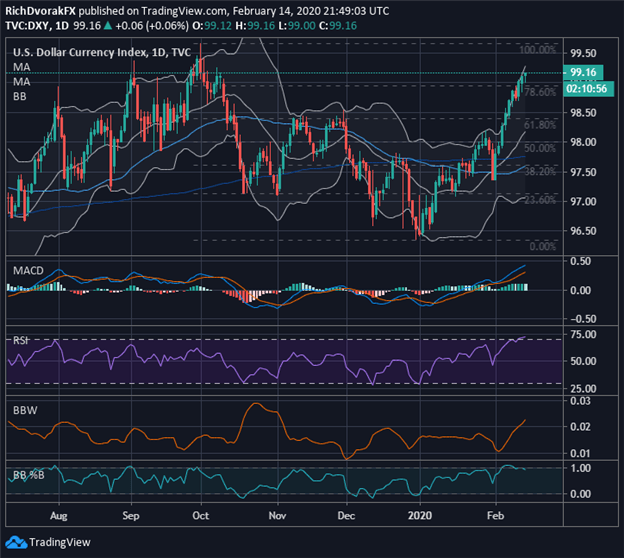

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (JULY 2019 TO FEBRUARY 2020)

Chart created by @RichDvorakFX with TradingView

The DXY Index is on pace to close above the 99.00 handle as forex traders continue to bid up the US Dollar following the series of solid economic data releases like nonfarm payrolls reported last week in addition to inflation figures and consumer sentiment data published this past Wednesday and Friday respectively.

After topping the 76.8% Fibonacci retracement level of the US Dollar Index’s most recent bearish leg, there seems to be an open stretch of runway for USD price action to continue its ascent higher to 2019 highs.

Although it is arguable that the US Dollar is overextended, the expanding Bollinger Band ™ could perhaps facilitate further upside potential before a mean-reversion lower or consolidation occurs.

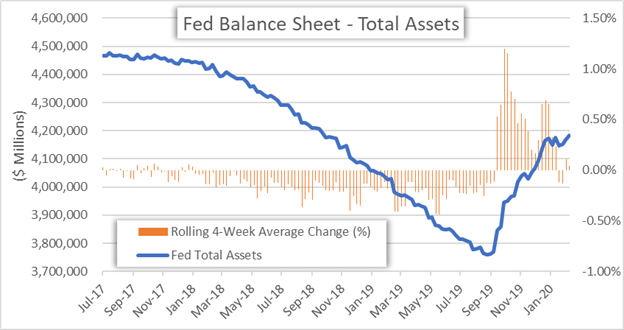

USD MAY RISE IF FED BALANCE SHEET GROWTH DECELERATES

(Click on image to enlarge)

Another fundamental development that has improved USD price outlook is the first sign of the Federal Reserve easing off the gas regarding its speed of balance sheet expansion.

Specifically, the New York Fed announced Thursday afternoon that it will decrease its aggregate limit on overnight repurchase agreement operations (repos) from $120 Billion to $100 Billion and cap for term repos from $35 Billion to $25 Billion.

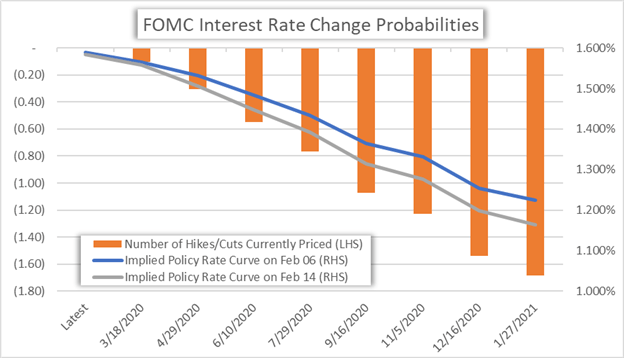

US DOLLAR COULD EXTEND GAINS IF FOMC MINUTES UNDERSCORE NEUTRAL MONETARY POLICY OUTLOOK

(Click on image to enlarge)

Likewise, an additional key driver of the US Dollar’s direction over the coming trading days will likely be the changes in FOMC interest rate change probabilities.

Minutes from the January Fed meeting are slated for release next week according to the economic calendar, which could spark an aggressive change in Fed rate cut bets and corresponding move in USD price action.

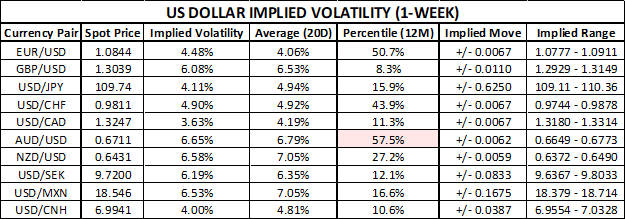

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY & TRADING RANGES (1-WEEK)

(Click on image to enlarge)

Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

That said, currency volatility for the week ahead appears relatively muted judging by the latest 1-week implied volatility readings across various major and minor currency pairs.

If coronavirus fears take the back seat, the USD and broader DXY Index could face downward pressure due to fading demand for safe-haven assets such as the US Dollar given its vast liquidity.