US Dollar Forecast: Climbing Inflation Expectations May Underpin USD

US DOLLAR FUNDAMENTAL FORECAST: MIXED

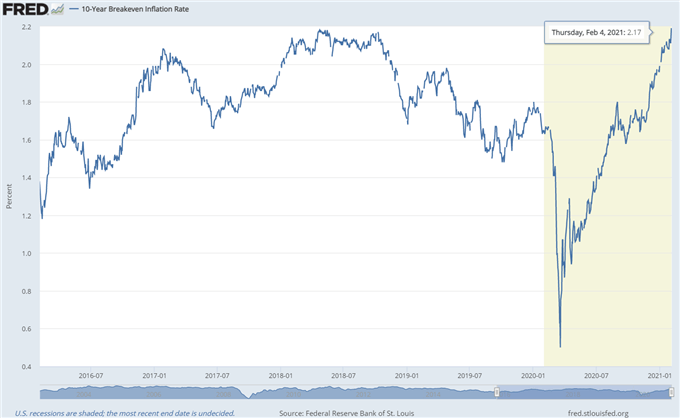

- Climbing inflation expectations may underpin USD against its major counterparts in the short-term.

- Q4 GDP figures and consumer price growth data for January will be keenly eyed by market participants.

INTENSIFYING SIGNS OF INFLATION TO BUOY USD

The US Dollar may continue to gain ground against its major counterparts in the near-term, as a noticeable pickup in inflation fuels bets that the Federal Reserve may tighten its monetary policy levers sooner than expected.

The Fed’s preferred measure of consumer price growth – the Core Personal Consumption Expenditure (PCE) index – climbed 1.5% YoY in December, exceeding market estimates of a 1.3% print. The ISM manufacturing prices sub-index also surged unexpectedly, rising to 82.1 in January and smashing forecasts for a more conservative increase to 77.

Indeed, inflationary pressures may continue to build in the coming weeks, as Democrats pave the way for President Joe Biden to pass the majority of his proposed $1.9 trillion stimulus package with a simple majority.

10-YEAR BREAKEVEN INFLATION RATE

Source – FRED

Positive vaccination progress and falling coronavirus cases may also foster further consumer price growth. The seven-day moving average tracking COVID-19 infections has declined by over 130,000 in the last three weeks, while over 33 million Americans have received at least one dose of a coronavirus vaccine.

However, it still seems relatively unlikely that the Fed will look to adjust its monetary policy settings anytime soon after the central bank reiterated its pledge to continuing increasing “its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial progress has been made toward the Committee’s maximum employment and price stability goals."

Several Fed members have also talked down the idea of tapering bond purchases anytime soon, with Chairman Jerome Powell stating that “the whole focus on exit is premature,” and St Louis Fed President James Bullard commenting that “we are still in the middle of a crisis, so it’s too early to initiate that discussion."

INFLATION RELEASES IN FOCUS

Looking ahead, inflation data for the month of January and fourth-quarter GDP figures will be closely eyed by market participants. A larger-than-expected rise in consumer price growth and a surprisingly positive GDP release could diminish the need for further stimulus and, in turn, underpin the US Dollar against its major counterparts.

Disclosure: See the full disclosure for DailyFX here.