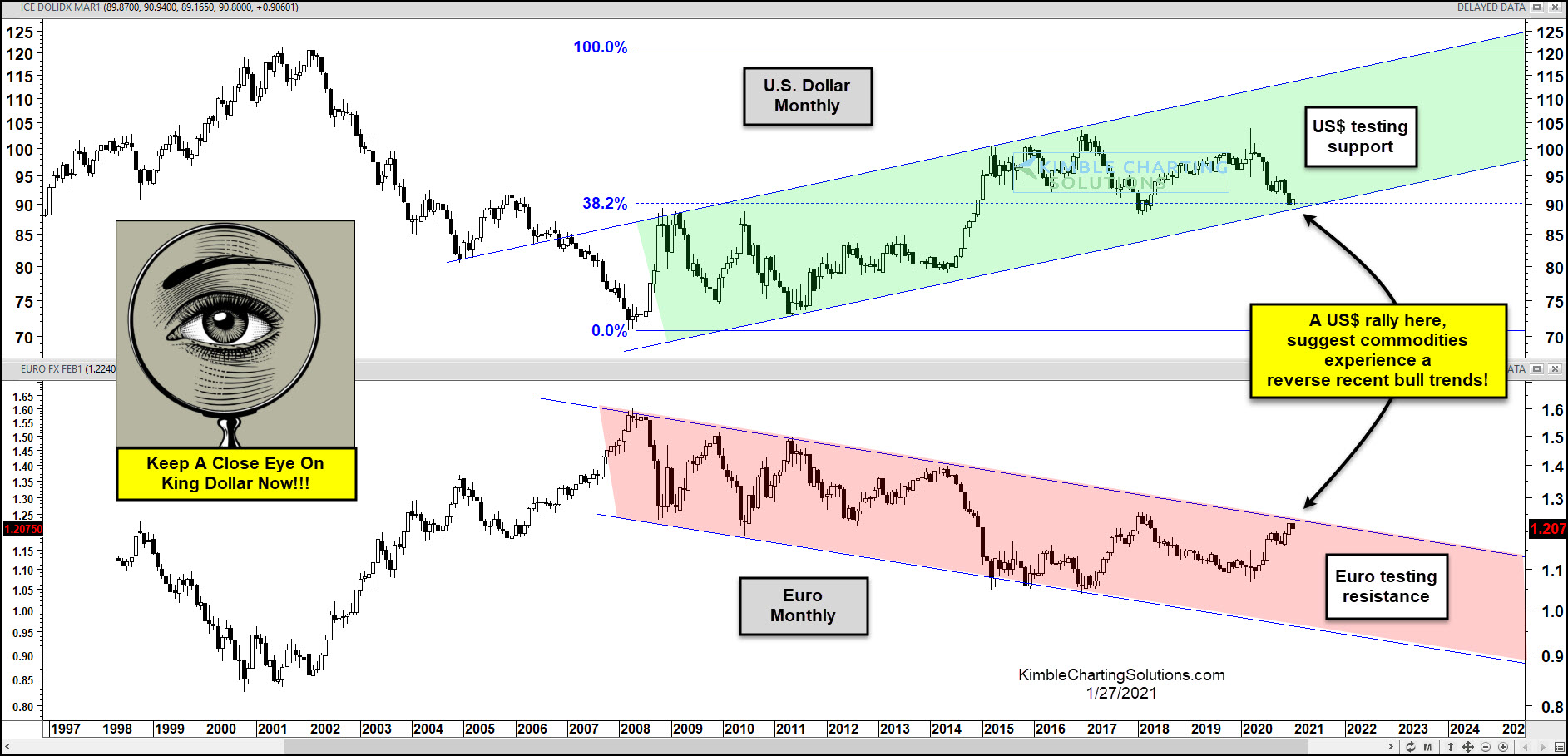

U.S. Dollar Collapse Point? Biggest Test In A Decade In Play

(Click on image to enlarge)

A lot has happened in the currency markets over the past year.

And important near-term trends are currently facing some big-time long-term trend support/resistance levels.

In today’s chart 2-pack we take a look at the U.S. Dollar currency index on a “monthly” basis and compare it to the Euro (EURUSD). Hint: both currencies are trading into important levels.

King Dollar has been trading within a rising trend channel for the past 12 years, while the Euro has done the same in the other direction. BUT both currencies are in counter-trend moves that are testing long-term support/resistance levels.

Currencies Make The Financial Markets Go Round

Recent weakness in the US Dollar (and strength in the Euro) has added fuel to the rally in commodities… but King Dollar is testing important rising trend-line support… at the same time that the Euro is testing resistance.

A rally in the US Dollar would suggest incoming headwinds for commodities prices. What happens at these inflection points will highly impact the commodities markets going forward.

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.