US And Asian Markets Pop On G20 News

This weekend could have turned out extremely positive or extremely negative for the global markets. It appears the news about the US and China adopting a 90 resolve to prevent escalation of trade issues in an attempt to foster a more suitable outcome for global trade was received by the global equity markets with great success.

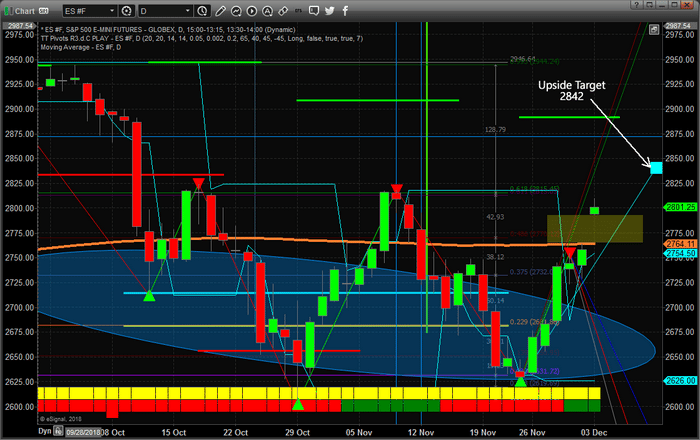

The US markets are up well over 1.5% on a massive price gap higher as markets opened Sunday night. This huge gap above the longer term Moving Average may be an indication that the US markets will attempt to rally to new all-time highs before the end of this year as we have been predicting for the past 50+ days.

What we need to see is the target price of 2842 being reached where we expect a bit of consolidation before price attempt to rocket higher towards new all-time highs.

At this point, shorts will be covering positions quickly over the next few days as they were caught on the wrong side of this trade. A massive short squeeze rally could unravel as a massive upside price move over the next 10~14 days ending just before Christmas 2018.

Follow our analysis to stay on the right side of this move. Our predictive modeling systems have been calling these market moves 30~60+ days in advance. Visit more