US: A Test Of ‘Patience’

'Cross-currents' have led the Federal Reserve to adopt a more 'patient', data dependent approach to monetary policy for 2019. While the market is pricing in an eventual cut as the next Fed move, we continue to look for one last 25 basis point hike in the summer.

The next move on rates

With the government shutdown over, we are receiving the backlog of data from the end of 2018. Most notably, 4Q GDP slowed by less than feared to 2.6% annualised, which left full year 2018 growth at 2.9%. The aggressive tax cuts at the beginning of 2018 put the US economy on a strong footing, with momentum being well maintained despite escalating trade tensions and the financial market turmoil seen in the latter part of the year.

It was for these reasons that the Federal Reserve adopted a more cautious position in January. Earlier this week, Fed Chair Jerome Powell repeated comments that economic and financial market 'crosscurrents and conflicting signals' have created uncertainty. While officials continue to believe the US economy is broadly in good shape, the fact that inflation pressures are perceived to be 'muted' means the Fed can afford to be 'patient' with regards to decisions on future policy changes.

At present, markets believe that the Fed’s neutral stance will eventually give way to policy easing with Fed funds futures contracts pricing in a 25 basis point rate cut by the summer of 2021. However, we continue to believe that the next move is more likely to be an interest rate increase.

Indeed, the economic tensions appear to have eased since the start of the year. The US-China trade truce that was called in early December delayed the imposition of additional tariffs on imports from China. President Trump continues to seek a concrete deal that will result in a lower bi-lateral deficit together with Chinese concessions on intellectual property and technology transfer.

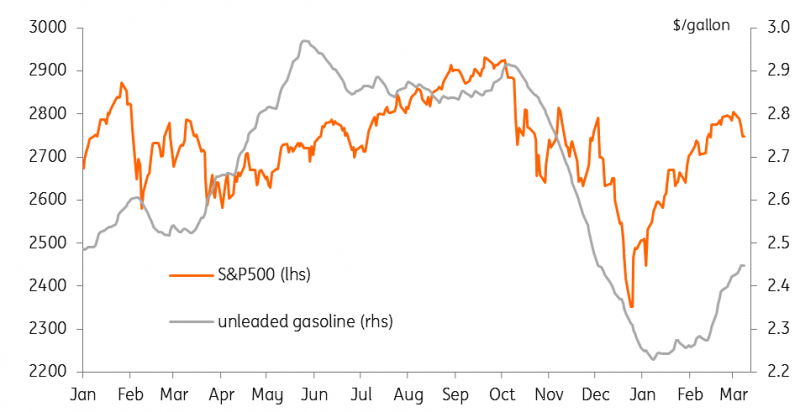

The hope is that a late-March summit can seal the deal with a 150-page document reportedly being finalised. Meanwhile, risk appetite has returned with equity markets recovering all of the losses seen since the beginning of October. Interestingly, gasoline prices have not rebounded to anywhere near the same extent, so household spending power continues to benefit.

Equities rebound, but gasoline faces resistance

(Click on image to enlarge)

Macrobond

Clear positives

We certainly accept that the US economy is not going to grow as strongly in 2019 as it did last year with the government shutdown having already helped take some of the wind out of its sails. The fiscal support from 2018’s aggressive tax cuts will undoubtedly fade while the lagged effects of higher interest rates and the stronger dollar clearly act as a brake. Weaker external demand is also a concern with Asia and European growth having slowed markedly through 2018 amid escalating trade protectionism fears.

That said, we still think there are clear positives that can keep the economy growing soundly, which in turn will lead to rising inflation pressures. Indeed, the jobs market remains an ongoing source of optimism. Firms have continued to hire workers aggressively at the start of the year, and wage pressures are rising. With real household disposable incomes growing strongly we expect consumer sentiment to remain high, supporting broader spending growth in the economy.

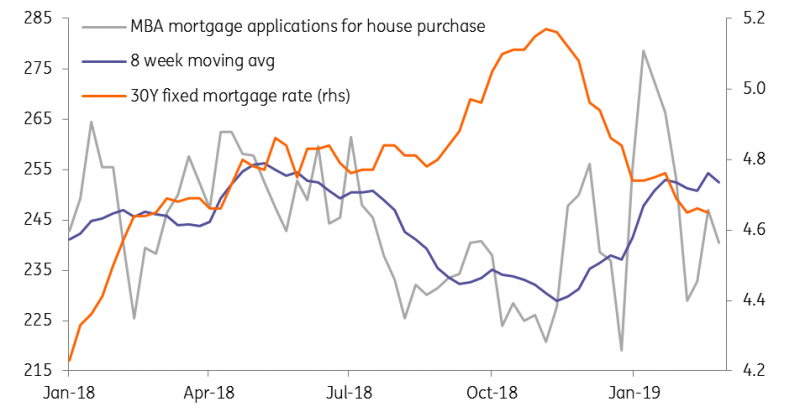

US housing market making a recovery

(Click on image to enlarge)

Bloomberg

There have also been some positive signals in the property market. Mortgage rates have dropped back sharply following the correction lower in Treasury yields, and this is prompting a pick-up in mortgage applications and approvals. Consequently, we could see a possible turnaround in home sales through 1H19, which may, in turn, stimulate a recovery in residential investment – a key component of GDP that has fallen for four consecutive quarters.

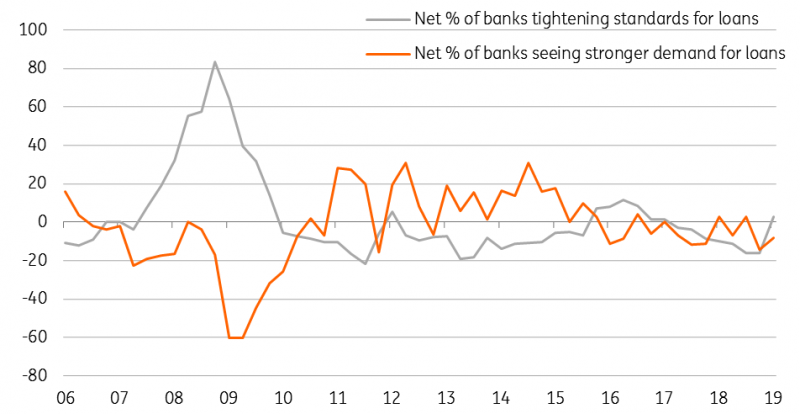

Senior Loan officers' survey - large & medium sized firms (revenue >$50mn)

(Click on image to enlarge)

Macrobond

Moreover, lending conditions don't appear onerous. Indeed, the Fed’s lending conditions survey suggests that there has been no major tightening of financial conditions despite the turmoil seen in markets at the back end of last year. As such, a lack of financing availability doesn’t appear to be a major constraint on economic activity. There are also encouraging signals regarding broader investment spending with business surveys holding at healthy levels. The latest ISM indices are consistent with decent growth.

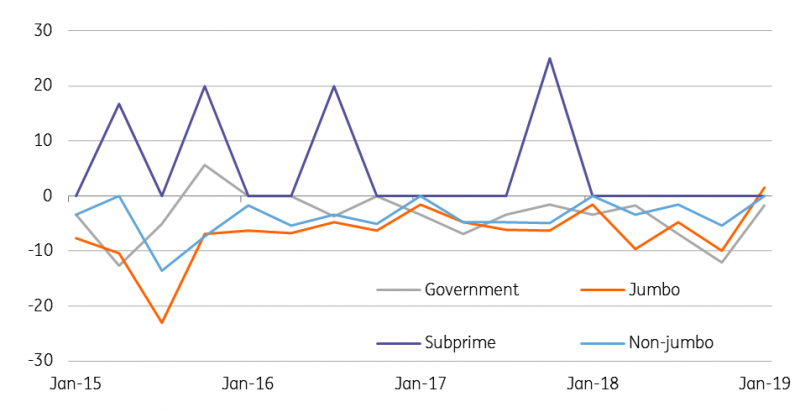

Senior Loan Officers survey - Net % of banks tightening mortgage standards

(Click on image to enlarge)

Macrobond

Given the lack of spare capacity in the economy and the fact wage pressures are building, we look for inflation to continue pushing higher through 2019. So, the combination of firm economic activity, a tight jobs market and rising inflation means we continue to look for a rate rise over the summer, but it is looking more likely to be in 3Q rather than in 2Q.

Trade is key

Trade policy remains a critical issue though. President Trump has been indicating that he thinks the US and China may be close to a deal, but there are issues to be hammered out regarding how any deal will be implemented and policed. Markets will remain cautious until they see something concrete – hopefully later this month. If such a deal does materialize, this will lift a dark cloud that has been hanging over the global economy.

However, should China trade talks break down, just as the US-Korea nuclear talks have done, then our forecast of an additional Fed rate hike looks vulnerable. If new trade sanctions are implemented, then this would be economically damaging, with American businesses and consumers facing higher prices and disruption to supply chains.

We are also likely to see a repeat of the bear market sentiment seen in late 2018. The economic risks would be heightened further should President Trump choose to hike tariffs on European car imports. After all, the Department for Commerce has decreed that having a strong US domestic auto industry is a national security issue, so President Trump has until mid-May to decide.

Donald Trump will be seeking concessions from Europe during the period that would remove the need for tariffs. However, if concessions aren’t forthcoming, he may hope that a short, sharp shock will be enough to incentivize Europe to back down. This would allow him to take a clear ‘victory’ on trade to the US electorate at next year’s Presidential election, but it would likely come at the expense of weaker near-term growth. The hit to sentiment and squeeze on spending power it generates may mean the Fed takes an even more cautious approach to monetary policy. Indeed, this trade war scenario is much more consistent with current market pricing of the next Fed move being an interest rate cut.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more