US & World Wheat Crops Down, But Weather Is Crops Focus Now

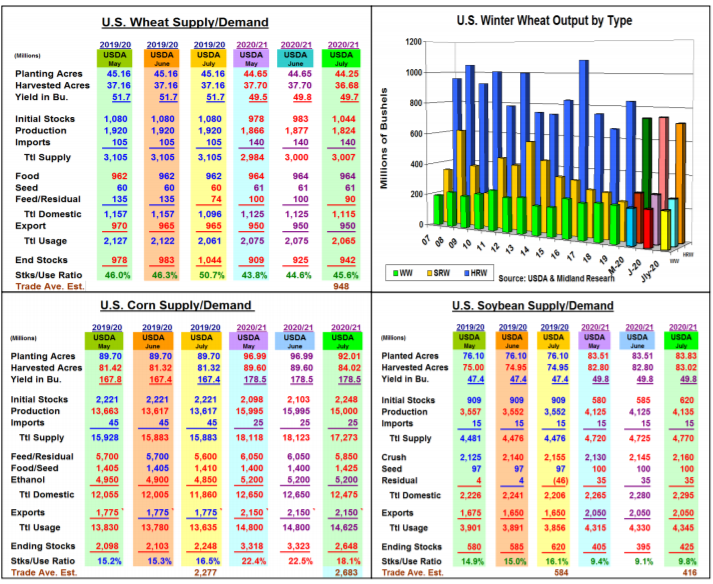

Market Analysis July’s US supply/demand revisions generally followed the indications from June 30th quarterly stocks & acreage changes. US corn & wheat ending stocks adjustments were about as expected while the USDA’s old-crop bean stocks were higher on a big residual change this month. The USDA also reduced the US winter wheat outlook lower than many analysts were thinking by slicing both the hard red and soft red varieties this month. Despite these modest USDA curves, a change in the weather models for the upcoming week moderating the temperatures for the C & E Midwest weaken CBOT prices late in the session.

Last month’s dropped in harvested area & some lower yields prompted a 53 million lower US wheat crop to 1.824 billion. The majority came from the winter wheat crop (48 million) as the northern Plains & eastern Midwest yields were reduced. However, wheat’s unexpectedly large old-crop stocks (less feed use) still helped to boost this food grain’s 20/21 ending stock by 17 million to 942 million bu. Smaller EU, Russian and N African crops helped slip the world’s output & stocks this month.

Looking at corn’s S&D revisions, the USDA did reduce feed’s old-crop demand by 100 million bu. after June’s higher quarterly stocks. They sliced 50 million from ethanol, but left exports unchanged resulting in 2.248 billion 19/20 stocks. These added stocks & corn’s 2020 yield staying unchanged reduced 2020/21’s total supplies by 850,000 million bu. However, the USDA did drop corn’s new-crop feed demand by 200 million putting this crop’s 2020/21 stocks at 2.648 billion bu.

In soybeans, the USDA did up the US old-crop crush by 15 million bu. & left their export outlook stagnate. However, the big surprise was their 50 million drop in beans’ residual demand (producing a negative number) to suggest a larger 2019 crop. Previous quarterly stock reports suggest a possible underestimate, but is this level the right one.

What’s Ahead: With limited changes in the latest US balance sheets, the market’s focus has switched to the US corn pollination weather the balance of July and soybean podding in August. The potential for intense heat returning to US Midwest remains.

Look to finish up 2019/20 corn & bean sales on Sept & August prices in the $3.45-50 & $9.10-20 ranges. Increase new-crop hedges to 25% at $3.60 & $9.15-25.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more