Upwork Could Head Down With Lockup Expiration

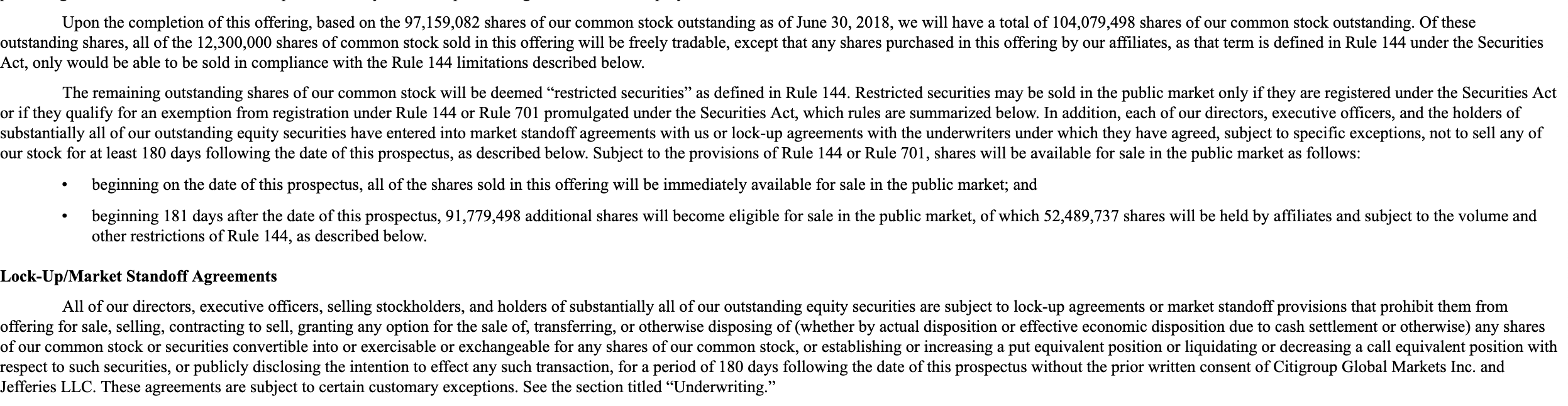

April 1, 2019, concludes the 180-day lockup period of Upwork Inc. (UPWK).

When the lockup period ends for Upwork Inc., its pre-IPO shareholders will have the ability to sell more than 91 million currently-restricted shares. With just 12.3 million shares of UPWK trading pursuant to the IPO, any significant sales could flood the secondary market for UPWK and cause a sharp, short-term downturn in share price.

(Click on image to enlarge)

Currently, UPWK trades in the $19 to $20 range. Shares of UPWK had a first day return of 41.2% and shares currently have a 33.7% return from IPO.

Business Overview: Online Platform that Connects Businesses to Independent Contractors

Upwork is an online platform that connects businesses with freelancers and independent professionals. The platform connects these businesses with a wide range of professionals who have many different talents. According to the firm's S-1, these talent categories include web development, sales, mobile app development, graphic design, data science and analytics, content marketing, and customer service. This information comes from the firm's S-1.

The platform offers a variety of features that help to simplify the process of finding the correct independent professional for completing your task. The platform allows you to contact talent and facilitates ongoing communication. You can also use the platform for invoicing and payment.

(Source: Upwork.com)

According to the firm's S-1, the company operates in the United States, the Philippines, India, and other countries abroad.

In its SEC filings, Upwork stated it is the "largest online global marketplace" connecting businesses with freelancers. For the 12 months ended June 30, 2018, Upwork had facilitated $1.56 billion in gross service volume (GSV) in over 2.0 million projects that involved 475,000 clients and 375,000 freelancers in more than 180 countries.

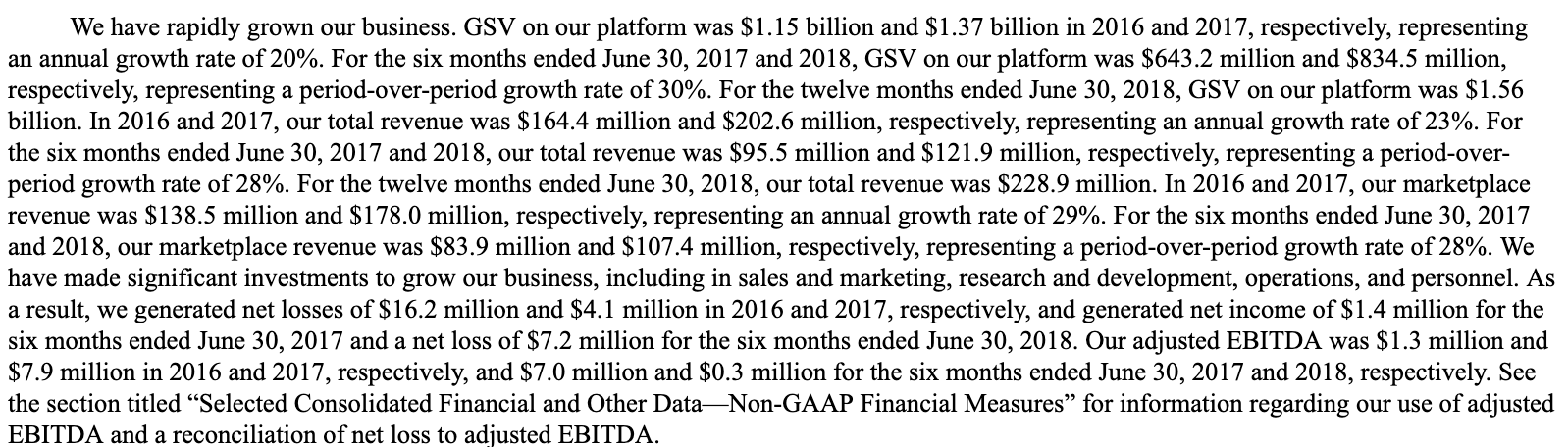

(Click on image to enlarge)

Source: S-1.

Upwork estimates that the total worldwide GSV volume was approximately $560 billion in 2017. In another estimate, McKinsey Global Institute expects that global opportunity to reach $2.7 trillion annually.

According to the firm's S-1, the company was formerly named Elance-oDesk. In May 2015, it changed its name to Upwork. The company was incorporated in 2013, has approximately 400 employees, and keeps its headquarters in Mountain View, California.

Company information sourced from the firm's website and S-1/A.

Financial Highlights

Upwork Inc. reported the following financial highlights for the fourth quarter and full fiscal year ending December 31, 2018:

Fourth Quarter 2018 Financial Results:

- Total revenue was $67.3 million for an increase of 23%. Marketplace revenue was $59.7 million for an increase of 24%, which represents 89% of total revenue for the fourth quarter.

- Gross profit increased 25% to $46.5 million, and gross margin was 69%, slightly higher than 68% in the same period of 2017.

- Net loss was $(5.4) million or $(0.05) per share versus a net loss of $(11.7) million or $(0.35) per share in the same period of 2017.

- Adjusted EBITDA was $3.6 million compared to $(1.9) million in the same period of 2017.

Full-Year 2018 Financial Result

- Total revenue was $253.4 million for an increase of 25%. Marketplace revenue increased 26% to $223.8 million.

- Gross profit was $171.9 million for an increase of 25%. Gross margin was 68%, which was the same as last year

- Net loss was $(19.9) million or $(0.38) per share compared to a net loss of $(10.6) million or $(0.32) per share a year ago.

Financial highlights sourced from the firm's website.

Management Team

President, CEO, and Director Stephane Kasriel has been with Upwork since April 2015. He has held senior positions at PayPal, Work4, Zong, and Fireclick. Mr. Kasriel earned an MS in computer science from Stanford University. In addition, he earned an MBA from INSEAD.

CFO Brian Kinion has been in his position since October 2017. His previous experience comes from stints at Marketo, SuccessFactors, CoTherix, Clearswift, DigitalThink, Netcentives, and KPMG Peat Marwick. He is a Certified Public Accountant and he holds a B.S. in accounting and an MBA from St. Mary's College in California.

Management information sourced from the firm's website and S-1/A.

Competition: Traditional Staffing Sources, Freelance Platforms, and Social Services

Upwork faces competition from a variety of sources including traditional staffing services, online freelance platforms, and online providers of professional services. These include Robert Half International (RHI), ManpowerGroup (MAN), Recruit (OTCPK: RCRRF) (OTCPK: RCRUY), Randstad (OTCPK: RANJF) (OTCPK: RANJY), The Adecco Group (OTC: AHEXF) (OTCPK: AHEXY), Fiverr, Freelancer.com, LinkedIn, GitHub, and Indeed.com.

Early Market Performance

The underwriters priced the IPO at $15 per share, above its expected price range of $12 to $14. The stock closed its first day at $21.18 for an increase of 41.2%. The stock reached a low of $16.01 on December 11. Share prices recovered to reach a high of $23.91 on February 27. Shares of UPWK have a 33.7% return from IPO.

Conclusion: UPWK an Attractive Short Ahead of IPO Expiration

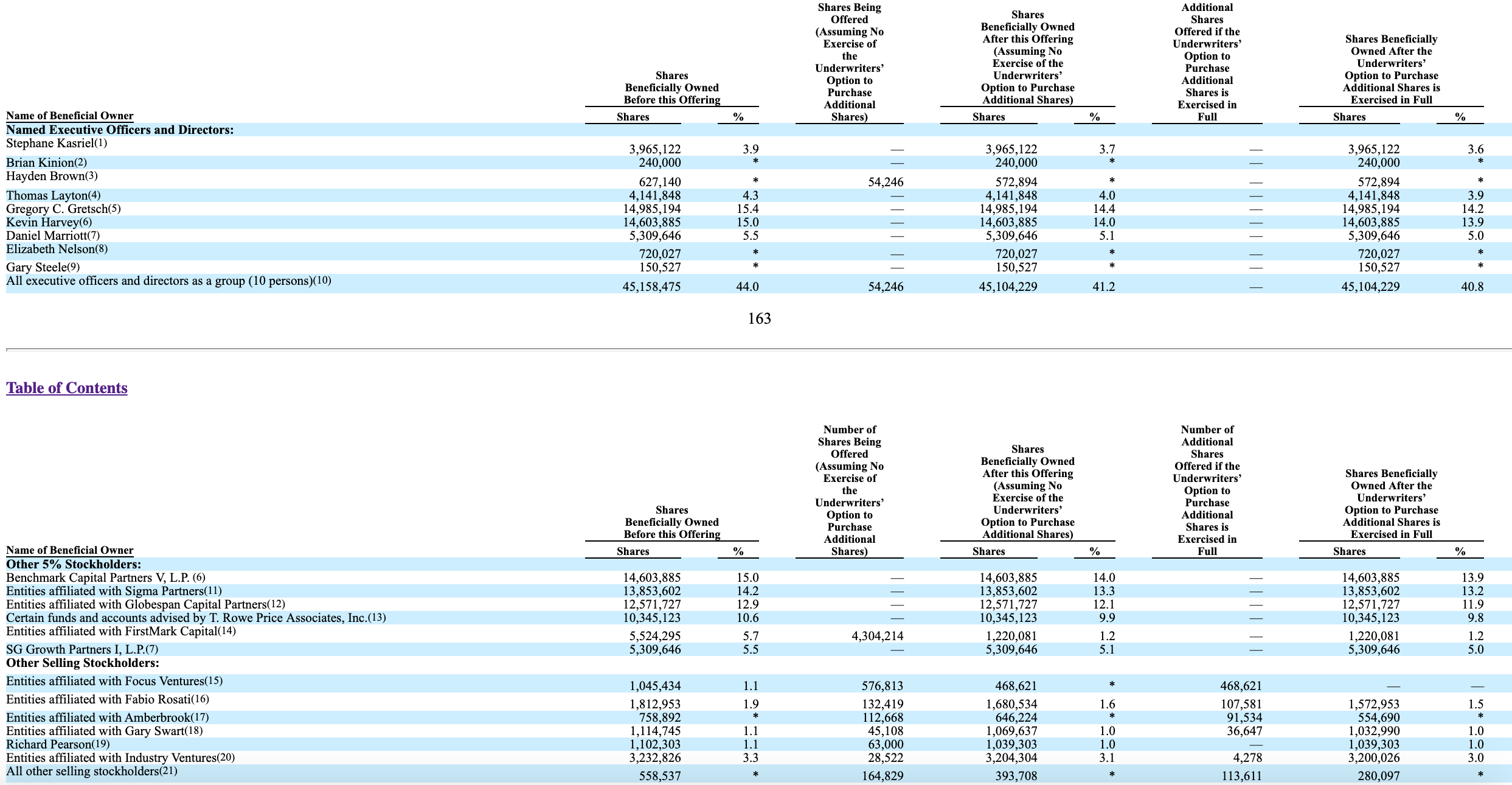

When the UPWK IPO lockup expires on April 1, pre-IPO shareholders and insiders will have the ability to sell more than 91 million shares of currently-restricted stock for the first time. This group of pre-IPO shareholders and company insiders includes numerous individuals and corporate entities.

(Click on image to enlarge)

(Source: S-1/A)

With just 12.3 million shares trading subject to the IPO, any significant sales of these 91 million restricted shares could flood the secondary market for UPWK and cause a sudden, sharp, downturn in share price.

Aggressive, risk-tolerant investors should consider shorting shares of UPWK ahead of the IPO lockup expiration on April 1. Interested investors should cover these short positions during the trading day on April 2.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more