Upbeat Australia Employment Report To Fuel AUD/USD Rate Recovery

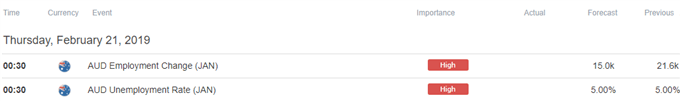

Updates to Australia’s Employment report may curb the AUD/USD pullback following the Federal Open Market Committee (FOMC) Minutes as the economy is expected to add another 15.0K jobs in January.

(Click on image to enlarge)

Signs of a more robust labor market may heighten the appeal of the Australian dollar as it boosts the outlook for growth and inflation, and the Reserve Bank of Australia (RBA) may have a difficult time defending the wait-and-see approach for monetary policy as ‘growth was expected to be a little above trend over the forecast period.’

In turn, a headline print of 15.0K or great may spark a bullish reaction in AUD/USD as it puts pressure on the RBA to lift the official cash rate (OCR) off of the record-low, but a dismal development may curb the recent appreciation in the Australian dollar as Governor Philip Lowe & Co. warn that there are‘significant uncertainties around the forecasts, with scenarios where an increase in the cash rate would be appropriate at some point and other scenarios where a decrease in the cash rate would be appropriate’.

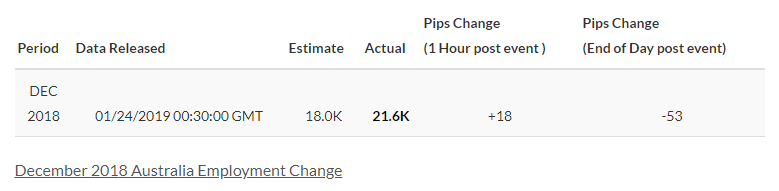

IMPACT THAT AUSTRALIA EMPLOYMENT REPORT HAD ON AUD/USD DURING THE LAST RELEASE

(Click on image to enlarge)

AUD/USD 5-Minute Chart

(Click on image to enlarge)

Fresh figures coming out of Australia showed the economy adding 21.6K jobs in December following a 39.0K expansion the month prior, while the Unemployment Rate unexpectedly narrowed to 5.0% from 5.1% during the same period as the Participation Rate slipped to 65.6% from 65.7% in November. A deeper look at the report showed part-time employment increasing 24.6K in December to lead the advance, while full-time positions slipped another 3.0K following a 7.3K contraction the month prior.

The Australian dollar nudged higher following the better-than-expected print, but the reaction was short-lived, with the aussie-dollar exchange rate slipping back below the 0.7100 handle to close the day at 0.7090.

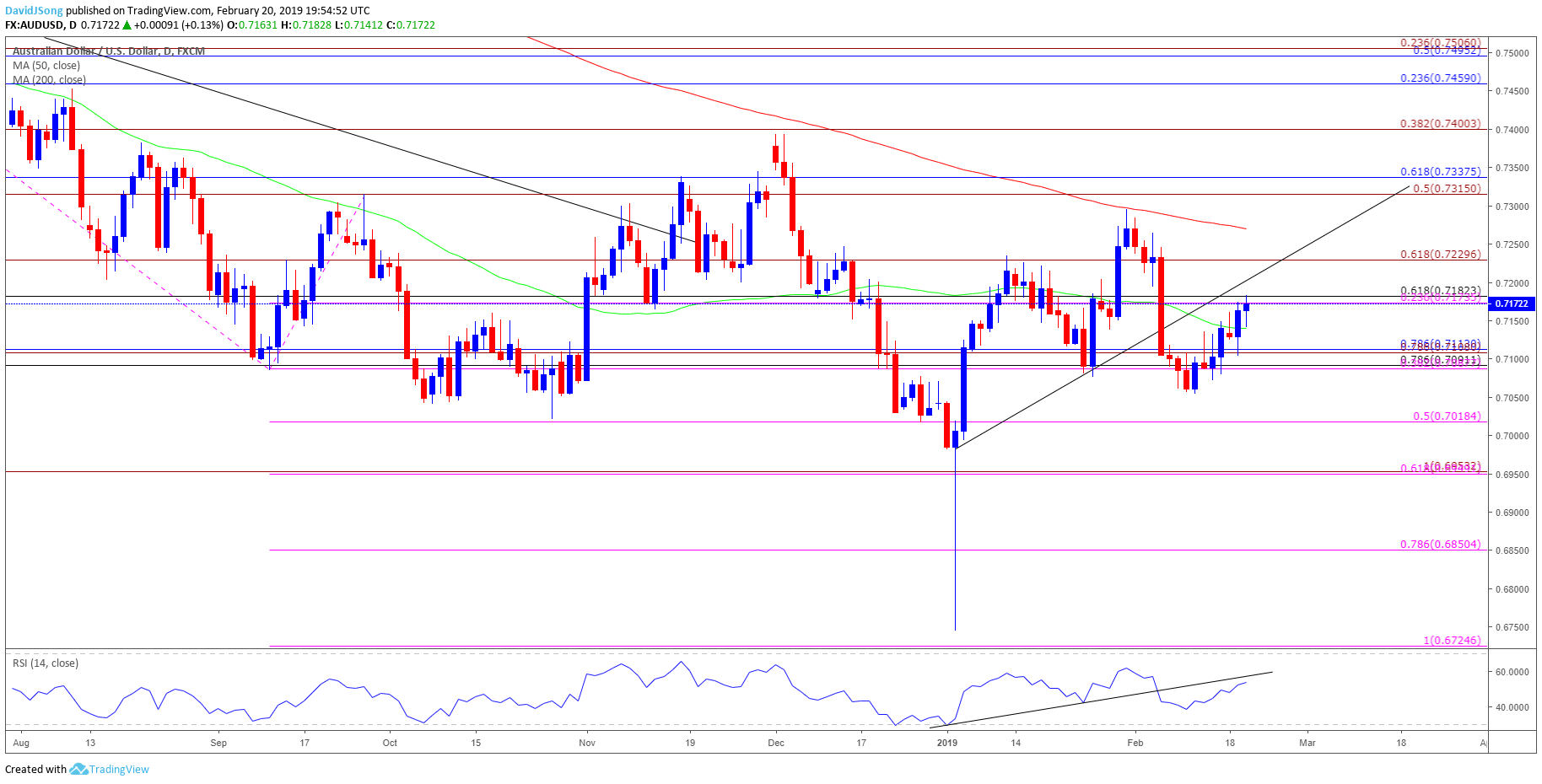

AUD/USD DAILY CHART

(Click on image to enlarge)

- Keep in mind, the broader outlook for AUD/USD remains tilted to the downside as the flash-crash rebound stalls at the 200-Day SMA (0.7276), with both price and the Relative Strength Index (RSI) failing to preserve the bullish formations from earlier this year.

- However, it seems as though AUD/USD will continue to hold above the psychologically important 0.7000 handle as it reverses course ahead of the 0.7020 (50% expansion) hurdle, with advance from the monthly-low (0.7054) bring the 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) region back on the radar.

- Need a break/close above the Fibonacci overlap to open up the 0.7230 (61.8% expansion) area, with the next region of interest coming in around 0.7320 (50% expansion) to 0.7340 (61.8% retracement).