Understanding The CFNAI Components - Tuesday, Dec. 25

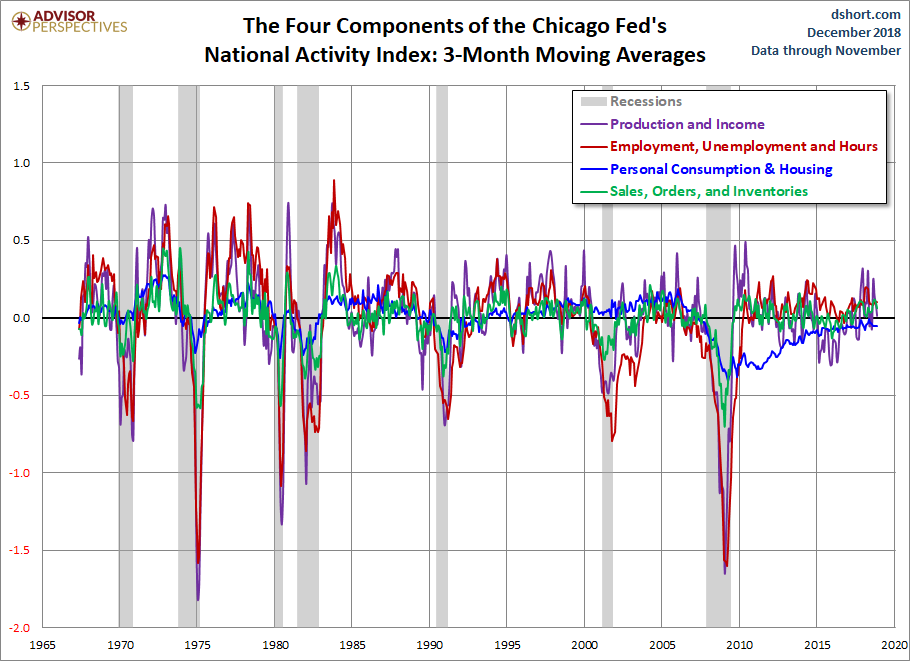

The Chicago Fed's National Activity Index, which we reported on this yesterday morning, is based on 85 economic indicators drawn from four broad categories of data:

- Production and Income

- Employment, Unemployment, and Hours

- Personal Consumption and Housing

- Sales, Orders, and Inventories

The complete list is available here in PDF format.

In the Chicago Fed update, we learned that "The CFNAI Diffusion Index, which is also a three-month moving average, decreased to +0.06 in November from +0.21 in October. Forty-eight of the 85 individual indicators made positive contributions to the CFNAI in November, while 37 made negative contributions. Forty-five indicators improved from October to November, while 37 indicators deteriorated and three were unchanged. Of the indicators that improved, 11 made negative contributions."

A chart overlay of the complete multi-decade span of all four categories, even if we use the three-month moving averages, is quite challenging for visual clarity:

So here is a close-up view since 2000:

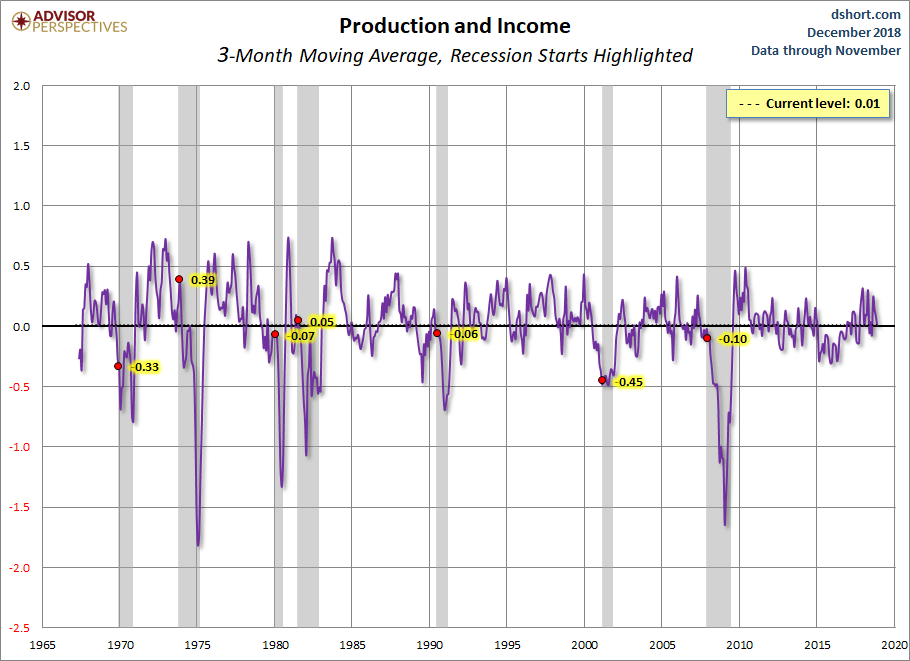

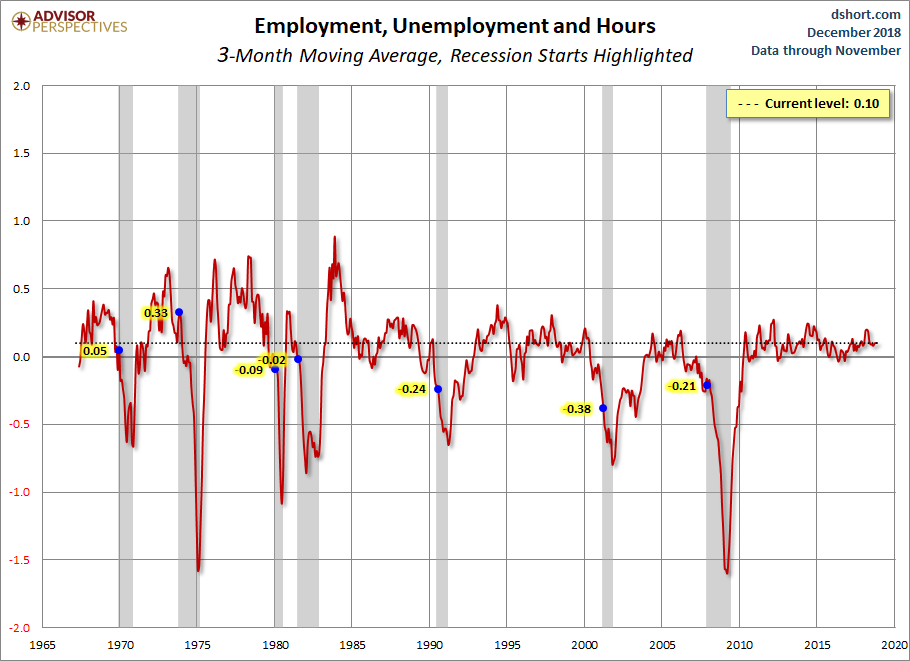

Here is a set of charts showing each of the four components since 1967. Because of the highly volatile nature of the data, the charts are based on three-month moving averages, a smoothing strategy favored by the Chicago Fed economists. The values for the months that the NBER subsequently identified as recession starts are also indicated.

To close this dissection of the CFNAI components, let's reassemble them for a closer look at their collective 3-month moving averages since 2007.

Check back next month for another close-up look at the latest trend directions.