Uncertainties Heighten Ahead Of Big Deadlines

If the political risks this week yield no progress and the economic sentiments diminish, Long USD/JPY?

Brexit, US Government funding and US-China trade deadlines ahead

This February will be a volatile week as multiple big deadlines are nearing. Investors are feeling more uneasy than they are relieved as the sentiments aren’t as optimistic as expected. Last week we saw risk aversion gaining momentum after risk currencies such as the Australian dollar and New Zealand dollar fell sharply due to poorer sentiments from central banks and labor data respectively.

Brexit

Prime Minister May will be delivering her speech on 13th February and no clear solution has yet emerged on how to break the deadlock. This is confirmed from a tweet from Donald Tusk, European Council President, which said “Still no breakthrough in sight” from his meeting with May on 7th February. The government will present a motion that would allow MPs greater control of the Brexit process if May does not present significant progress in Brexit this Wednesday.

US Government spending

The US government will be faced with another possible shutdown if a new funding bill isn’t passed before 15th February when the funding runs out. Trump previously demanded USD5.7 billion for a wall along the US-Mexico border which was rejected by the Democrats. So far, he has signaled optimism about the progress of congressional talks on border security last Thursday. Even though both sides seemed close to clinching a deal last Friday, significant gaps remain, and momentum appears to have slowed.

US-China trade talks

President Donald Trump previously declared that he had no plans to meet with Chinese President Xi Jinping before the 1st March deadline to achieve a trade deal which heightened fears that talks may fall through. Treasury Secretary Steven Mnuchin and Trade Negotiator Robert Lighthizer are headed to Beijing this week for another round of talks and CNBC reported last Friday that the March deadline could be postponed “via telephone”.

If talks were to fall through, US will proceed to increase tariffs from 10% to 25% on USD 200 billion worth of Chinese imports. This could hurt the already slowing growth of the global economy.

This week will also be an important week for the dollar as a string of data will be released ranging from CPI to retail sales. As Fed Chairman Powell has mentioned previously that further rate hikes this year will be heavily dependent on data, this means that stronger data this week could definitely push the dollar higher.

Our Picks

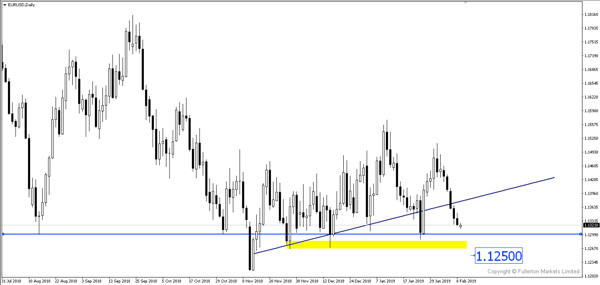

EUR/USD: Amidst weaker eurozone data and heightened uncertainties, this pair could fall below 1.300 towards 1.1250 this week.

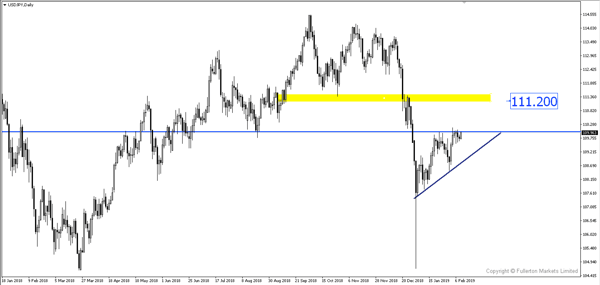

USD/JPY: This pair could break the 110.00 resistance easily and move higher towards 111.20 amidst heightened uncertainties.

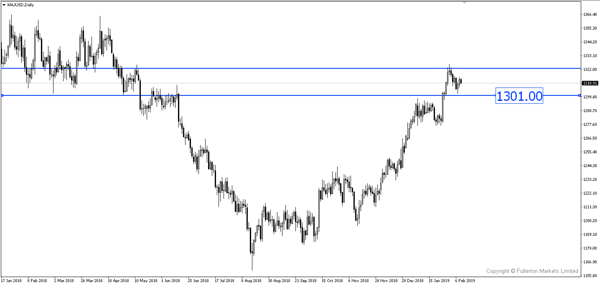

XAU/USD: This pair may fall towards 1301 due to technical retracements.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more