Two Leading Sectors Of The Economy - Manufacturing And Housing - Turn Even Hotter

Last month I wrote that both the manufacturing and housing sectors were “on fire.” If anything, this month they turned white-hot, with both construction spending and ISM manufacturing data at levels not seen in years.

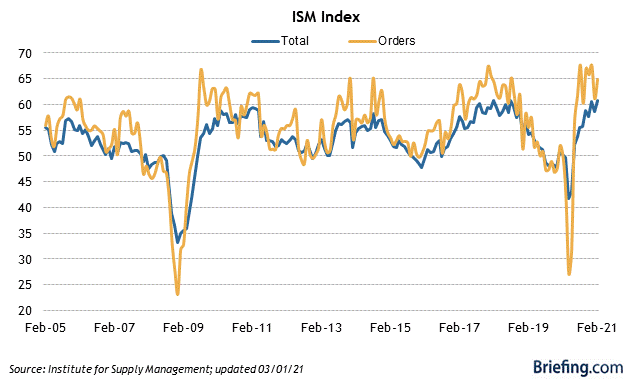

The overall ISM manufacturing reading rose from 58.7 to 60.8, tying the highest reading since the Great Recession, and indeed since 2004. The even more leading new orders subindex also rose from 61.1 to 64.8, not quite as high as readings earlier in autumn 2020:

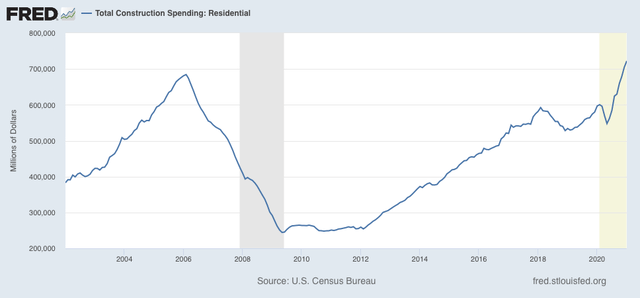

Turning to construction, in January spending for residential construction surged even further, up 2.5% for the month. This was the highest nominal reading ever:

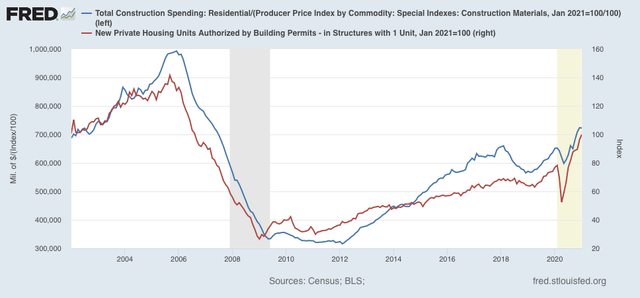

Taking into account inflation - deflating by the PPI for construction materials, which rose 2.7% for the month, in the graph below - residential construction spending (blue) declined -0.2%. Because permits have to be taken out before construction can begin, typically these lead construction spending (although in fairness that really hasn’t been true in the past 2 years). Below I show the less volatile single family permits (right scale):

This year, 2021, is likely going to be absolutely gangbusters for residential construction spending, which means lots more money flowing through the economy as a whole.

Simply put, this morning’s two reports together show that manufacturing and housing, the two most important leading sectors of the real economy, are if anything even hotter than before, and are likely to power very strong GDP gains as vaccinations (hopefully) case the pandemic strictures to give way.

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.