Tug Of War Across Markets Hides "Trade Of A Lifetime"

Another day, another set of market takes warning that the recent advent of helicopter money - which resulted in a mind-boggling $21 trillion in policy stimulus and roughly a quarter of global GDP in just the past six months - will lead to a 1970's style stagflation, runaway inflation, and - perhaps for some - the trade of a lifetime.

In his latest Bear Trap Report, author Larry McDonald writes that "the trade of a lifetime is found in a growing tug of war across markets." He is referring to the ongoing clash between inflation and deflation. As he adds, investors are focused on obvious deflation risk, "but the side effects of the $15 Trillion of fiscal and monetary spending globally are underappreciated" (it's really $21 trillion according to BofA).

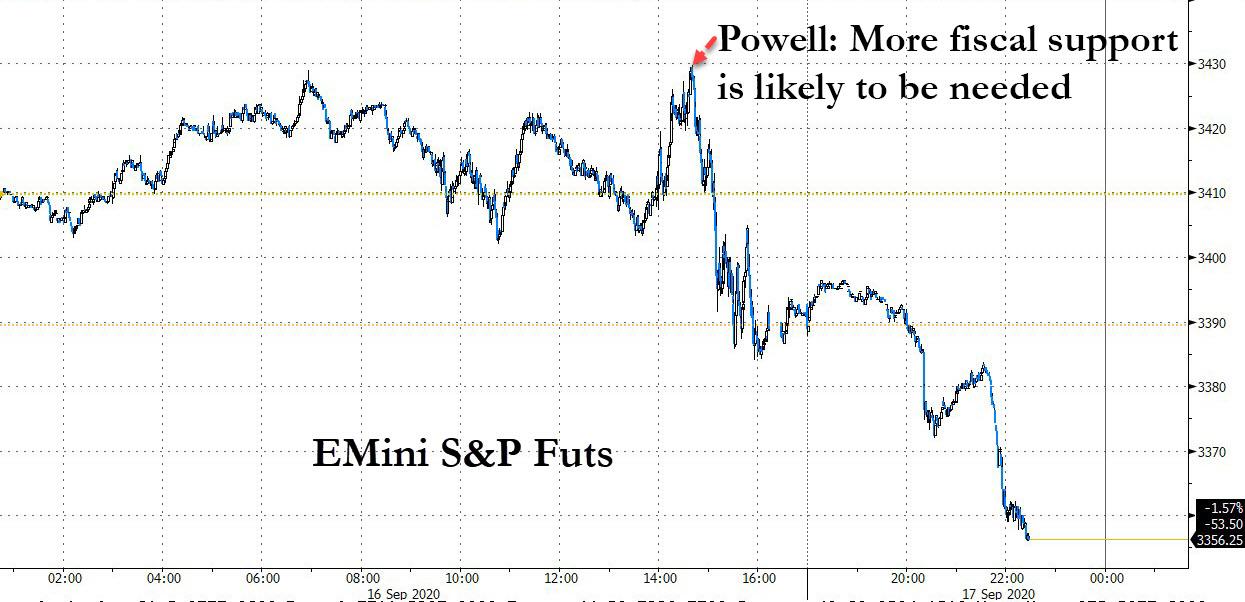

And while everybody knows the COVID-19 tragedy poses a significant deflation risk, in McDonalds' view, "the 'unexpected' we must be positioned for is trillions in fiscal stimulus oozing into the economy after this virus has been snuffed out." This is a topic we touched on last week, as we pointed out that Powell's clear invocation of more fiscal stimulus during the FOMC presser is what catalyzed the break in the market's upward momentum as tech names were furiously sold off.

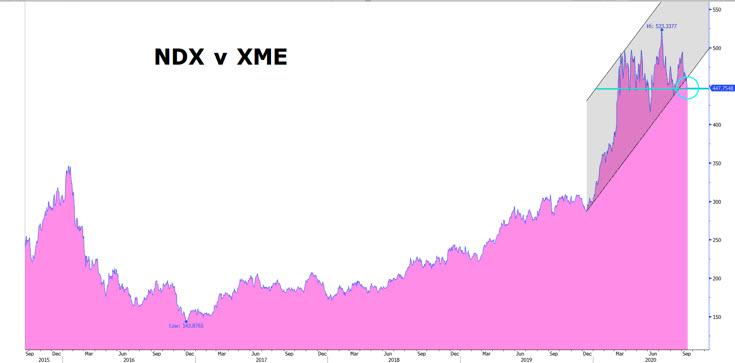

And while going into the FOMC reflation was largely "left for dead" as the sharp rebound in the QQQ's following the early September swoon showed, McDonald now sees last week's outperformance of the XME Metals & Materials ETF as the first heartbeat of a phoenix coming back to life, "the genesis of a significant leg higher."

Furthermore, he notes, "we don’t even need real inflation for commodities to shine looking forward. The consensus is so skewed to further deflation that even the slightest change in expectations will lead to meaningful outperformance from commodity-sensitive risk assets relative to the S&P 500."

There's more: Powell himself may be sending markets a message and not just in the Fed's sudden halt of corporate bond and ETF purchases in August. This is what McDonald said about the key message from last week's FOMC:

"We believe the most important takeaway from this week's FOMC meeting comes down to Chairman Powell feebly attempting to parse between QE and forward rates guidance. On Wednesday, the Fed gave 'powerful forward guidance' of zero rate hikes for as far as the eye can see, but was unable to provide any forward guidance on asset purchases - Powell refused to answer the question twice in the press conference. With conviction, we believe this is significant and the probability of a Nasdaq crash has risen meaningfully.

"In our view, Chair Powell is sending Congress and SoftBank a very clear message. The last thing the FOMC wants right now? To get back into a '2010-2016' like-situation where politicians keep piling all the heavy lifting on central banks. Now, that would be deflationary (Sequestration, Tea Party)! The second last thing the FOMC wants right now is excessive speculation in the Nasdaq - if it pops like the dot-com bubble, it would require even more help from the Fed. They want to let some air out of the balloon, without disrupting financial conditions on Main St."

And while the Fed also gave the doves what they wanted by indefinitely extending QE (which remains at a tune of $120 billion/monthly), the question that Powell refused to answer is what is the definition of indefinitely: three months? Twelve months? Three years?

"Not only did the Fed not answer the question, but Powell left the door open for less balance sheet accommodation. This, ladies and gentleman, is the sword thrust into the side of the beast that is the Nasdaq. A ferocious bull is wounded."

To be sure, the market is clearly starting to appreciate the growing double threat of a potential reflationary spillover from tens of trillions in stimulus and the Fed's "not so dovish" twist. Powell didn't offer investors certainty on the balance sheet expansion policy path, which according to Bear Traps "was a shot across the bow" and "the bottom line, for big tech to command today's lofty valuations, balance sheet expansion certainty is needed from the Fed."

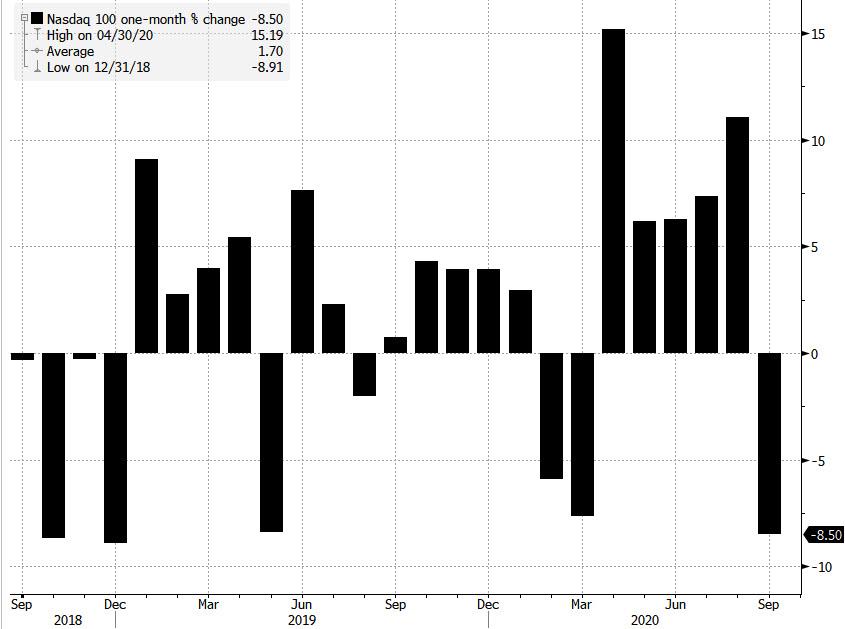

The result: the worst September for the Nasdaq since Q4 2018:

At this point, and likely true to its name, the Bear Traps report turns fatalistic, warning that "a lot of pain has been inflected, the bulls will try and buy the dips into quarter-end, September 30. We see a crash by October 10, sell every rally."

That may be a bit extreme, because the muscle memory of traders is still buzzing with the expectation that a market crash will merely prompt the Fed to go back to its monetary stimulus roots. As such, instead of selling, traders may well resume buying, having already priced in the necessary step of Fed intervention (which however requires another market crash). So the sequence of events, especially with Trump desperate to demonstrate a strong stock market into the election, is not quite so clear to us.

However, one thing that is clear is that the market remains solidly in the deflation camp, which in turn, reveals what the Bear Traps report contends is the story of the month, namely "the growth to value tremors have been revisiting with intensity, the 'quake' is coming."

This can be seen in the chart of Russell growth to value below.

The chart is zoomed in on where said tremors have seen the ratio peak at an all time high in early September, and then quickly reversing to three month lows in what may be the start of an epic mean reversion.

So is long Value/short Growth the trade of a lifetime?

According to McDonald, as long as the RLG Russel Growth vs. RLV Russell Value ratio stays under 1.85, "the long value trade is a home-run," as more and more investing legends - Druckenmiller, Einhorn, Melkman, Greenspan, Sherman/Gundlach, and co - publicly talk-up inflation risk:

"The natives are restless, real money asset managers are listening. Capital is starting to exit growth, nearly $1 trillion last ten days."

And the cherry on top: a Bridgewater implosion:

"In our view, the modern risk-parity model is about to collapse and is in store for a colossal face-lift (risk parity = long equities and extra-long bonds)."

Why? Because a "convexity climax" would mean that by the time we actually see inflation, it will be far too late to protect a bond portfolio.

"Today, an extra $70 trillion in fixed income globally sits with less than 1.0% in yield, this comes with a steep price. After a long decade of austerity, Brexit, trade wars, and COVID-19; bond investors have fallen into a deep sleep. Every extra dollar placed in this ocean of risk changes the formula. The market's reaction function will join us FAR before inflation actually appears. It's already happening today. Hence, the latest commodity bid, you don't see 35% one-month moves in Silver very often."

Without going into too much depth, there are countless underlying inflation drivers which both the Fed and Congress have already put in play.

"A shift from just in time global supply chain to increased domestic manufacture as a counterpoise to China's Belt and Road policy is a safe forecast. This will cause a huge demand for labor. The Phillips Curve won't remain flat under that scenario. The younger generations as a rule are sensitized to environmental concerns. As the USA and Europe become more green, associated costs will cause extra price pressure. In sum, inflation is a quite complex phenomenon, and thus is unlikely to have a simple, obvious cause. This explains why academia has failed to arrive at a nice, neat simple explanatory model for inflation.

"Right now we have massive money creation, massive fiscal stimulus, and strong social forces combining to create an inflation juggernaut. Stocks and bonds will both enter a secular bear market, debt as a percentage of GDP will continue to climb, nominal tax rates on the rich will increase, Central Banks will remain accommodative at least for the medium term, and money supply will continue to expand. Most important of all, wages will go higher. The risk-parity trade is dead. Over the next twelve months we will bury it and read its last rites."

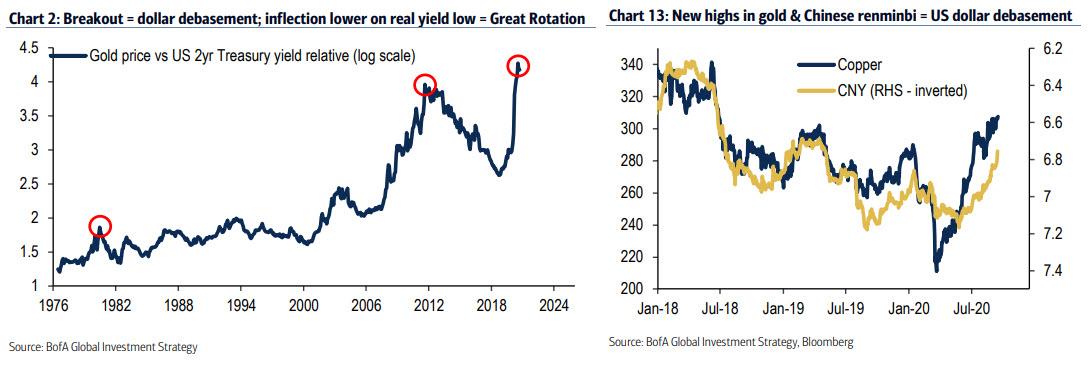

It's not just McDonald: another inflationary prediction comes from BofA CIO Michael Hartnett, who gives two reasons why inflation assets will outperform:

- Gold vs Treasuries at critical US/EU debt crises highs of 2011/2012 (Chart 2); new highs in gold & Chinese renminbi = US dollar debasement (Chart 13); lower gold & higher real yields (last trough was 2012) = Great Rotation; in both scenarios inflation assets would outperform.

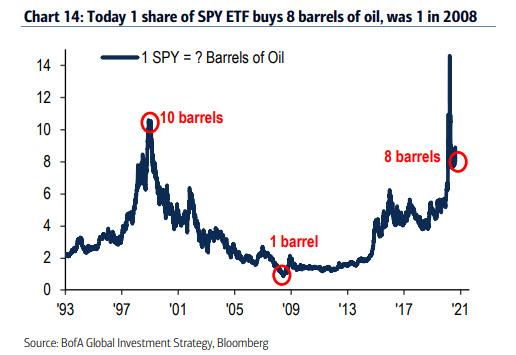

- Oil vs US stocks close to 90-year lows; today, 1 share of SPY ETF buys 8 barrels of oil, was just 1 barrel in 2008.

Finally, in evaluating a near-term trigger, McDonald notes that:

"As Congress delivers the next fiscal care package, hand in hand with a vaccine cocktail coming to market in the months ahead, it will be a reflation investors delight. These two engines will be the trade's rocket fuel, propelling the investment thesis from the early to 'middle innings.' Months from now, Powell may look very wise in not offering up 'certainty in balance sheet accommodation' ahead of Congress and Vaccines. He kept his powder dry."

But what if Congress fails to deliver this year as the constant bickering between Pelosi and McConnell strongly suggests? Well, then the deflation camp has another party, potentially resulting in a 10-20% drawdown. However, it is precisely that market stress that will force the classic policy response out of Capital Hill.

The conclusion: "This New Deal on steroids will have one anchor tenant as large scale infrastructure spending will join us early next year - next, commodities and value crush growth stocks in 2021."

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more