Tuesday Talk: Value Stocks And NFTs - Holy Oxymoron, Batman!

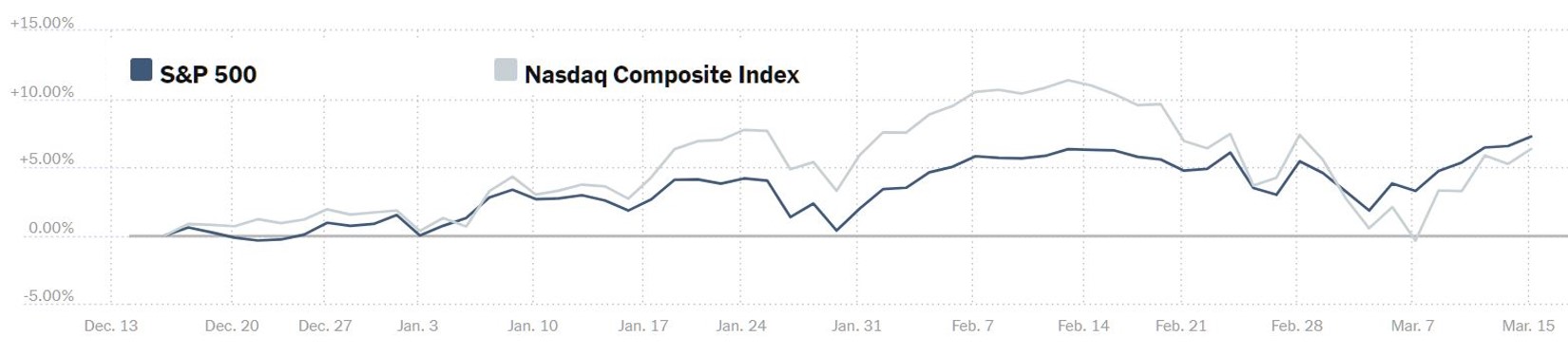

Value stocks and NFTs may not seem to go together, but they certainly are capturing a lot of headlines while the Nasdaq and Tech stocks seem to be emerging from "corrective" territory. On Monday, U.S. Markets ended on an upbeat note, the S&P 500 closed at 3,969, up .65%, the Dow Jones Industrial Average closed at 32,853, up .53% and the Nasdaq closed at 13,460, up 1.05%. Currently, market futures are trading light green. A look at the 3 month chart of the S&P and Nasdaq indices shows that the markets are continuing to trend higher, but did undergo something of a correction in the last month.

Chart Source: The New York Times

TalkMarkets contributor Alex Barrow in a TM Editor's Choice column entitled, Value Will Continue To Outperform? runs through the charts noting that value stocks have considerable upside potential in what he considers to be a strong bull market.

"I believe the recent outperformance of value over growth is just the start of a cyclical trend, and there’s plenty of long runway for this to continue to play out."

Below are a couple of the value and bull sentiment charts he includes in his article.

“The EPS recovery is in 2021 should be the fastest since 2010, and it’s driven by Value. Our Growth index’s EPS is 15% above trend-line, while Value is 38% below.”

"The Bull & Bear Indicator remains elevated but still below an official sell signal."

Barrow has several other good snapshots of where he thinks the markets are right now, including this quip about General Motors (GM). "A massive false bear trap — allowing some whale(s) to accumulate a large position — followed by a face-ripping rally... But, in all honesty, I’d be interested in maybe playing this on a pullback."

Bitcoin (BITCOMP) continues on its speculative run upwards at a rate that would cause even the brightest and most colorful tulip to blush and wilt. Maithya Kitonyi writing in an exclusive piece for TalkMarkets, Is Bitcoin Pullback An Opportunity To Buy? looks at what this means for investors. Here are some of his thoughts:

"The price of bitcoin has pulled back to trade at around $56,000 after hitting a new historical high of more than $61,900. The pioneer cryptocurrency has demonstrated over the last few months its undoubted potential despite still facing a cloud of pessimism from anti-crypto investors.

However, crypto enthusiasts will be looking at the current pullback as an opportunity to buy bitcoin before the next bull-run begins. Nonetheless, the volatility exhibited by the BTC/USD alongside other cryptocurrencies suggests that there could more options to profit from bitcoin in 2021."

Kitonyi suggests the following three routes for investing in bitcoin. None are without specific risks, so be sure to read through the article and investigate further before putting your money on the table.

1. Trade BTC/USD Volatility - "Trading bitcoin may be a more viable option for traders looking to benefit in the short term. The BTC/USD has experienced highly volatile trading sessions, which means that there are opportunities to benefit from both sides of the trade."

2. Buy BTC Crypto Funds - "Another way would be to invest via crypto funds. Here a few stand out based on the performance over the last few months. The 21Shares Bitcoin ETP is up more than 178% over the last three months while counterparts HANetf BTCetc Bitcoin Exchange Traded Crypto and VanEck Vectors Bitcoin ETN have gained 181% and 171%, respectively over the same period."

3. Just buy and hold - "The other alternative would be to buy and hold the world’s most popular cryptocurrency. Some analysts have suggested that bitcoin could easily surge to trade at around $300k within the next eight months. If you can withstand the short-term volatility, then HODLing (buy and hold) would be an ideal strategy to profit from bitcoin."

Whatever you do be careful!

And if bitcoin is not speculative enough for you Shivdeep Dhaliwal updates us regarding the latest in NFT tradable assets in NFT Sneakers That Don't Yet Exist Fetched $3.1M In Just Seven Minutes. Hold on to your "PF Flyers" Robin we're in for quite a ride.

"The non-fungible token craze has now extended to sneakers with hundreds of pairs getting sold as digitalized NFT for over $3 million in a span of seven minutes. All in all, tokens representing 608 pairs were minted, which netted the sellers $3.08 million. RTFKT said Monday owners of the NFT token sneakers would be able to redeem a physical pair in their size for 48 hours beginning April 10. Some Fewocious NFT shoes are already trading for double their launch price and with each resale, Rtfkt receives a cut. The resale proceeds increase the appeal of NFTs as it allows creators to earn on their creation ceaselessly."

Value vs NFTs? Can you repeat the question? ![]()

![]()

![]()

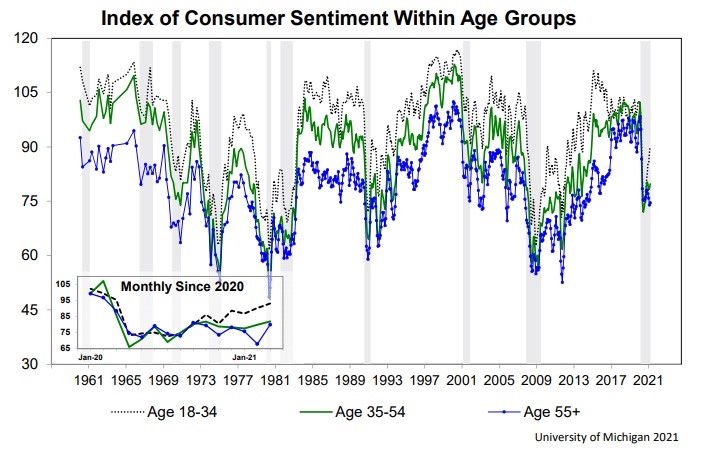

In their piece Stock Market Cycles & Upcoming Decade the Staff at Upfina take a stab at the intersections between the markets, economic recovery and consumer sentiment, as well as what the spike in treasury bond yields may or may not signal.

1. Consumer Sentiment - Here are some notes from the University of Michigan preliminary March sentiment index. "The overall index rose from 76.8 to 83. That was caused by a 6.8 rise in the expectations index which got to 77.5. Somehow expectations are still 2.2 points lower than last year. We are confident the next six months will be better than the six months following the March 2020 sentiment report...The current conditions index rose from 86.2 to 91.5. The largest monthly gains were from those in the bottom third of income and those 55 years and older. It’s no surprise those in the bottom income group are more confident given the spike in job creation in the leisure and hospitality industry. The March jobs report should be very strong. The increase in confidence from older people is coming from them catching up to younger folks and because most have been vaccinated." Below is the current sentiment index chart:

2. Spending is Perking Up - "As of the week of March 8th, card spending growth was -7.9% relative to the pre-pandemic trend. That’s one of the highest readings since the pandemic started...Every single economic print will show strong yearly growth from March. Yearly retail sales growth is going to be insane in March because of the stimulus and the weak comp."

3. Will Something Break? - "The 10 year yield has been rising quickly. Some investors are shocked by this, but they shouldn’t be. We had one of the fastest recoveries in the stock market ever...Many investors are waiting for something to ‘break’ because such a rise is usually indicative of a major shift. The most obvious candidate of something breaking is high multiple tech stocks. Any expensive stock is at risk of weakness...The economy isn’t breaking; it is healing. It’s a positive to see the yield rise because it means the vaccination process is going smoothly."

4. This Is New - "The rise in the 10 year yield has caused the Nasdaq to underperform the S&P 500. This sounds like an obvious relative performance because speculative growth stocks don’t like rising rates...The 10 year yield is wreaking havoc on growth stocks compared to the rest of the market. It hasn’t been as dramatic as it can be because the overall market has been rising. This trend could get ugly in a correction. The stock market moves in cycles. On a multi-month timeframe, we are closer to the end than the beginning of the current bull market given the yet to be seen change in macro, high valuations and the historic retail investor participation. "

Whew, that's enough to chew on without even reading the whole article.

What better way to round out this week's column than with some musings from Charlie Munger which Ingrid Hendershot covers for us in her TalkMarkets exclusive Munger Musings. Here are some of the things Munger has to say about life and current market events:

Regarding SPACs - "It’s just that the investment banking profession will sell sh** as long as sh** can be sold...I think this kind of crazy speculation in enterprises not even found or picked out yet is a sign of an irritating bubble. I think it must end badly, but I don't know when."

About Robinhood - "If you're selling them gambling services where you rake profits off the top like many of these new brokers who specialize in luring the gamblers in, I think it's a dirty way to make money. And I think that we're crazy to allow it."

On Bitcoin - "Bitcoin is really a kind of artificial substitute for gold. Since I never buy gold, I never buy any bitcoin, and I recommend other people follow my practice.” Bitcoin, Munger said, reminded him of an old Oscar Wilde quote about fox hunting: “the pursuit of the uneatable by the unspeakable.”

Defining Value Investing - "Value investing — the way I conceive it — is always wanting to get more value than you pay for when you buy a stock, and that approach will never go out of style. I think all good investing is value investing."

How to live a Happy Life - "The first rule is to set low expectations. That’s one you can easily arrange. If you have unrealistic expectations, you’re going to be miserable all your life."

Have a good week.

Actually, the secret to being sort of "rich" is to always need less than you have. That is the way to do well in the monetary aspects but it will not in any stretch assure happiness, except as far as the money goes. BUT there is more to life than money, folks. Trust me on that one.