Tuesday Talk: The Old Slide And Glide

On Monday both the yields for 10 year and 30 year US Treasuries slid slightly from last week's highs. Tech stocks responded by gliding higher. The S&P 500 closed yesterday at 3,941, up 0.7% and edging ever closer to 4,000. The Dow closed at 32,731, up 0.32% while the Nasdaq closed at 13,378, up a whopping 1.23%. Currently, futures for all three indices are trading slightly in the red.

The Fed has stated loud and clear that it is not going to raise rates, but the markets are skeptical. In their article Most Had A Financially Good 2020?, the Staff at TalkMarkets contributor Upfina takes a look at this phenomenon as well as the effects of the 2020 stimulus programs on the economy thus far.

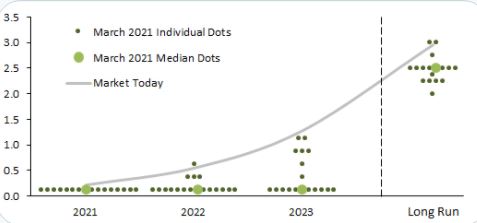

"We suggested the market might come to understand the Fed’s new average inflation targeting policy following its March meeting. However, that hasn’t fully happened yet. The Fed’s raised GDP and inflation outlook didn’t change its zero percent interest rate policy. It still doesn’t expect to hike rates through 2023. As you can see from the chart below, the market is still expecting more rate hikes than the Fed is guiding for. If the market was an FOMC member, it would be the most hawkish member.

Even the market’s long-run rate is higher than the Fed’s midpoint. It might take longer for the market to realize that the Fed isn’t going to hike anytime soon. Many traders believe the Fed will be forced to hike by the market. That generally doesn’t happen. The market can force the Fed to cut rates by cratering, but it can’t force the Fed to hike rates. The only thing that can force the Fed to hike is spiking inflation."

And on the effect of stimulus programs...

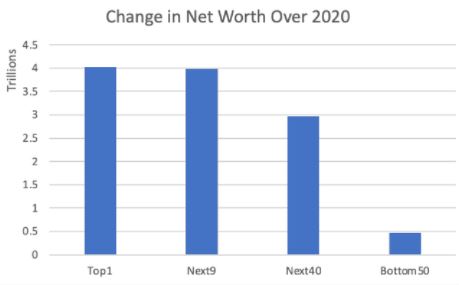

"If someone would have told you 2 years ago that in 2020 there would be a pandemic catalyzed recession, yet everyone’s net worth would rise, you wouldn’t have believed them. The scale of the fiscal and monetary stimulus following the pandemic is unparalleled in the past few decades. Wealth was transferred to Americans at the expense of the government and the Fed.

As you can see from the chart below, the top 1% of net worth gained $4 trillion last year. The bottom 50% gained $470 billion. The top 1% benefited from the roaring housing and stock markets. Almost every asset has done well since March 2020. The bottom 50% was helped by the transfer payments."

But here's the kicker as Upfina sees it...

"Back in the last expansion, we discussed how the bottom 50% didn’t own stocks. That changed in 2020, but it might not have been a good shift. New investors bought risky stocks, treating the market like a casino. Of course, the term risky is subjective. However, most sober minds believe thousands of percent gains in unprofitable businesses with no catalysts are probably not sustainable. Many new gamblers will retort that they know it’s not sustainable. However, the crowd always gets hurt when bubbles implode. This will be a net negative for the bottom 50% when the euphoria dies down."

TalkMarkets contributor Jeffrey Snider is concerned about sentiment forecasting vs actual conditions on the ground which are topics he covers and charts in his article Being Unsentimental About Economic Meteorology.

"The Federal Reserve's Chicago branch is piling on the downside. According to its National Activity Index, national activity in February 2021 might’ve been decidedly awful. How bad? A huge miss, down at -1.09. Even considering the cold spell in Texas, and its ice-cold electrical spillovers, analysts were still thinking the headline might only dip moderately from January’s rather hot “stimulus” overheated +0.75.

After all, -1.09 is in rare territory which is why it has our attention at the moment; going back to the beginning of the index, apart from January 1978 you don’t see anything below -1 outside of recession.

Of course, the US and the rest of the global economy is already in one, so it might seem like splitting hairs."

Snider follows-up on this comment by showing us German and Japanese sentiment charts showing that those economies are on the verge of taking off. But are they and is ours?

"Even in Japan, sentiment right now is severely outpacing that situation. While nowhere near as over-hyped as they are in German finance, Japan’s “leading” sentiment index has at least rebounded substantially. Very much like Germany, the same survey panel’s assessment of the current Japanese situation remains very different from indicated forward optimism; and that difference is growing...Right now in 2021 is when that faith is supposed to be paying off, not in the next set of forward-looking distant hopes...Sentiment is great for DSGE models and media stories, but it hasn’t kept the economy warm enough when it’s really been needed."

So what about that old saw "What's good for General Motors (it's rising stock price) is good for America?"

In a TalkMarkets exclusive contributor Arthur Donner takes a look at the post-pandemic economy and doesn't like everything he sees. In Serious Structural Problems Will Remain Even After The US Economy Recovers From The Pandemic Donner notes, "The US economy was experiencing major structural challenges even before the pandemic began, but of course, the unique nature of the supply side pandemic recession has made matters much worse."

Here are some of his additional observations:

"Shrinking Labor Force Participation Is A Major Structural Problem For The US Economy

Recently the labor force participation rate in the US edged down to 61.4% in January 2021 from 61.5% in the previous month. More tellingly, the latest labor force participation rate was more than 1.9 percentage points below its February 2020 level. In other words, about five million Americans have dropped out of the labor force because of the pandemic recession.

The service industries which have been ravaged in the pandemic (e.g., hospitality, travel, etc.,) will find it exceedingly difficult to recover compared to the goods-producing sectors of the economy.

There will be an increase in government interest payments as a % of GDP. This could result in a greater burden on future tax revenues. As well, there is always the risk that the reluctance of markets to buy government debt will cause rising bond yields."

And most problematic for the future, Donner says, "the serious inequality issue in the US will likely become worse with rising income polarization making it more difficult for young Americans to realize their economic dreams."

In Existing-Home Sales Down 7% In February, contributor Jill Mislinski pulls out the latest charts and looks at the figures.

"This morning's release of the February Existing-Home Sales showed that sales fell to a seasonally adjusted annual rate of 6.22 million units from the previous month's revised 6.66 million. The Investing.com consensus was for 6.50 million. The latest number represents a 7.0% decrease from the previous month."

So is this bad news? After a red hot year in the U.S. housing market one shouldn't race to make hasty conclusions. Mislinski includes this quote from Lawrence Yun, the National Association of Realtor’s chief economist: "Despite the drop in home sales for February – which I would attribute to historically-low inventory – the market is still outperforming pre-pandemic levels."

The chart below of median prices for single family homes over the last year would seem to bear this out.

TalkMarkets contibutor David Vomund closes out today's round-up by Looking Back at where we were just one year ago.

"A year ago the market plunged 34 percent in just 23 trading days as one-third of investors hit the panic button and sold. While some had second thoughts and repurchased stocks, others didn’t. Emotions ran high...The worst-case was priced into stocks last year until the bottom in March, then investors began to change...Investors anticipated the vaccines and pent-up demand that we are now experiencing. Stocks rallied … a lot...When something is in everyone’s best interest and there is no constituency for failure you should always count on a better-than-expected outcome."

Well, we've got vaccines and plenty of market sentiment as noted above, but I think these below words from Vomund are good for all of us to keep in our caps as we glide along.

"It is constructive to look back and remember your emotions from a year ago when the outlook was so bleak. What investment decisions are you proud of and which do you regret? It is important to reflect on that because there will be more panic selling in our future. And you’ll be able to say, “This isn’t my first rodeo.”"

Have a good week.

Well written and informative, and interesting beside. And it is becoming more and more obvious that the federal reserve is either a bunch of doddering old fools or a team of arch- villians bent on destruction to benefit their "friends" in that top 1%, knowing exactly what damage they are causing.

And the worst part is that the course is set and any rescue is unlikely, since Superman has left the area.

Thank you for the comments. As for Superman, can't hurt to keep an eye on the sky...

One more thought is that it is not that"bottom 50% that are now investing, but mostly that middle 50%. The bottom quarter of the population still does not have enough to be able to invest. The lucky one have upgraded from "Broke" to Poor.