Tuesday Talk: Of Stocks And Dollars

While the nation teeters between relief and anxiety, the stock market, teetering too, seems (at this point) to be determined to look through to (and beyond) January 21. While the markets posted new highs on Friday, Monday the S&P 500 closed at 3,799, down 25 pts, the Dow closed at 31,009, down 89 pts and the Nasdaq 100 closed at 12,897 down 208 pts. Currently futures for all 3 indices are green.

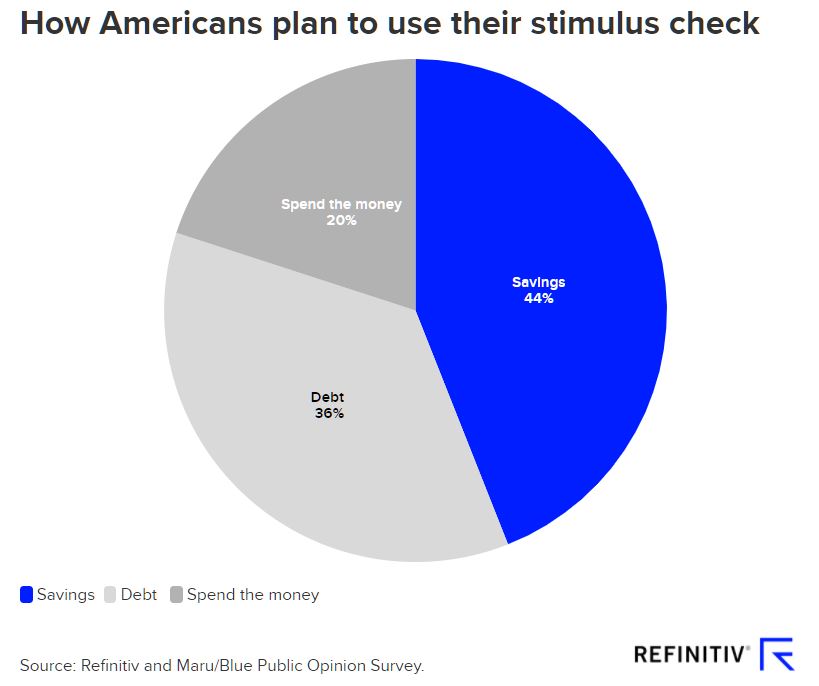

Talk Markets contributor Jharonne Martis in COVID-19 Stimulus Payments Inspire Saving Over Spending, says, perhaps out of anxiety, many Americans are planning to add the next round of COVID relief checks to their savings.

"The (stimulus) program was intended to fuel economic activity by consumers. However, a large proportion of Americans are telling us that they will be saving their stimulus checks instead, followed by paying off debt. Therefore, they are not directly putting the money back into the economy. The survey shows that one in five Americans intends to spend their stimulus check... There are more than 10 million Americans unemployed and they are most likely to spend their stimulus checks on basic living expenses."

With regards to market activity Declan Fallon, in Minor Losses Keep Markets Near Highs takes a look at the major charts and says that "Losses were not unexpected and trading volume was light."

Assessing Monday's activity on the Nasdaq (QQQ), he says: "Nasdaq was one of the worst-hit on the day, but the mini push to a new swing high is still intact; the 20-day MA is the support level to watch."

Regarding the S&P 500: "The S&P lost less than 1% as it too came back off its high. The rising trendline is the support level here. Technicals are all net positive. This is a hold if you have the SPY ETF (SPY). "

Wrapping up with a look at the Russell 2000 (IWM) Fallon notes: "The Russell 2000 registered a very small loss as it retains its leadership role in the market. As with the S&P and Nasdaq, we can look to the 20-day MA for support. Technicals are all net positive."

Here is the chart for the Russell 2000:

Following up on that optimism, Harvi Sadhra in a TalkMarkets exclusive, considers some sure and steady picks as 2021 spreads out in front of us. In 3 Stocks To Buy In Case Of A Market Crash In 2021, Sadhra suggests that Amazon, Costco and AT&T will take investors through thick and thin in the coming year.

"Amazon (AMZN):

Amazon stock is trading at $3,160 levels currently but don’t let the high stock price throw you off. The e-commerce behemoth is on its way to becoming even bigger in 2021. It has benefited a lot from the pandemic and, according to reports, will end 2020 with 410 million sq feet of fulfillment centers, up 80% from 2019...Analysts have given the stock a target of $3,819, an upside of almost 20% from current levels. This stock is an easy buy in a bad market. If the stock price is too much for you to invest at one shot, you could consider going in for fractional ownership.

Costco Wholesale Corporation (COST):

Costco is a company that has stood the test of time. It is an all-weather stock...Costco hasn’t let the pandemic let it get lazy. It leaned into its e-commerce business and increased revenues by 62.5% in December 2020 compared to December 2019 and by 75.2% for a year-on-year comparison for an 18-week period. The stock trades at $368 right now and analysts have given it a target of $400.

AT&T (T):

AT&T is a dividend investor’s dream stock. The stock trades at $30 and has a forward yield of 6.95%. The company has tons of cash to distribute to its investors and doesn’t hesitate to do so. AT&T stock is a good addition to a portfolio that wants passive income. The management has laid out a plan for continued dividend payouts and the company is confident that it can continue to generate similar levels of free cash flow."

Read the full article for more details. As always "caveat emptor".

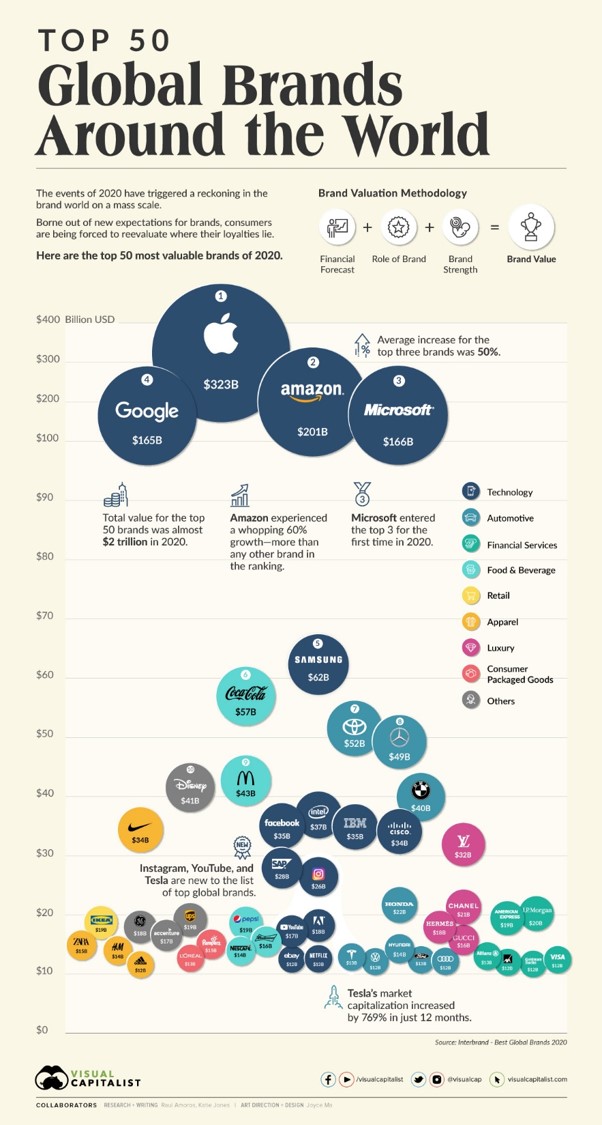

TalkMarkets contributor Katie Jones assesses which brands came out on top globally at the end of 2020 in her visualization graphic and article, The Top 50 Most Valuable Global Brands.

"For many brands, it has been a devastating year to say the least. Over half of the most valuable global brands have experienced a decline in brand value, a measure that takes financial projections, brand roles in purchase decisions, and strengths against competitors into consideration. But where some have faltered, others have asserted their dominance and stepped up for their customers like never before."

If you think this is just a name (and logo) game you are wrong. Jones notes:

"It is clear that brands that went above and beyond during the COVID-19 pandemic not only benefit from more meaningful connections with their customers; it also pays financially—with brand value for all 100 companies included in the study totaling $2 trillion."

I have pasted the top 10 brands below. See the article for the list of the entire 100.

The US dollar had been seen as weakening but now seems to be trending stronger. Time for a look from a couple of our contributors.

Kathy Lien notes that Dollar Rally Gains Momentum In New Trading Week and explains some of the reasons for same:

"Despite the first month of job losses in April, the uptick in manufacturing and service sector activity combined with the jump in wages last month renewed demand for US dollars. Vaccine optimism is going a long way in shielding the economy from a winter downturn. Treasury yields are moving upwards with 10-year rates rising to their highest level since March. All of this tells us investors are starting to believe that the central bank is overly dovish and the economy will recover faster. In fact, Federal Reserve President Bostic said the central bank is not locked into a paradigm and could change their outlook. It's far too early to predict a change of course but when there is a recovery, the US will enjoy one of the strongest...The dollar had also become grossly oversold as stocks extended to record highs. "

Yohay Elam writing in EUR/USD: Another Dead Cat Bounce? The Fed Is Tolerating The Return Of King Dollar makes the following observations regarding the greenback's recent behavior:

"“Never believe anything until it is officially denied” – this quote, attributed to Otto von Bismarck and others is relevant to how the Federal Reserve is pushing the dollar higher.

Officials at the world’s most powerful central bank are denying the need to taper bond buys in 2021. However, they are contemplating printing fewer dollars – and not mentioning adding new ones. Moreover, the Fed seems to tolerate the increase in long-term interest rates as reflected by higher Treasury yields – the key upside dollar driver.

Why is the Fed allowing returns to rise? Like Wall Street investors, it is seeing through the current hardship and into the post-pandemic world.

Raphael Bostic, President of the Atlanta branch of the Federal Reserve, and Robert Kaplan, his colleagues from the Dallas Fed, both mulled a future reduction to the bank’s Quantitative Easing program on Monday.

President-elect Joe Biden will introduce his economic plans on Thursday. The prospects of some $3 trillion in fresh funds for the economy raises the economic outlooks and lessens the case for more monetary stimulus.

Overall, there is room for the dollar to resume its gains – at least until the Fed has a change of heart, which is unlikely while stock markets do not crash."

Alfred E. Neuman aside, there is much reason for consternation and worry in the week and days ahead. In the fall of 1932, as America was rolling out "The New Deal", President Franklin D. Roosevelt had these words for the nation:

Have a good week.