Tuesday Talk: How're You Doing Neighbor, Eh?

The Canadian economy is starting to get into post-pandemic gear. Consumer prices have been rising and people have been returning to work. The government hopes the increased pace of vaccinations will halt the effects of the third COVID-19 wave currently hitting Canada. As of last week 24% of the population had been vaccinated. Still there are caution lights flashing, suggesting a bumpy ride back to recovery may be in store.

TalkMarkets contributor Alex Sakharov writing in Canadian Retail Sales On Wednesday May Be The First Wake-Up Call is concerned that many of the current rebound statistics being reported are due to an ease in COVID restrictions and increase in economic activity in March before the current third pandemic wave hit the country. In the article Sakharov reports on several mixed signals which could stymie a Canadian recovery:

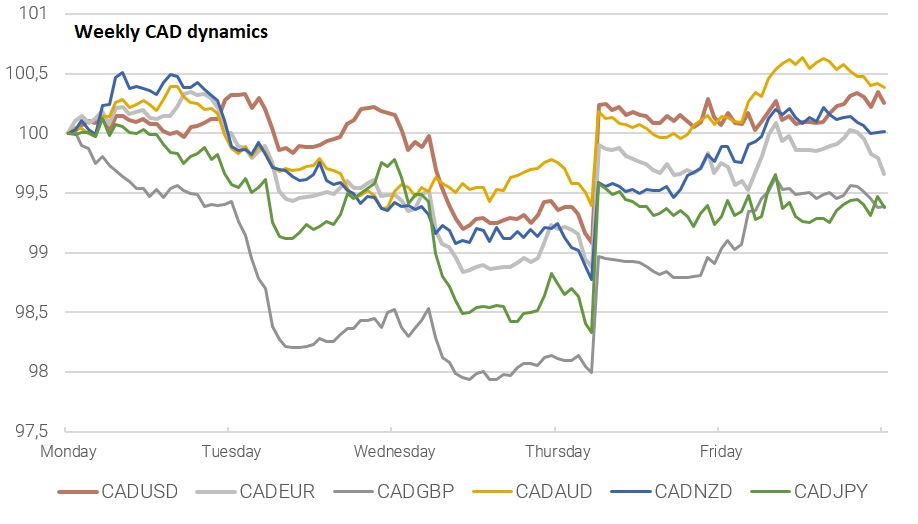

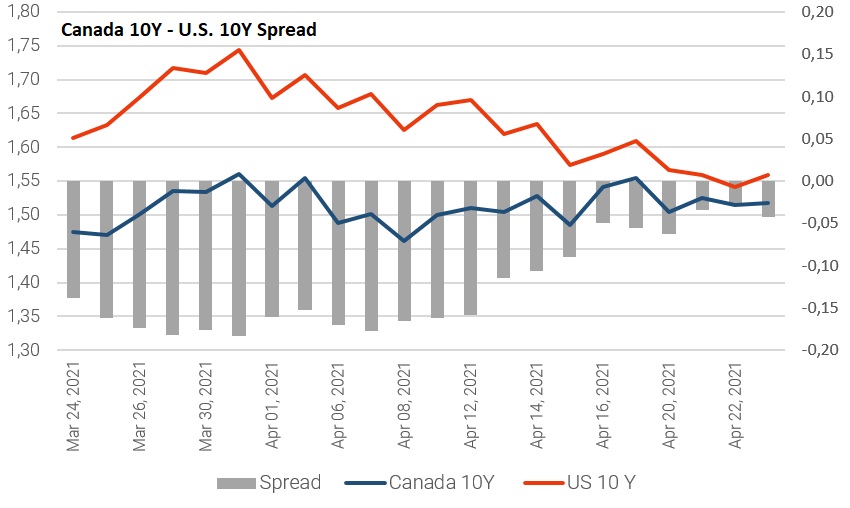

"The Bank of Canada signaled about hike rates possibility earlier than expected and decided to adjust the (bond buying) program to a target of $3 billion weekly net purchases of Government of Canada bonds, which means a 25% cut. Following the Bank of Canada decision, CAD strengthened against major currencies." (FXC)

"This decision affected the bond market first, causing a slight increase in the 10Y bond yield to 1.559%. This growth was short-lived, and the yield stabilized over the following days at 1.520%. The bond purchase program cutback implies a gradual rise in yields. In the future, it may lead to the spread between 10-year Canadian and U.S. bonds above zero."

"If retail sales data on Wednesday, April 28 are worse than forecasted, it will be a first wake-up call. ADP Nonfarm Employment change data in mid-May will show how the business responded to the pandemic third wave. If retail sales rise over 4.0%, then the Canadian dollar is likely to rise against the GBP, EUR, and JPY."

In a TalkMarkets exclusive Canada’s Jobs Recovery From The Pandemic Downturn Is Very Different From Past Recessions contributor Arthur Donner discusses the effects of "The see-saw pattern of Canada’s economic response to the pandemic has also been reflected in an uneven pattern of the job’s recovery."

"For example, in March Canada recorded a huge 303,000 rebound in employment and a decline in the unemployment rate to 7.5% from the previous month’s 8.2% level. Most of the jobs gained in March were in the hard-hit service-producing industries. In particular, the retail sector fully recovered its hefty January losses with employment increasing 95,000 in March. As well, the information, culture, and recreation services industry added 62,000 jobs in March, representing the first monthly increase since September 2020. Canada’s labor force participation rate has nearly returned to its pre-crisis level."

"Nonetheless, we are still facing an immediately darker period ahead. Since April COVID-19 restrictions have been tightened in most jurisdictions across Canada, including in British Columbia, Quebec, and Ontario. The new restrictions will likely cause a pause or perhaps even a short-term retreat on the jobs recovery front. The new job restrictions will certainly be reflected in the April results."

A bit of a see-saw indeed, but Donner is overall optimistic about a Canadian rebound as long as the vaccination program's success continues.

Take that shot, neighbor.

TalkMarkets contributor Robert Carnell checks in on how the recovery is going in South Korea in Korean GDP Pushes Above Pre-Pandemic Levels.

"South Korea's GDP rose by 1.6% in 1Q21, stronger than the 1.1% expected, and up even from the solid 1.2% figures recorded for 4Q20 which was revised slightly higher from an initial 1.1% reading. That leaves GDP up 1.8%YoY, in other words, higher than a year ago, and also just higher than 4Q2019 pre-pandemic GDP levels too."

Carnell notes that these numbers surprised him and fellow ING economists and strengthen the prospects for the South Korean GDP to grow a whopping 4% in 2021.

"The underlying momentum of the economy is obviously stronger than we had thought, with strength concentrated in the electronics sectors and supporting industries, but also broadening out to industries like autos. Export strength remains supported by regional, in particular Chinese strength, and this could also gain more support as countries like the US and regions like Europe see further economic growth as their economies re-open."

While the threat of COVID still looms Carnell concludes with a cautious, but heady forecast for the Korean economy.

"Rising daily case numbers in Korea, albeit still only around the 700-750 mark currently, are a worry. We have seen repeatedly how rising cases at a low level can lead rapidly to an out-of-control situation (NB India), and Korea's vaccine rollout has been slow, even by comparison with other Asian countries. So before we push through the entire forecast update implied by today's figures, we may wait a month to see how the pandemic and vaccine rollouts progress. 3.5% is a good starting point for a 2021 GDP upgrade this month. We can see if there is room for a 4% forecast next month if the vaccination rate picks up and COVID cases remain moderate."

Closer to home but affecting consumers worldwide, TM contributor Timothy Taylor takes stock of Amazon (AMZN) as Jeff Bezos steps down from the company's CEO position and transitions to Executive Chairman of the Board. The first part of Taylor's article includes quotes from Bezos' last letter to shareholders as CEO.

"For economists, one measure of value is the total value of Amazon's stock which now stands at about $1.6 trillion (and Bezos owns about one-eighth of that). But his letter focuses on the most recent year. He writes:

Last year, we hired 500,000 employees and now directly employ 1.3 million people around the world. We have more than 200 million Prime members worldwide. More than 1.9 million small and medium-sized businesses sell in our store, and they make up close to 60% of our retail sales. Customers have connected more than 100 million smart home devices to Alexa. Amazon Web Services serves millions of customers and ended 2020 with a $50 billion annualized run rate.

During 2020, Amazon had a net income of $21.3 billion. Bezos adds:

Customers complete 28% of purchases on Amazon in three minutes or less, and half of all purchases are finished in less than 15 minutes. Compare that to the typical shopping trip to a physical store – driving, parking, searching store aisles, waiting in the checkout line, finding your car, and driving home. Research suggests the typical physical store trip takes about an hour. If you assume that a typical Amazon purchase takes 15 minutes and that it saves you a couple of trips to a physical store a week, that’s more than 75 hours a year saved. That’s important. We’re all busy in the early 21st century. So that we can get a dollar figure, let’s value the time savings at $10 per hour, which is conservative. Seventy-five hours multiplied by $10 an hour and subtracting the cost of Prime gives you value creation for each Prime member of about $630. We have 200 million Prime members, for a total in 2020 of $126 billion of value creation.

While Taylor is not dismissive of Amazon's critics he believes in giving credit where credit is due and leaves readers to consider the following:

"Building an interactive website that works at large scale is a monumental task. As one counterexample among many, think about the issues that arose when trying to build websites for buying health insurance in the aftermath of the Patient Protection and Affordable Care Act of 2010, or think about the computer network problems of the Internal Revenue Service. Yes, it's plausible that if Bezos had never started Amazon, some other company would have emerged from the dot-com scrum of the late 1990s. However, Bezos led the company that actually did it. Whether you are a fan or detractor of Amazon, the sheer size and scope of what has been built commands attention."

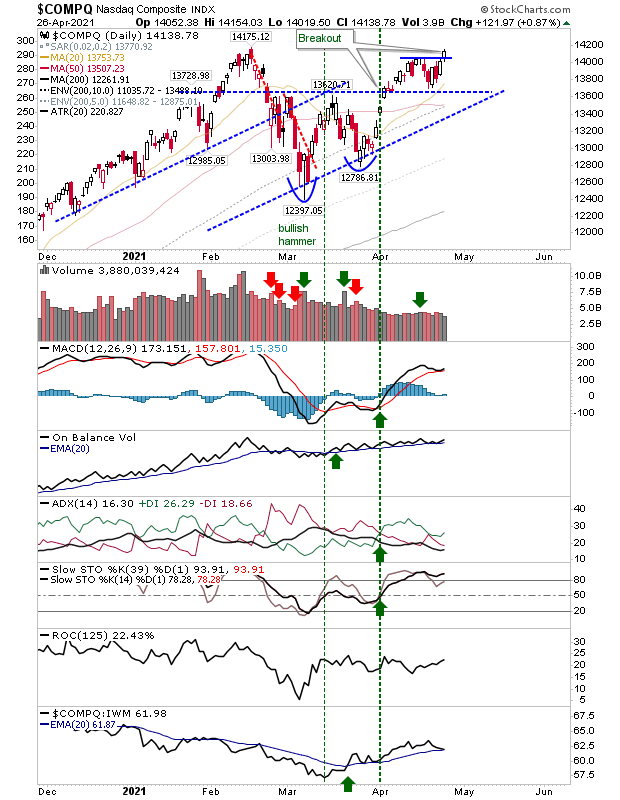

Declan Fallon closes out this week's contributor roundup with some positive comments about the major indices. Writing in Nasdaq Breakout As Life Returns To Markets, Fallon notes the following:

"After days when things were very quiet for the market, it looks like the Nasdaq (QQQ) has finally come to life. The Nasdaq hasn't quite closed at a new all-time high but it has managed to clear the small handle it was shaping just below resistance. Technicals are positive, even as relative performance drifts lower. This might be the cue to kick the next major rally and end the 4-month consolidation."

On the S&P and the Russell 2000 Fallon has this to say:

"The S&P (SPY) did edge a new all-time high, but it did it on one of the smallest of gains. This index has been doing the running since the middle of March, but it may find itself in a shift back towards Small Caps. The Russell 2000 (IWM) is interesting as we had a 'bull trap' in March, but now we have a 'bear trap'; technicals are improving and if the 'bear trap' is to become dominant we should see relative performance switch to a new 'buy' signal and a continuation of the rally."

Well, we will have to see how the rest of the week plays out. Elsewhere on TalkMarkets you will find contributors who write of further pullbacks and consolidation.

Keep both hands on the wheel. I'll see you in May.