Tuesday Talk: Full Steam Ahead

March left quietly, saving the fanfare and roar for April. Markets are at new highs with the S&P 500 closing above 4,000 in the first two trading sessions of the month. So far, investors are responding "full steam ahead" to Biden's infrastructure bill despite the plans to pay for it with higher corporate taxes.

Monday the S&P 500 closed at 4,078, up 1.44%, the Dow closed at 33,527, up 1.13 and the Nasdaq Composite closed at 13,706, up 1.67%. Currently S&P futures are trading at 4,057, down 0.27%, Dow futures are trading at 33,356, down 0.18% and Nasdaq 100 futures are trading at 13,545, down 0.30%.

TalkMarkets contributor Stephen Innes sums up the market headlines in Fresh Highs As US Economic Data Fuels The Fire. Some of his takes on the markets are as follows:

- Equity Markets - "The market just took another monumental stepping stone as both backwards-looking (payrolls) and forward-looking (ISM) is confirming what investors have been pricing in all along up until now: a post-COVID return to economic glory. Both historical and forward-looking strategies have their place, but when both confirm a huge economic rebound, there’s only one place for stocks to go: higher. Provided the data continues to be supportive, equities and risk-on can remain at elevated levels for some time – or at least until the next unexpected downside shocker hits."

- Oil Markets - "Oil prices continued to slide overnight as third and fourth wave virus outbreaks in Europe and parts of Asia, notably India, have elevated lockdown concerns that continue to hit both spot and forward demand outlooks. And at this stage of the oil market recovery, COVID-19 resurgence is walking back investor thoughts of an oil super-cycle down to a very wobbly monocycle on this bumpy road to recovery." (OIL)

- Currency Markets - "The US dollar is weaker through the global risk-on channel as FX traders sell the dollar, anticipating investors putting more money to work outside of the US...Vaccinations are set to accelerate significantly in April and May, and experience suggests current lockdowns will lower COVID-19 case numbers relatively soon. Indeed, this should be positive for the EURO." (FXE)

- Gold Markets - "Gold is a bit stronger this morning due to a weaker US dollar and slightly easier US yields. Gold has formed a short-term double bottom but needs to break above $1,750 before it can head higher. The metal could struggle to extend last week's recovery with the positive US NFP underpinning risk-on sentiment." (GLD)

Many market watchers expected the dollar's strength to continue based on the strong jobs report coming out of the U.S. last week. Contributor Kathy Lien explains that the Easter holiday is responsible for most of the current weakness seen in the greenback over the last few days in her TalkMarkets Editor's Choice article, Nearly 1 Million Jobs But Dollar Barely Budges – Here’s Why.

"Nearly a million jobs were created, the most in 7 months. Economists were looking for NFPs to rise by 647k and instead, it jumped 916k. The unemployment rate dropped to 6%, which was right in with expectations. Such a blowout jobs number should have driven the U.S. dollar sharply higher and while the greenback spiked after the initial release, its gains were modest. A large part of that had to do with the Easter holidays in the U.S. and abroad. Equity markets were closed, so not many investors were around to react to the report. Average hourly earnings growth also declined, which was a complete surprise. Economists anticipated a modest 0.1% increase but wages dropped for the first time since June. On top of that the percentage of people on long-term unemployment rose to 43.4% from 41.5%."

However, despite this dose of less than good news, Lien believes the continuing outlook is for a strong dollar:

"Even though there was some underlying weakness, the U.S. dollar’s dominance hasn’t been challenged because the labor market is recovering faster than most other nations. With more than 38% of all adults receiving at least one dose and more than 1 in 5 fully vaccinated, the near-term outlook is strong. More jobs will be added in the coming months as we head into a vibrant summer spending season. According to the Center of Disease Control, fully vaccinated people can travel will “little risk” to themselves. This reassurance will help reinvigorate the travel industry."

Contributor Brian Romanchuk writes that the U.S. Economy Getting Better, But... he is concerned about labor markets and supply chains. He makes the following observations:

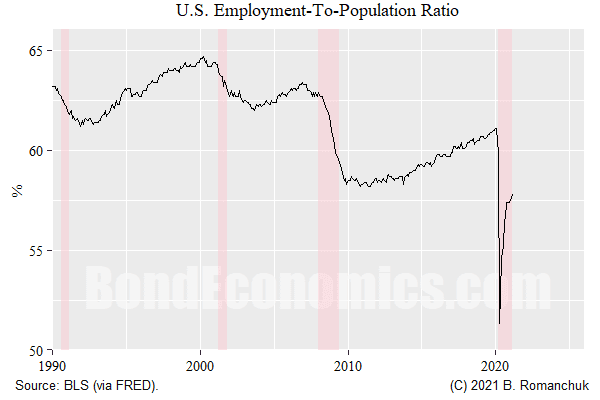

"The reality is that current conditions are nowhere near normal. At the beginning of the last cycle, the only labor market series that offered useful information was the employment-to-population ratio. As the figure below shows, we are still below the lows of the last cycle. There is a demographics story that suggests that the employment-to-population should drop as a result of the ageing population. Although true, the people who were pushing that story the hardest in 2010 were horrifically wrong about the time required for the labor market to overheat (which it never really did)."

"This cycle is unusual in other respects, with supply chain disruptions. In Canada and the United States, the housing market is exuberant, and there are materials shortages. I accept that similar disruptions could blindside my rather benign inflation outlook. That said, modern developed economies have shrugged off the inflationary impacts of oil price spikes in recent decades, and energy prices are embedded throughout the entire supply chain. From a market's standpoint, one can argue that the markets are not pricing in much tightening on a multi-year horizon."

TalkMarkets contributor Bob Lang in his article Ignore The Pundits: The Markets Look Strong says that financial news writers who keep finding potholes in the road are just being party poopers. He says that the data shows the markets are strong and we should go with that. Here are some of his thoughts:

"I don’t know how anyone in the media can be negative as the markets continue to rise. The data points toward a strong economic recovery from a pandemic-induced slump. Some real-time estimates point to a 6.5% growth rate during Q1 with more to come during Q2. Negative, indeed!"

"If you bundle February (job gains) revisions with March (jobs data), well over 1 million new jobs were created. Those numbers are not a one-off. The momentum is real, and we could see more strong job gains in the months to come. This is real data that is going to make a huge difference for the economy."

"Ignore the “glass half empty” mentality. Anyone who has said this experiment with flush liquidity is going to fail has been wrong so far. If you’ve been listening to the most accurate message – the one coming directly from the data and the markets – you’re not complaining. Keep on listening!"

Well to Bob and anyone else who may be driving a Tesla (TSLA) out there, just remember that it's autopilot feature is only semi-autonomous.

That said, the positive jobs data is good news for the economy and investors, and TalkMarkets contributor Sweta Killa in 4 ETF Zones Set To Bloom In A Booming Job Market suggests just how we might make some hay while the sun is shining. After thoroughly summarizing the jobs data for readers (worth reading) Sweta offers a few ETFs for our consideration.

"1. Invesco DB US Dollar Index Bullish Fund (UUP) - A healing job market and a recovering economy will pull in more capital into the country and lead to appreciation of the U.S. dollar. UUP is the prime beneficiary of the rising dollar as it offers exposure against a basket of six world currencies — euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

2. iShares Russell 2000 ETF (IWM) - As pint-sized stocks are closely tied to the U.S. economy and do not have much exposure to the international market, these stocks generally outperform on improving American economic health. IWM is one of the largest and the most popular ETFs in the small-cap space.

3. Consumer Discretionary Select Sector SPDR Fund (XLY) - Robust job gains will increase consumers’ power to spend more on luxury items. While most of the consumer discretionary ETFs will benefit from this trend, the ultra-popular XLY having AUM of $19.4 billion and an average daily volume of 4.4 million shares could be a compelling choice. It tracks the Consumer Discretionary Select Sector Index and holds 63 securities with higher concentration on the top two firms with 23.1% and 13.6% share, respectively.

4. SPDR S&P Homebuilders ETF (XHB) - Solid labor market fundamentals along with affordable mortgage rates will continue to fuel growth in the homebuilding sector. The most popular choice in the homebuilding space, XHB, follows the S&P Homebuilders Select Industry Index."

Be sure to click through to the article for full details. As always, caveat emptor.

The debate over the infrastructure bill will no doubt grow louder in the coming weeks. With that in mind, I leave you with this pithy quote from former British Prime Minister, Margaret Thatcher - "You and I come by road or rail, but economists travel on infrastructure."

Have a good week.