Tuesday Talk: A January Jolt To Start The Year

January started with a jolt. Whether this is a sign that the bears have come out of the forest or just first of the year profit-taking combined with Senate runoff and COVID-19 jitters remains to be seen. Yesterday the S&P 500 closed at 3,701, down 55 pts or 1.48%, the Dow closed at 30,224, down 382 pts or 1.25%, while the Nasdaq closed at 12,698, down 190 pts or 1.45%. Currently, market futures for all 3 indices have turned from green to slightly red.

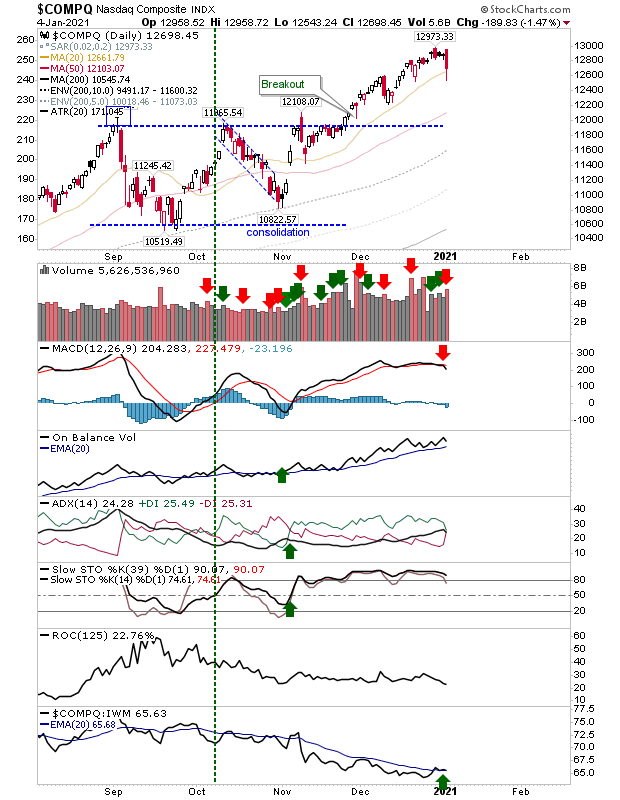

TalkMarkets contributor Declan Fallon writing in The Year Starts With Selling says, "The first day of the New Year starts with selling on heavier volume distribution. Today may be the start of something, but one day's selling does not make a crash. For the Nasdaq (QQQ), we have the MACD trigger 'sell' but still a bullish cross in relative performance to Small Caps. The selling was looking bad but buyers were able to step in at the 20-day MA." Here is the chart:

He includes Monday's trading charts for the S&P 500 (SPX) and Russell 2000 (IWM) as well. A keen technical analyst Fallon's take on the first trading day of the new year is this:

"I'm (also) tracking the relationship of the indices to their 200-day MAs. All are above the 95% zone of historic price extension relative to their 200-day MAs, with the Russell 2000 substantially so at 30.4%, where the 99% level comes in at 21.4% (dating back to 1987) - even after the decline from 201.18 ($IWM). A reversion to mean is coming, and it will look painful, but in real terms, it probably won't make it back to its 200-day MA."

Contributors Warren Patterson and Wenyu Yao from ING Economics take a look at what is up in commodities in their article OPEC+ Struggles To Come To An Agreement. Looking at Energy, Metals and Agriculture here is what they have to say about the current outlook for all three.

Energy - " The oil market gave back all of its early gains yesterday and ended up settling down on the day, with OPEC+ failing to come to an agreement on production levels for February. Given the latest developments and concerns over COVID-19, we believe that the group should take a more prudent approach and maintain the current level of cuts. A further easing in cuts does leave some downside risk for the market, particularly in the current environment."

Metals - "The metals complex started the new year on a strong footing, driven by tailwinds from negative US real yields and a weaker dollar. Spot gold had a breakout, trading above US$1,900/oz for the first time since early November, reaching a high this morning of a little over US$1,945/oz. Similarly, spot silver prices have also strengthened, with prices hitting a high of US$27.56/oz yesterday (Monday). Turning to industrial metals, the weaker dollar has been a driving force behind the strength that we have seen across markets. LME nickel led the way, with the metal rallying more than 4%, and hitting an intraday high of US$17,520/t...This strength has continued in trading today."

Agriculture - "Soybeans have continued their bull run, with the CBOT March contract trading well above US$13/bu, on the back of tightening supply prospects from Latin America, along with robust Chinese demand...Sugar and ICE No 11 sugar prices have been trading firm, with prices briefly trading above USc16/lb yesterday, levels last seen back in 2017."

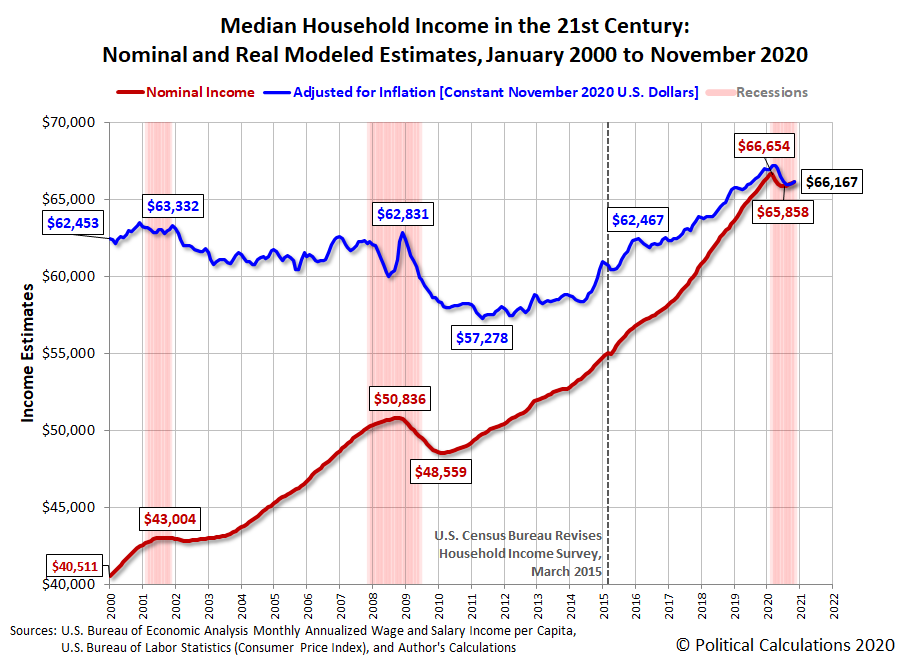

Moving to a look at some other economic indicators, TalkMarkets contributor Ironman brings us the latest tabulations in Median Household Income In November 2020 as to how the pandemic has affected American households after nearly one year. It is interesting to note, that median income while having fallen from it's high at the beginning of 2020 seems to be ending the year close to 2019 levels. Ironman does note that the December lockdown in California where 1 in 8 Americans reside could lower the latest (November 2020) estimates. Still, Ironman projects that the: "initial estimate of median household income of in November 2020 is $66,167, an increase of $101 (or 0.15%) above the initial estimate of $66,066 for October 2020."

See the following chart and read the full article for additional details.

Contributor John Galt while anticipating sharp rises in EPS in 2021, expects the prices of many stocks to contract in the new year due to overreaching valuations accrued in 2020. Writing in Stocks Set For Multiple Contraction In 2021, Galt makes some observations, (charts included) about the mismatches between EPS and stock prices and the pace of the economic recovery as well as some surprising comments about the tobacco industry.

"EPS growth and stock prices don’t always match if you’re looking at data by year. As you can see from the table below, in 3 out of the 7 years EPS fell, stocks were up. In 5 of 9 times the stock market fell, EPS growth was positive. We will likely see very strong stock price growth and weak returns in 2021."

Regarding the current economic outlook, Galt includes the latest weekly economic index provided by the NY Federal Reserve which "is continuing to show better growth. In the week of December 26th, the yearly growth rate improved to -1.32% from -1.95%. " Here is the graph:

Galt's current concluding outlook for the year ahead is as follows:

"EPS is likely going to rise sharply in 2021, but stocks will pull back especially the overvalued names such as Tesla (TSLA). We will see a multiple contraction that makes stocks cheap again. Given the spike in EPS that’s coming, even a 10% rise in stocks will make them cheaper on a trailing basis...Tobacco stocks are very cheap. They are hated for ethical reasons, but their bonds are still getting capital. Many think they will outperform in 2021, with Altria (MO) doing particularly well."

Craig Lazzara in an interesting piece entitled Persistence notes that investors who had the fortitude to bear the market storms of 2020 ended the year by being handsomely rewarded. He includes the following chart of the S&P 500 over the last 30 years for illustrative purposes.

Lazzara notes "Even in extreme declines, standing firm can pay off. There have been ten years (including 2020) when the S&P 500’s peak-to-trough decline exceeded 15%; in half of them, the market finished in positive territory. A year later, the gain from the bottom averaged 38%. Market history tells us that selling can be most damaging precisely when it’s most tempting. The key to success in 2020 was resisting the urge to panic when panic seemed like the most reasonable path."

It looks as if this first week of 2021 is going to be as volatile as any of those experienced in 2020. I'll leave you with this quote from Isaac Asimov to provide perspective to the sights and sounds currently confronting us.

Have a good week.

Once again a healthy collection of information and insights

Thanks, William

Thanks @[David Marshall](user:121103), really enjoy this weekly column.

Thanks, Kurt.