Trucking Industry Growth Is Reported From Alternate Universes In February 2019

Headline data for truck shipments showed that the American Trucking Association (ATA) tonnage showed continued strong year-over-year growth, but Cass said the year-over-year growth rate continues to contract.

Analyst Opinion of Truck Transport

I tend to put a heavier weight on the CASS index which this month contracted year-over-year. On the other hand, the ATA index declined but remains strongly in expansion. One or both of these indices is reporting data from alternate universes.

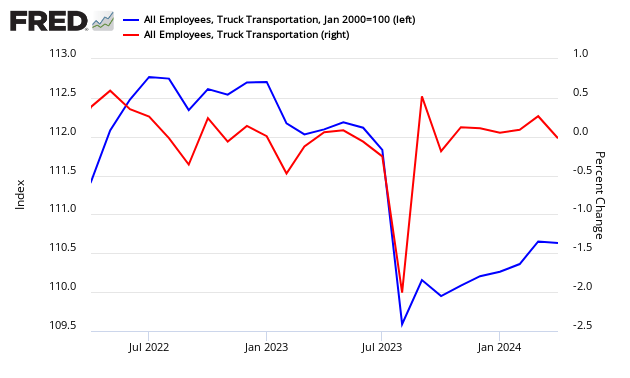

Econintersect tries to validate truck data across data sources. It appears this month that truck employment rate of growth continues to slow. Please note using BLS employment data in real time is risky, as their data is normally backward adjusted (sometimes significantly).

ATA Trucking

American Trucking Associations' advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.2 % in February after increasing 2.5 % in January.

Said ATA Chief Economist Bob Costello:

After a strong January, I'm a pleasantly surprised that the index didn't fall much last month. I continue to expect tonnage to moderate like other indicators, including retail sales, manufacturing activity and housing starts. Additionally, the level of inventories throughout the supply chain have increased, which is a drag on truck freight.

ATA Truck tonnage this month

Compared with February 2018, the SA index increased 5.4%, down from January's 5.8% gain

source: ATA

CASS FREIGHT INDEX REPORT

The following was reported by CASS:

The continued decay in the Cass Freight Shipments Index is beginning to give us cause for concern. When the December 2018 Shipments Index was negative for the first time in 24 months, we dismissed the -0.8% year-over-year decline as reflective of a tough comparison "because December 2017 was an all-time high for the month" and also because of "the stabilizing patterns we see in almost all of the underlying freight flows." When January 2019 was also negative (down a mere -0.3%), we again pointed out that January 2018 was also an all-time high for the month and saw no reason to be alarmed about the overall economy. While we are still not ready to turn completely negative in our outlook, we do think it is prudent to become more alert to each additional incoming data point on freight flow volume and are more cautious today than we have been since we began predicting the recovery of the U.S. industrial economy and the rebirth of the U.S. consumer economy in the third quarter of 2016.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more