Trucking Industry Growth Down In May 2019

Headline data for the American Trucking Association (ATA) tonnage showed little year-over-year growth, and the CASS Freight Index reported the year-over-year growth rate continues in contraction.

Analyst Opinion of Truck Transport

The CASS index is inclusive of rail, truck, and air shipments. The ATA truck index is inclusive of only member movements.

I tend to put a heavier weight on the CASS index which continued in contraction year-over-year. On the other hand, the ATA index significantly declined and is barely in expansion.

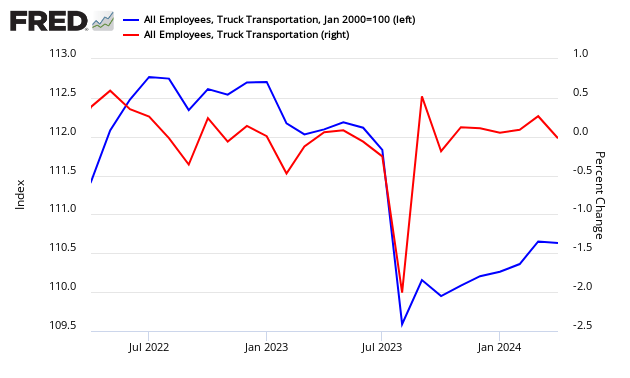

Econintersect tries to validate truck data across data sources. It appears this month that truck employment rate of growth continues to slow. Please note using BLS employment data in real time is risky, as their data is normally backward adjusted (sometimes significantly).

ATA Trucking

American Trucking Associations' advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 6.1% in May after jumping 7% in April. In May, the index equaled 114 (2015=100) compared with 121.4 in April.

Said ATA Chief Economist Bob Costello:

As expected, tonnage corrected in May from the surprising surge in April. The economy is still growing, but the recent volatility in truck tonnage fits with a broader economy that is showing more mixed signals. The good news is if you ignore recent highs and lows, tonnage appears to be leveling off, albeit at a high level.

ATA Truck tonnage this month

Compared with May 2018, the SA index increased 0.9%, the smallest year-over-year gain since April 2017.

source: ATA

CASS FREIGHT INDEX REPORT

The following was reported by CASS:

Beyond our concern that the Cass Freight Shipments Index is negative on a YoY basis for the sixth month in a row:

- We are concerned about the severe declines in international airfreight volumes (especially in Asia) and the ongoing swoon in railroad volumes, especially in auto and building materials;

- We see the weakness in spot market pricing for transportation services, especially in trucking, as consistent with and a confirmation of the negative trend in the Cass Shipments Index;

- As volumes of chemical shipments have lost momentum in recent weeks, our concerns of the global slowdown spreading to the U.S., and the trade dispute reaching a 'point of no return' from an economic perspective, grow.

Bottom line, more and more data is indicating that this is the beginning of an economic contraction. If a contraction occurs, then the Cass Shipments Index will have been one of the first early indicators once again.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more