Troubling Tuesday: Oil’s Not Well

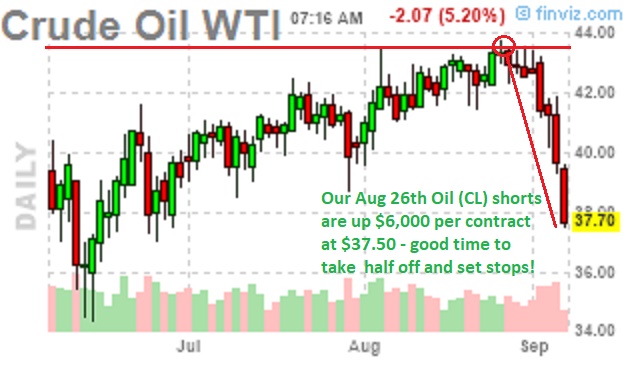

$6,000 per contract! That's how much our Members have made (so far) shorting oil off our August 26th "Hurricane Edition." when I said to our Members in the Morning Report:

Hurricane Laura is coming.

It's a good excuse to get Oil (/CL) back to $43.50 but it makes a nice short there as nothing else is going on in the energy market to prop it up.We do have a holiday weekend approaching (next Friday) but driving is mostly off the table this year and, for oil, I'm a lot more concerned with the Dollar bouncing back from it's -10% position and kicking oil's ass after Powell's speech tomorrow at the Jackson Hole conference.

While I prefer to short the Oil (/CL) Futures at $43.50 with very tight stops over that line, we can also make the simple bet that oil won't be over $50 in April by picking up the following bearish spread on USO:

Buy 20 USO April $35 puts for $6 ($12,000)

Sell 20 USO April $30 puts for $3.15 ($6,300)

Sell 10 USO Sept $30 puts for 0.52 ($520)

If USO goes below $30, we need to take a loss on the short Sept $30 puts but, if not, we can sell those puts for 0.50 each month and collect $2,000 more through January. As it stands, the net of the spread is $5,180 and it's $8,000 in the money at $31 to start.If we drop our basis by $2,000 more, we should be in very good shape.

USO, as you can see, remains on track and the April $35 puts are now $7.80 (USO)

($15,600)

and the $30 puts are $4.40

($8,800)

and the short Sept $30 puts died last week

(Wednesday morning)

at 0.75

($750)

so the spread is up about$1,000

(20%)

at $6,050 so far. Setting those stops is key as the short puts are now $1.75 – exactly enough to wipe out our profits if we hadn't taken the loss below the $30 cut-off.

You should always have a trading plan set up – especially for short-term trades. We often don't seem to have a plan for our long-term positions but our plan is usually to stick with them and let our hedges do their job. The hedges are the plan and we often make just as much money on the hedges as we do on the long positions.

Last week, for example, in our Live Trading Webinar, we went long on gasoline (/RB) as it hit $1.18 and that became a hedge to protect our shorts on oil – in case it all went the wrong way. Having the longs on /RB protected us against the bounce (weak) in /CL and we were able to exit the /RB longs with a very nice gain of $1,200 per contract but, more importantly, it allowed us to hold onto our /CL shorts, which ended up making $6,000 per contract.

Speaking of hedging, the Nasdaq is taking yet another massive dive this morning, down 2.5% (300 points) already and that is NOT a good way to start the day. The Nasdaq, through (SQQQ) and (TQQQ) as well as (TSLA), is the primary hedge in our Short-Term Portfolio.

I recently went over why we cashed out (partially) and got more bearish into the end of August back on the 24th (see also: "Record-High Wednesday, Again") and, as I said at the time, I'd rather be prepared for the crash too early than be over-exposed and surprised by it when it comes and that's exactly what happened/is happening – as we had a very boring couple of weeks watching the market continue higher but now we get all the fun of watching it crash from the sidelines – which really beats being caught up in the panic by a mile, doesn't it?

There's no big news but there's no good news likely to hit this week and the market momentum has shifted down a bit and we'll see if we test some support lines. After the holiday weekend, there isn't much going on on the data front but next week should be more interesting and stimulus talk will come back quickly if the market has a 10% correction (5% so far).

.jpg)

And, of course, this week, the Back to School disaster begins!

Click here to try Phil's Stock World free. Try PSW's ...

more