Treasury Yields Plunge Below 1.30% To 5 Month Lows, 3-Sigma Below FV According To JPM

After a modest stabilization overnight, the collapse in 10Y yields has resumed this morning tracking the latest drop in oil, which is down following a WSJ report that the UAE plans to "sell as much crude as possible before demand dries up" and aims to boost production and market share unilaterally amid high demand in threat to OPEC stability.

As a result of the latest deflationary gust, 10Y yields have dropped below 1.30%, sliding to the lowest since February 19...

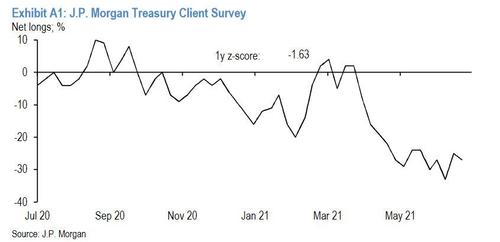

... as the short squeeze discussed yesterday - as a reminder the latest JPM Treasury Client Survey found a near-record number of shorts - accelerates.

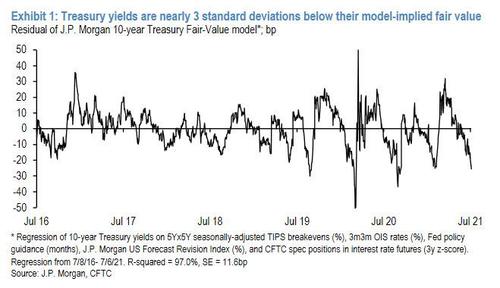

Indeed, in a note from JPM's rates strategists led by Jay Berry, titled aptly enough "Prediction? Pain", the bank writes that "the reaction of the Treasury market to data over the last week and the lack of reaction in the TIPS market indicates this move has been exaggerated by short-covering." This in turn he left the left 10-year Treasury yields about 25bp, or 3-standard deviations below their fair value according to the JPM model.

Needless to say, this is surprising to JPMorgan, which adds that although the data flow since late last week came in weaker than consensus expectations, "the 10+bps decline in 10-year yields since Friday morning seems outsized all considered." Underscoring the confusion, JPM points to medium-term market-based inflation expectations which have barely budged the last two days (even with crude prices sliding), and the market-implied timing to Fed liftoff has moved little as well.

To JPM, "net of these factors, Treasuries have diverged further from our fair-value framework. Though yields tend to mean revert with relatively low frequency, 10-year Treasury yields now appear 25bp too low relative to their drivers, a 3-standard deviation divergence, and the largest such deviation since the early fall 2020."

As a result, JPM concludes that "position technicals are exaggerating the moves in Treasury yields as of late: our weekly Treasury Client Survey has remained short relative to average levels over the last year (Exhibit A1), and we will be interested to see how positions have evolved when the next survey is released tomorrow morning."

Separately, JPM also writes that the release of the June FOMC meeting minutes will be illustrative: "it’s our sense the leadership is not represented in the 7 participants who have forecast a hike in 2022, and we will look for confirmation in the minutes. We will also look for more clarity on how the FOMC defines “substantial further progress” as we progress toward a potential taper announcement later this year. Finally, we will be interested to see if there is broad-based support to taper MBS more aggressively than Treasuries. We do not think this view is widely held by the Committee and we expect the Fed to taper Treasuries in a 2- to-1 ratio to MBS, proportional to the pace of purchases."

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more